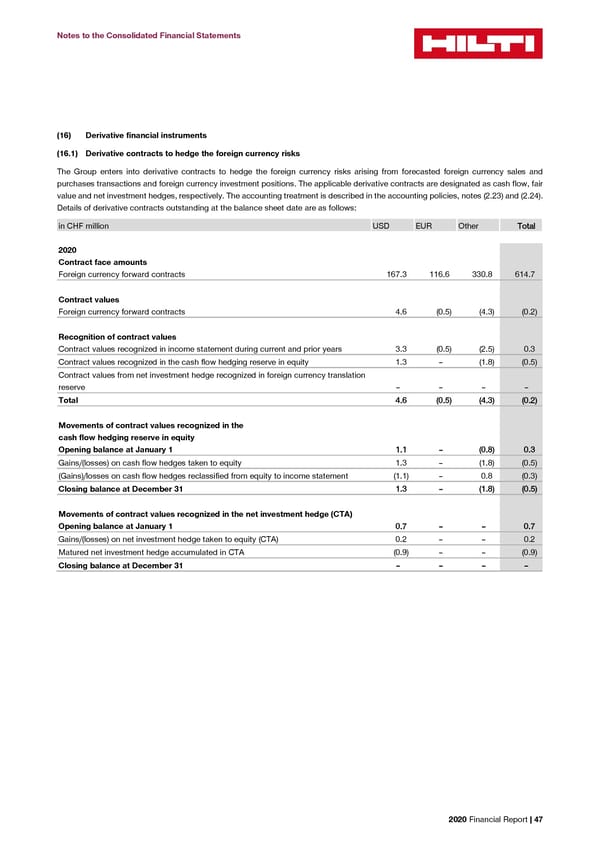

Notes to the Consolidated Financial Statements (16) Derivative financial instruments (16.1) Derivative contracts to hedge the foreign currency risks The Group enters into derivative contracts to hedge the foreign currency risks arising from forecasted foreign currency sales and purchases transactions and foreign currency investment positions. The applicable derivative contracts are designated as cash flow, fair value and net investment hedges, respectively. The accounting treatment is described in the accounting policies, notes (2.23) and (2.24). Details of derivative contracts outstanding at the balance sheet date are as follows: in CHF million USD EUR Other TToottaall 2020 Contract face amounts Foreign currency forward contracts 167.3 116.6 330.8 614.7 Contract values Foreign currency forward contracts 4.6 (0.5) (4.3) (0.2) Recognition of contract values Contract values recognized in income statement during current and prior years 3.3 (0.5) (2.5) 0.3 Contract values recognized in the cash flow hedging reserve in equity 1.3 – (1.8) (0.5) Contract values from net investment hedge recognized in foreign currency translation reserve – – – – Total 44..66 ((00..55)) ((44..33)) ((00..22)) Movements of contract values recognized in the cash flow hedging reserve in equity Opening balance at January 1 11..11 –– ((00..88)) 00..33 Gains/(losses) on cash flow hedges taken to equity 1.3 – (1.8) (0.5) (Gains)/losses on cash flow hedges reclassified from equity to income statement (1.1) – 0.8 (0.3) Closing balance at December 31 11..33 –– ((11..88)) ((00..55)) Movements of contract values recognized in the net investment hedge (CTA) Opening balance at January 1 00..77 –– –– 00..77 Gains/(losses) on net investment hedge taken to equity (CTA) 0.2 – – 0.2 Matured net investment hedge accumulated in CTA (0.9) – – (0.9) Closing balance at December 31 –– –– –– –– 2020 Financial Report | 47

2020 Financial Report Page 48 Page 50

2020 Financial Report Page 48 Page 50