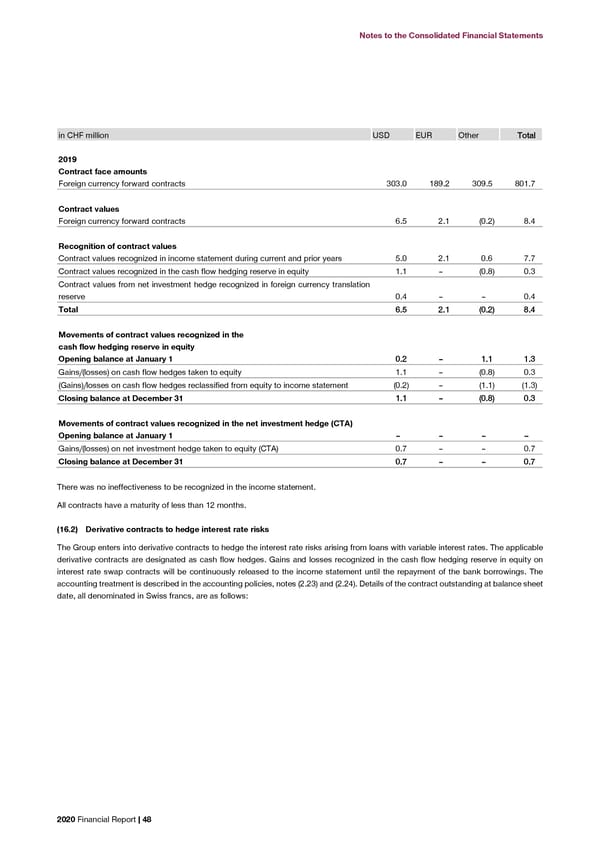

Notes to the Consolidated Financial Statements Notes to the Consolidated Financial Statements in CHF million USD EUR Other TToottaall in CHF million 22002200 2019 2019 Outstanding interest rate swaps Contract face amounts Contract face amounts 60.0 60.0 Foreign currency forward contracts 303.0 189.2 309.5 801.7 Recognition of contract values Contract values Contract values recognized in the cash flow hedging reserve in equity 3.8 4.7 Foreign currency forward contracts 6.5 2.1 (0.2) 8.4 Movements of contract values recognized in the cash flow hedging reserve in equity Recognition of contract values Opening balance at January 1 44..77 55..33 Contract values recognized in income statement during current and prior years 5.0 2.1 0.6 7.7 Gains/(losses) on cash flow hedges taken to equity 0.6 0.9 Contract values recognized in the cash flow hedging reserve in equity 1.1 – (0.8) 0.3 (Gains)/losses on cash flow hedges reclassified from equity to income statement (1.5) (1.5) Contract values from net investment hedge recognized in foreign currency translation Closing balance at December 31 33..88 44..77 reserve 0.4 – – 0.4 Total 66..55 22..11 ((00..22)) 88..44 The fixed interest rate is 1.9% (2019: 1.9%) and the floating rate is LIBOR. Movements of contract values recognized in the (16.3) Reconciliations cash flow hedging reserve in equity Opening balance at January 1 00..22 –– 11..11 11..33 in CHF million Foreign Interest TToottaall Gains/(losses) on cash flow hedges taken to equity 1.1 – (0.8) 0.3 currency rate risks (Gains)/losses on cash flow hedges reclassified from equity to income statement (0.2) – (1.1) (1.3) risks Closing balance at December 31 11..11 –– ((00..88)) 00..33 2020 Current assets 6.5 – 6.5 Movements of contract values recognized in the net investment hedge (CTA) Non-current assets – 3.8 3.8 Opening balance at January 1 –– –– –– –– Current liabilities (6.7) – (6.7) Gains/(losses) on net investment hedge taken to equity (CTA) 0.7 – – 0.7 Non-current liabilities – – – Closing balance at December 31 00..77 –– –– 00..77 Total net book value derivative financial instruments at December 31 ((00..22)) 33..88 33..66 There was no ineffectiveness to be recognized in the income statement. Cash flow hedging reserve in equity (0.5) 3.8 3.3 All contracts have a maturity of less than 12 months. Gains/(losses) on cash flow hedges taken to equity (0.5) 0.6 0.1 (16.2) Derivative contracts to hedge interest rate risks (Gains)/losses on cash flow hedges reclassified from equity to income statement (0.3) (1.5) (1.8) The Group enters into derivative contracts to hedge the interest rate risks arising from loans with variable interest rates. The applicable in CHF million Foreign Interest TToottaall derivative contracts are designated as cash flow hedges. Gains and losses recognized in the cash flow hedging reserve in equity on currency rate risks interest rate swap contracts will be continuously released to the income statement until the repayment of the bank borrowings. The risks accounting treatment is described in the accounting policies, notes (2.23) and (2.24). Details of the contract outstanding at balance sheet date, all denominated in Swiss francs, are as follows: 2019 Current assets 11.0 – 11.0 Non-current assets – 4.7 4.7 Current liabilities (3.0) – (3.0) Non-current liabilities – – – Total net book value derivative financial instruments at December 31 88..00 44..77 1122..77 Cash flow hedging reserve in equity 0.3 4.7 5.0 Gains/(losses) on cash flow hedges taken to equity 0.3 0.9 1.2 (Gains)/losses on cash flow hedges reclassified from equity to income statement (1.3) (1.5) (2.8) The cash flow hedging reserve in equity net of tax amounts to CHF 2.9 million (2019: CHF 4.4 million). 2020 Financial Report | 48 2020 Financial Report | 49

2020 Financial Report Page 49 Page 51

2020 Financial Report Page 49 Page 51