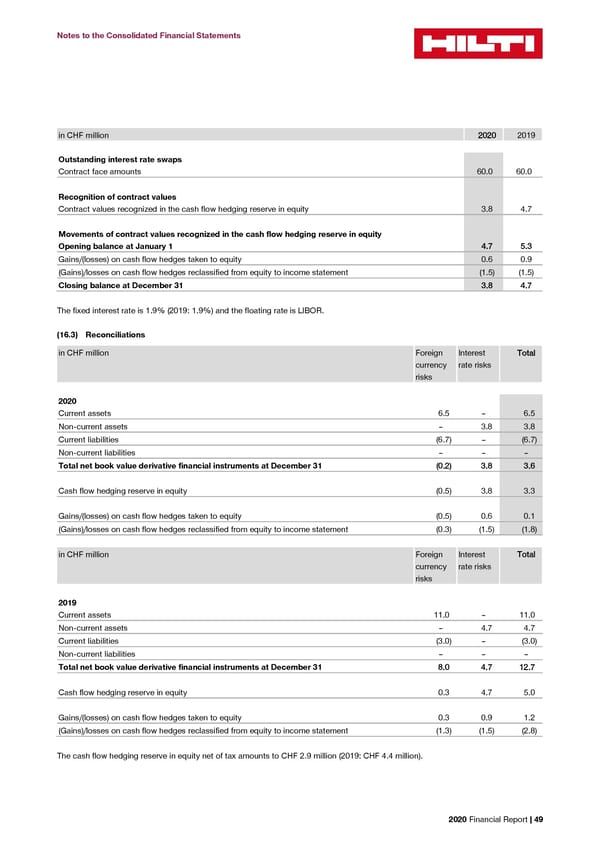

Notes to the Consolidated Financial Statements in CHF million 22002200 2019 Outstanding interest rate swaps Contract face amounts 60.0 60.0 Recognition of contract values Contract values recognized in the cash flow hedging reserve in equity 3.8 4.7 Movements of contract values recognized in the cash flow hedging reserve in equity Opening balance at January 1 44..77 55..33 Gains/(losses) on cash flow hedges taken to equity 0.6 0.9 (Gains)/losses on cash flow hedges reclassified from equity to income statement (1.5) (1.5) Closing balance at December 31 33..88 44..77 The fixed interest rate is 1.9% (2019: 1.9%) and the floating rate is LIBOR. (16.3) Reconciliations in CHF million Foreign Interest TToottaall currency rate risks risks 2020 Current assets 6.5 – 6.5 Non-current assets – 3.8 3.8 Current liabilities (6.7) – (6.7) Non-current liabilities – – – Total net book value derivative financial instruments at December 31 ((00..22)) 33..88 33..66 Cash flow hedging reserve in equity (0.5) 3.8 3.3 Gains/(losses) on cash flow hedges taken to equity (0.5) 0.6 0.1 (Gains)/losses on cash flow hedges reclassified from equity to income statement (0.3) (1.5) (1.8) in CHF million Foreign Interest TToottaall currency rate risks risks 2019 Current assets 11.0 – 11.0 Non-current assets – 4.7 4.7 Current liabilities (3.0) – (3.0) Non-current liabilities – – – Total net book value derivative financial instruments at December 31 88..00 44..77 1122..77 Cash flow hedging reserve in equity 0.3 4.7 5.0 Gains/(losses) on cash flow hedges taken to equity 0.3 0.9 1.2 (Gains)/losses on cash flow hedges reclassified from equity to income statement (1.3) (1.5) (2.8) The cash flow hedging reserve in equity net of tax amounts to CHF 2.9 million (2019: CHF 4.4 million). 2020 Financial Report | 49

2020 Financial Report Page 50 Page 52

2020 Financial Report Page 50 Page 52