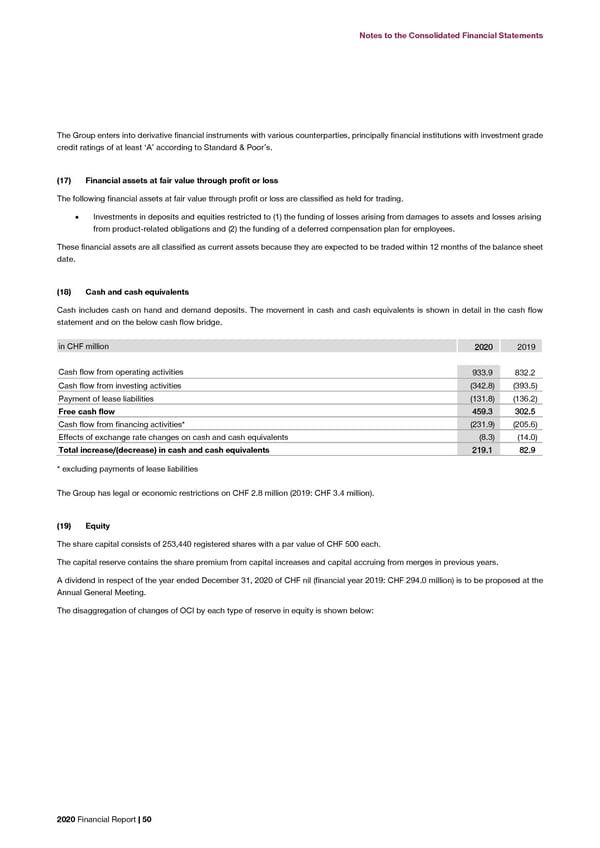

Notes to the Consolidated Financial Statements Notes to the Consolidated Financial Statements The Group enters into derivative financial instruments with various counterparties, principally financial institutions with investment grade in CHF million Foreign Cash flow Retained Non- TToottaall credit ratings of at least ‘A’ according to Standard & Poor’s. currency hedging earnings controlling translation reserve interests (17) Financial assets at fair value through profit or loss reserve The following financial assets at fair value through profit or loss are classified as held for trading. 2020 Gains/(losses) on cash flow hedges taken to equity – 0.1 – – 0.1 • Investments in deposits and equities restricted to (1) the funding of losses arising from damages to assets and losses arising Deferred tax on gains/losses on cash flow hedges taken to equity – – – – – from product-related obligations and (2) the funding of a deferred compensation plan for employees. (Gains)/losses on cash flow hedges reclassified from equity to income These financial assets are all classified as current assets because they are expected to be traded within 12 months of the balance sheet statement – (1.8) – – (1.8) date. Deferred tax on gains/losses on cash flow hedges reclassified from equity to income statement – 0.2 – – 0.2 (18) Cash and cash equivalents Foreign currency translation differences (56.9) – – (0.7) (57.6) Deferred tax on foreign currency translation differences 0.5 – – – 0.5 Cash includes cash on hand and demand deposits. The movement in cash and cash equivalents is shown in detail in the cash flow Items that may be subsequently reclassified to the income statement ((5566..44)) ((11..55)) –– ((00..77)) ((5588..66)) statement and on the below cash flow bridge. Remeasurements on employee benefits – – 18.6 – 18.6 in CHF million 22002200 2019 Deferred tax on remeasurements on employee benefits – – (2.0) – (2.0) Items that will never be reclassified to the income statement –– –– 1166..66 –– 1166..66 Cash flow from operating activities 933.9 832.2 Cash flow from investing activities (342.8) (393.5) Total other comprehensive income 2020 ((5566..44)) ((11..55)) 1166..66 ((00..77)) ((4422..00)) Payment of lease liabilities (131.8) (136.2) Free cash flow 445599..33 330022..55 in CHF million Foreign Cash flow Retained Non- TToottaall Cash flow from financing activities* (231.9) (205.6) currency hedging earnings controlling Effects of exchange rate changes on cash and cash equivalents (8.3) (14.0) translation reserve interests Total increase/(decrease) in cash and cash equivalents 221199..11 8822..99 reserve * excluding payments of lease liabilities 2019 Gains/(losses) on cash flow hedges taken to equity – 1.2 – – 1.2 The Group has legal or economic restrictions on CHF 2.8 million (2019: CHF 3.4 million). Deferred tax on gains/losses on cash flow hedges taken to equity – (0.1) – – (0.1) (19) Equity (Gains)/losses on cash flow hedges reclassified from equity to income statement – (2.8) – – (2.8) The share capital consists of 253,440 registered shares with a par value of CHF 500 each. Deferred tax on gains/losses on cash flow hedges reclassified from equity to income statement – 0.3 – – 0.3 The capital reserve contains the share premium from capital increases and capital accruing from merges in previous years. Foreign currency translation differences (48.0) – – (0.1) (48.1) A dividend in respect of the year ended December 31, 2020 of CHF nil (financial year 2019: CHF 294.0 million) is to be proposed at the Deferred tax on foreign currency translation differences 0.2 – – – 0.2 Annual General Meeting. Items that may be subsequently reclassified to the income statement ((4477..88)) ((11..44)) –– ((00..11)) ((4499..33)) The disaggregation of changes of OCI by each type of reserve in equity is shown below: Remeasurements on employee benefits – – (81.7) – (81.7) Deferred tax on remeasurements on employee benefits – – 13.4 – 13.4 Items that will never be reclassified to the income statement –– –– ((6688..33)) –– ((6688..33)) Total other comprehensive income 2019 ((4477..88)) ((11..44)) ((6688..33)) ((00..11)) ((111177..66)) 2020 Financial Report | 50 2020 Financial Report | 51

2020 Financial Report Page 51 Page 53

2020 Financial Report Page 51 Page 53