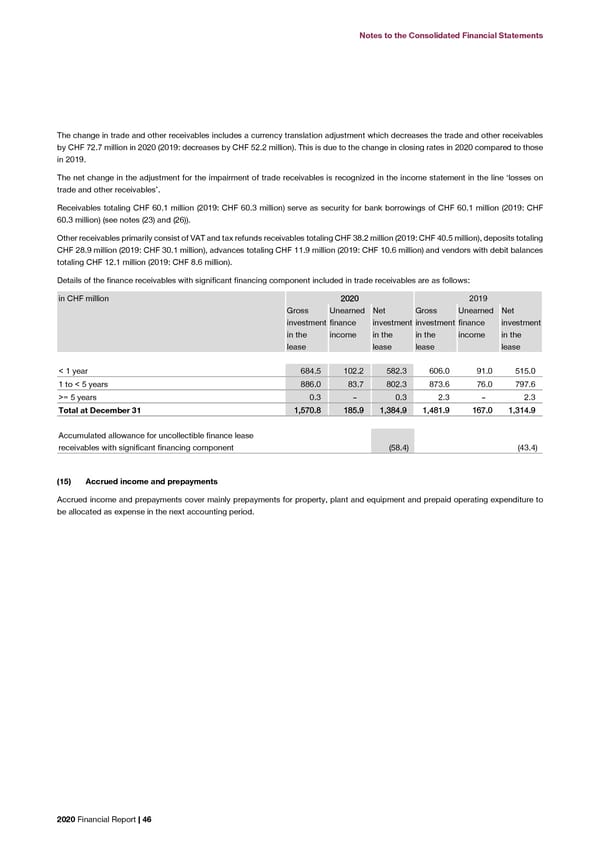

Notes to the Consolidated Financial Statements Notes to the Consolidated Financial Statements The change in trade and other receivables includes a currency translation adjustment which decreases the trade and other receivables (16) Derivative financial instruments by CHF 72.7 million in 2020 (2019: decreases by CHF 52.2 million). This is due to the change in closing rates in 2020 compared to those in 2019. (16.1) Derivative contracts to hedge the foreign currency risks The net change in the adjustment for the impairment of trade receivables is recognized in the income statement in the line ‘losses on The Group enters into derivative contracts to hedge the foreign currency risks arising from forecasted foreign currency sales and trade and other receivables’. purchases transactions and foreign currency investment positions. The applicable derivative contracts are designated as cash flow, fair value and net investment hedges, respectively. The accounting treatment is described in the accounting policies, notes (2.23) and (2.24). Receivables totaling CHF 60.1 million (2019: CHF 60.3 million) serve as security for bank borrowings of CHF 60.1 million (2019: CHF Details of derivative contracts outstanding at the balance sheet date are as follows: 60.3 million) (see notes (23) and (26)). in CHF million USD EUR Other TToottaall Other receivables primarily consist of VAT and tax refunds receivables totaling CHF 38.2 million (2019: CHF 40.5 million), deposits totaling CHF 28.9 million (2019: CHF 30.1 million), advances totaling CHF 11.9 million (2019: CHF 10.6 million) and vendors with debit balances 2020 totaling CHF 12.1 million (2019: CHF 8.6 million). Contract face amounts Foreign currency forward contracts 167.3 116.6 330.8 614.7 Details of the finance receivables with significant financing component included in trade receivables are as follows: in CHF million 22002200 2019 Contract values Gross Unearned Net Gross Unearned Net Foreign currency forward contracts 4.6 (0.5) (4.3) (0.2) investment finance investment investment finance investment in the income in the in the income in the Recognition of contract values lease lease lease lease Contract values recognized in income statement during current and prior years 3.3 (0.5) (2.5) 0.3 Contract values recognized in the cash flow hedging reserve in equity 1.3 – (1.8) (0.5) < 1 year 684.5 102.2 582.3 606.0 91.0 515.0 Contract values from net investment hedge recognized in foreign currency translation 1 to < 5 years 886.0 83.7 802.3 873.6 76.0 797.6 reserve – – – – >= 5 years 0.3 – 0.3 2.3 – 2.3 Total 44..66 ((00..55)) ((44..33)) ((00..22)) Total at December 31 11,,557700..88 118855..99 11,,338844..99 11,,448811..99 116677..00 11,,331144..99 Movements of contract values recognized in the Accumulated allowance for uncollectible finance lease cash flow hedging reserve in equity receivables with significant financing component (58.4) (43.4) Opening balance at January 1 11..11 –– ((00..88)) 00..33 Gains/(losses) on cash flow hedges taken to equity 1.3 – (1.8) (0.5) (15) Accrued income and prepayments (Gains)/losses on cash flow hedges reclassified from equity to income statement (1.1) – 0.8 (0.3) Closing balance at December 31 11..33 –– ((11..88)) ((00..55)) Accrued income and prepayments cover mainly prepayments for property, plant and equipment and prepaid operating expenditure to be allocated as expense in the next accounting period. Movements of contract values recognized in the net investment hedge (CTA) Opening balance at January 1 00..77 –– –– 00..77 Gains/(losses) on net investment hedge taken to equity (CTA) 0.2 – – 0.2 Matured net investment hedge accumulated in CTA (0.9) – – (0.9) Closing balance at December 31 –– –– –– –– 2020 Financial Report | 46 2020 Financial Report | 47

2020 Financial Report Page 47 Page 49

2020 Financial Report Page 47 Page 49