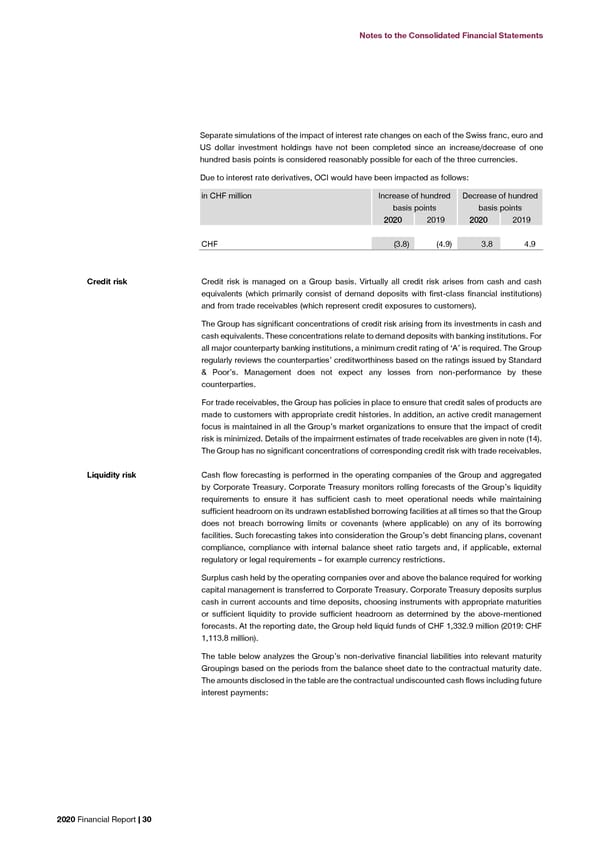

Notes to the Consolidated Financial Statements Notes to the Consolidated Financial Statements Separate simulations of the impact of interest rate changes on each of the Swiss franc, euro and in CHF million Less than 1 Between 1 Between 2 Over 5 years US dollar investment holdings have not been completed since an increase/decrease of one year and 2 years and 5 years hundred basis points is considered reasonably possible for each of the three currencies. Due to interest rate derivatives, OCI would have been impacted as follows: At December 31, 2020 Bonds and borrowings 145.5 29.9 369.7 101.1 in CHF million Increase of hundred Decrease of hundred Lease liabilities 126.3 102.7 159.1 105.8 basis points basis points Trade and other payables 468.4 2.0 7.8 8.0 22002200 2019 22002200 2019 in CHF million Less than 1 Between 1 Between 2 Over 5 years CHF (3.8) (4.9) 3.8 4.9 year and 2 years and 5 years At December 31, 2019 Credit risk Credit risk is managed on a Group basis. Virtually all credit risk arises from cash and cash Bonds and borrowings 228.5 40.1 222.0 101.1 equivalents (which primarily consist of demand deposits with first-class financial institutions) Lease liabilities 131.6 98.0 177.0 95.1 and from trade receivables (which represent credit exposures to customers). Trade and other payables 471.7 4.3 23.8 8.1 The Group has significant concentrations of credit risk arising from its investments in cash and cash equivalents. These concentrations relate to demand deposits with banking institutions. For Most of the non-trading Group’s gross or net settled derivative financial instruments are in hedge all major counterparty banking institutions, a minimum credit rating of ‘A’ is required. The Group relationships and are due to be settled gross or net within 12 months of the balance sheet date. regularly reviews the counterparties’ creditworthiness based on the ratings issued by Standard These contracts require undiscounted contractual cash inflows of CHF 626.4 million (2019: CHF & Poor’s. Management does not expect any losses from non-performance by these 802.1 million) and undiscounted contractual cash outflows of CHF 630.4 million (2019: CHF counterparties. 803.5 million). All of the non-trading Group’s derivative financial instruments are in hedge relationships and are disclosed in note (16). Group has policies in place to ensure that credit sales of products are For trade receivables, the made to customers with appropriate credit histories. In addition, an active credit management focus is maintained in all the Group’s market organizations to ensure that the impact of credit risk is minimized. Details of the impairment estimates of trade receivables are given in note (14). The Group has no significant concentrations of corresponding credit risk with trade receivables. Liquidity risk Cash flow forecasting is performed in the operating companies of the Group and aggregated by Corporate Treasury. Corporate Treasury monitors rolling forecasts of the Group’s liquidity requirements to ensure it has sufficient cash to meet operational needs while maintaining sufficient headroom on its undrawn established borrowing facilities at all times so that the Group does not breach borrowing limits or covenants (where applicable) on any of its borrowing facilities. Such forecasting takes into consideration the Group’s debt financing plans, covenant compliance, compliance with internal balance sheet ratio targets and, if applicable, external regulatory or legal requirements – for example currency restrictions. balance required for working Surplus cash held by the operating companies over and above the capital management is transferred to Corporate Treasury. Corporate Treasury deposits surplus cash in current accounts and time deposits, choosing instruments with appropriate maturities or sufficient liquidity to provide sufficient headroom as determined by the above-mentioned forecasts. At the reporting date, the Group held liquid funds of CHF 1,332.9 million (2019: CHF 1,113.8 million). derivative financial liabilities into relevant maturity The table below analyzes the Group’s non- Groupings based on the periods from the balance sheet date to the contractual maturity date. The amounts disclosed in the table are the contractual undiscounted cash flows including future interest payments: 2020 Financial Report | 30 2020 Financial Report | 31

2020 Financial Report Page 31 Page 33

2020 Financial Report Page 31 Page 33