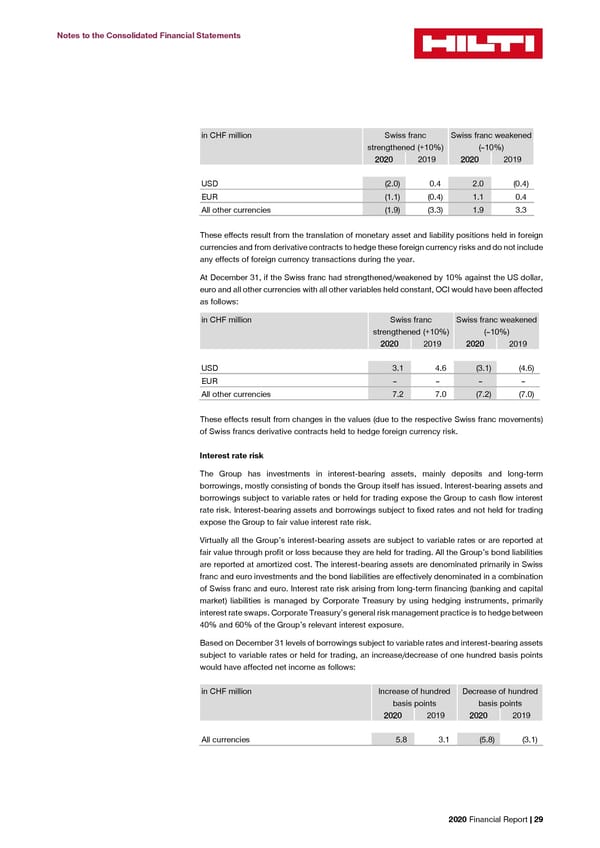

Notes to the Consolidated Financial Statements in CHF million Swiss franc Swiss franc weakened strengthened (+10%) (–10%) 22002200 2019 22002200 2019 USD (2.0) 0.4 2.0 (0.4) EUR (1.1) (0.4) 1.1 0.4 All other currencies (1.9) (3.3) 1.9 3.3 These effects result from the translation of monetary asset and liability positions held in foreign currencies and from derivative contracts to hedge these foreign currency risks and do not include any effects of foreign currency transactions during the year. At December 31, if the Swiss franc had strengthened/weakened by 10% against the US dollar, euro and all other currencies with all other variables held constant, OCI would have been affected as follows: in CHF million Swiss franc Swiss franc weakened strengthened (+10%) (–10%) 22002200 2019 22002200 2019 USD 3.1 4.6 (3.1) (4.6) EUR – – – – All other currencies 7.2 7.0 (7.2) (7.0) These effects result from changes in the values (due to the respective Swiss franc movements) of Swiss francs derivative contracts held to hedge foreign currency risk. Interest rate risk The Group has investments in interest-bearing assets, mainly deposits and long-term borrowings, mostly consisting of bonds the Group itself has issued. Interest-bearing assets and borrowings subject to variable rates or held for trading expose the Group to cash flow interest rate risk. Interest-bearing assets and borrowings subject to fixed rates and not held for trading expose the Group to fair value interest rate risk. Virtually all the Group’s interest-bearing assets are subject to variable rates or are reported at fair value through profit or loss because they are held for trading. All the Group’s bond liabilities are reported at amortized cost. The interest-bearing assets are denominated primarily in Swiss franc and euro investments and the bond liabilities are effectively denominated in a combination of Swiss franc and euro. Interest rate risk arising from long-term financing (banking and capital market) liabilities is managed by Corporate Treasury by using hedging instruments, primarily interest rate swaps. Corporate Treasury’s general risk management practice is to hedge between 40% and 60% of the Group’s relevant interest exposure. Based on December 31 levels of borrowings subject to variable rates and interest-bearing assets subject to variable rates or held for trading, an increase/decrease of one hundred basis points would have affected net income as follows: in CHF million Increase of hundred Decrease of hundred basis points basis points 22002200 2019 22002200 2019 All currencies 5.8 3.1 (5.8) (3.1) 2020 Financial Report | 29

2020 Financial Report Page 30 Page 32

2020 Financial Report Page 30 Page 32