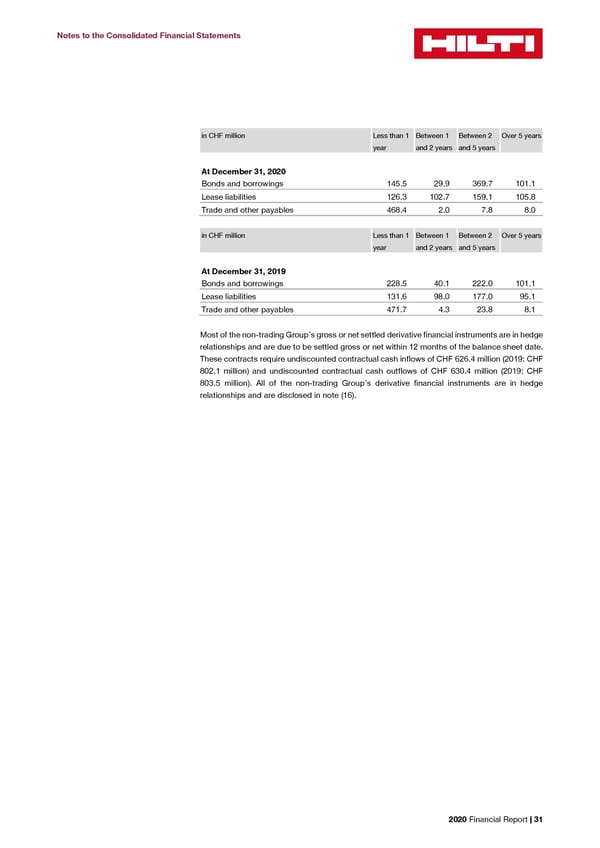

Notes to the Consolidated Financial Statements in CHF million Less than 1 Between 1 Between 2 Over 5 years year and 2 years and 5 years At December 31, 2020 Bonds and borrowings 145.5 29.9 369.7 101.1 Lease liabilities 126.3 102.7 159.1 105.8 Trade and other payables 468.4 2.0 7.8 8.0 in CHF million Less than 1 Between 1 Between 2 Over 5 years year and 2 years and 5 years At December 31, 2019 Bonds and borrowings 228.5 40.1 222.0 101.1 Lease liabilities 131.6 98.0 177.0 95.1 Trade and other payables 471.7 4.3 23.8 8.1 Most of the non-trading Group’s gross or net settled derivative financial instruments are in hedge relationships and are due to be settled gross or net within 12 months of the balance sheet date. These contracts require undiscounted contractual cash inflows of CHF 626.4 million (2019: CHF 802.1 million) and undiscounted contractual cash outflows of CHF 630.4 million (2019: CHF 803.5 million). All of the non-trading Group’s derivative financial instruments are in hedge relationships and are disclosed in note (16). 2020 Financial Report | 31

2020 Financial Report Page 32 Page 34

2020 Financial Report Page 32 Page 34