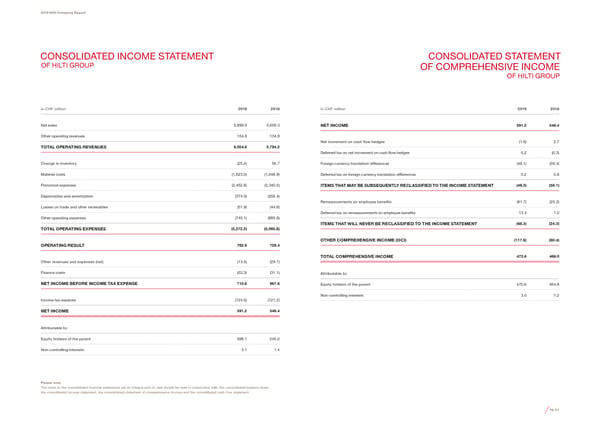

2019 Hilti Company Report CONSOLIDATED INCOME STATEMENT CONSOLIDATED STATEMENT OF HILTI GROUP OF COMPREHENSIVE INCOME OF HILTI GROUP 2019 2018 in CHF million 2019 2018 in CHF million Net sales 5,899.9 5,659.3 NET INCOME 591.2 546.4 Other operating revenues 154.9 134.9 Net movement on cash 昀氀ow hedges (1.6) 2.7 TOTAL OPERATING REVENUES 6,054.8 5,794.2 Deferred tax on net movement on cash 昀氀ow hedges 0.2 (0.3) Change in inventory (25.4) 56.7 Foreign currency translation differences (48.1) (59.3) Material costs (1,623.0) (1,648.9) Deferred tax on foreign currency translation differences 0.2 0.8 Personnel expenses (2,452.8) (2,340.5) ITEMS THAT MAY BE SUBSEQUENTLY RECLASSIFIED TO THE INCOME STATEMENT (49.3) (56.1) Depreciation and amortization (374.0) (202.4) Remeasurements on employee bene昀椀ts (81.7) (25.3) Losses on trade and other receivables (51.9) (44.8) Deferred tax on remeasurements on employee bene昀椀ts 13.4 1.0 Other operating expenses (745.1) (885.9) ITEMS THAT WILL NEVER BE RECLASSIFIED TO THE INCOME STATEMENT (68.3) (24.3) TOTAL OPERATING EXPENSES (5,272.2) (5,065.8) OTHER COMPREHENSIVE INCOME (OCI) (117.6) (80.4) OPERATING RESULT 782.6 728.4 TOTAL COMPREHENSIVE INCOME 473.6 466.0 Other revenues and expenses (net) (13.5) (29.7) Finance costs (53.3) (31.1) Attributable to: NET INCOME BEFORE INCOME TAX EXPENSE 715.8 667.6 Equity holders of the parent 470.6 464.8 Non-controlling interests 3.0 1.2 Income tax expense (124.6) (121.2) NET INCOME 591.2 546.4 Attributable to: Equity holders of the parent 588.1 545.0 Non-controlling interests 3.1 1.4 Please note The notes to the consolidated 昀椀nancial statements are an integral part of, and should be read in conjunction with, the consolidated balance sheet, the consolidated income statement, the consolidated statement of comprehensive income and the consolidated cash 昀氀ow statement. 76–77

2019 Company Report Page 41 Page 43

2019 Company Report Page 41 Page 43