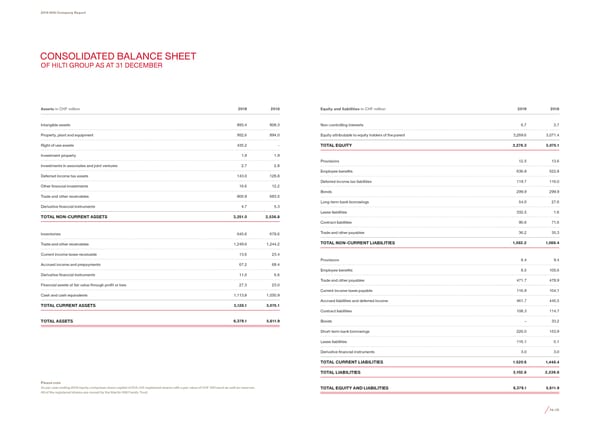

2019 Hilti Company Report CONSOLIDATED BALANCE SHEET OF HILTI GROUP AS AT 31 DECEMBER Assets in CHF million 2019 2018 Equity and liabilities in CHF million 2019 2018 Intangible assets 893.4 808.3 Non-controlling interests 6.7 3.7 Property, plant and equipment 952.6 894.0 Equity attributable to equity holders of the parent 3,269.6 3,071.4 Right of use assets 435.2 - TOTAL EQUITY 3,276.3 3,075.1 Investment property 1.9 1.9 Provisions 12.5 13.6 Investments in associates and joint ventures 2.7 2.8 Employee bene昀椀ts 636.8 522.8 Deferred income tax assets 143.0 128.8 Deferred income tax liabilities 119.7 116.0 Other 昀椀nancial investments 16.6 12.2 Bonds 299.9 299.9 Trade and other receivables 800.9 683.5 Long-term bank borrowings 54.0 27.6 Derivative 昀椀nancial instruments 4.7 5.3 Lease liabilities 332.5 1.6 TOTAL NON-CURRENT ASSETS 3,251.0 2,536.8 Contract liabilities 90.6 71.6 Inventories 645.6 678.6 Trade and other payables 36.2 35.3 Trade and other receivables 1,249.6 1,244.2 TOTAL NON-CURRENT LIABILITIES 1,582.2 1,088.4 Current income taxes receivable 13.6 23.4 Provisions 8.4 9.4 Accrued income and prepayments 67.2 68.4 Employee bene昀椀ts 8.5 105.6 Derivative 昀椀nancial instruments 11.0 6.6 Trade and other payables 471.7 478.9 Financial assets at fair value through pro昀椀t or loss 27.3 23.0 Current income taxes payable 116.9 104.1 Cash and cash equivalents 1,113.8 1,030.9 Accrued liabilities and deferred income 461.7 445.5 TOTAL CURRENT ASSETS 3,128.1 3,075.1 Contract liabilities 108.3 114.7 TOTAL ASSETS 6,379.1 5,611.9 Bonds – 33.2 Short-term bank borrowings 226.0 153.9 Lease liabilities 116.1 0.1 Derivative 昀椀nancial instruments 3.0 3.0 TOTAL CURRENT LIABILITIES 1.520.6 1,448.4 TOTAL LIABILITIES 3,102.8 2,536.8 Please note As per year ending 2018 equity comprises share capital of 253,440 registered shares with a par value of CHF 500 each as well as reserves. TOTAL EQUITY AND LIABILITIES 6,379.1 5,611.9 All of the registered shares are owned by the Martin Hilti Family Trust. 74–75

2019 Company Report Page 40 Page 42

2019 Company Report Page 40 Page 42