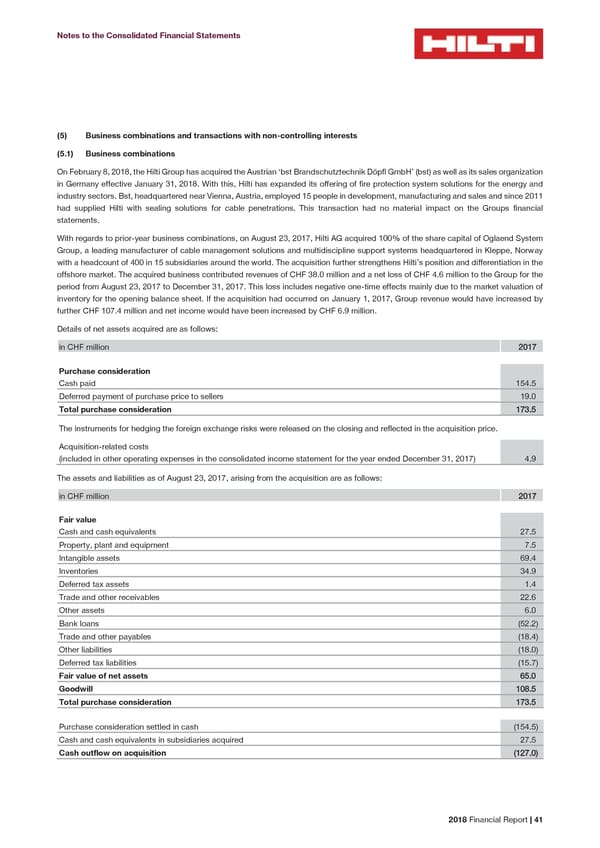

Notes to the Consolidated Financial Statements Business combinations and transactions with non-controlling interests (5) (5.1) Business combinations On February 8, 2018, the Hilti Group has acquired the Austrian ‘bst Brandschutztechnik Döpfl GmbH’ (bst) as well as its sales organization in Germany effective January 31, 2018. With this, Hilti has expanded its offering of fire protection system solutions for the energy and industry sectors. Bst, headquartered near Vienna, Austria, employed 15 people in development, manufacturing and sales and since 2011 had supplied Hilti with sealing solutions for cable penetrations. This transaction had no material impact on the Groups financial statements. With regards to prior-year business combinations, on August 23, 2017, Hilti AG acquired 100% of the share capital of Oglaend System Group, a leading manufacturer of cable management solutions and multidiscipline support systems headquartered in Kleppe, Norway with a headcount of 400 in 15 subsidiaries around the world. The acquisition further strengthens Hilti’s position and differentiation in the offshore market. The acquired business contributed revenues of CHF 38.0 million and a net loss of CHF 4.6 million to the Group for the period from August 23, 2017 to December 31, 2017. This loss includes negative one-time effects mainly due to the market valuation of inventory for the opening balance sheet. If the acquisition had occurred on January 1, 2017, Group revenue would have increased by further CHF 107.4 million and net income would have been increased by CHF 6.9 million. Details of net assets acquired are as follows: in CHF million 2017 Purchase consideration Cash paid 154.5 Deferred payment of purchase price to sellers 19.0 Total purchase consideration 173.5 The instruments for hedging the foreign exchange risks were released on the closing and reflected in the acquisition price. Acquisition-related costs (included in other operating expenses in the consolidated income statement for the year ended December 31, 2017) 4.9 The assets and liabilities as of August 23, 2017, arising from the acquisition are as follows: in CHF million 2017 Fair value Cash and cash equivalents 27.5 Property, plant and equipment 7.5 Intangible assets 69.4 Inventories 34.9 Deferred tax assets 1.4 Trade and other receivables 22.6 Other assets 6.0 Bank loans (52.2) Trade and other payables (18.4) Other liabilities (18.0) Deferred tax liabilities (15.7) Fair value of net assets 65.0 Goodwill 108.5 Total purchase consideration 173.5 Purchase consideration settled in cash (154.5) Cash and cash equivalents in subsidiaries acquired 27.5 Cash outflow on acquisition (127.0) 2018 Financial Report | 41

2018 Financial Report Page 42 Page 44

2018 Financial Report Page 42 Page 44