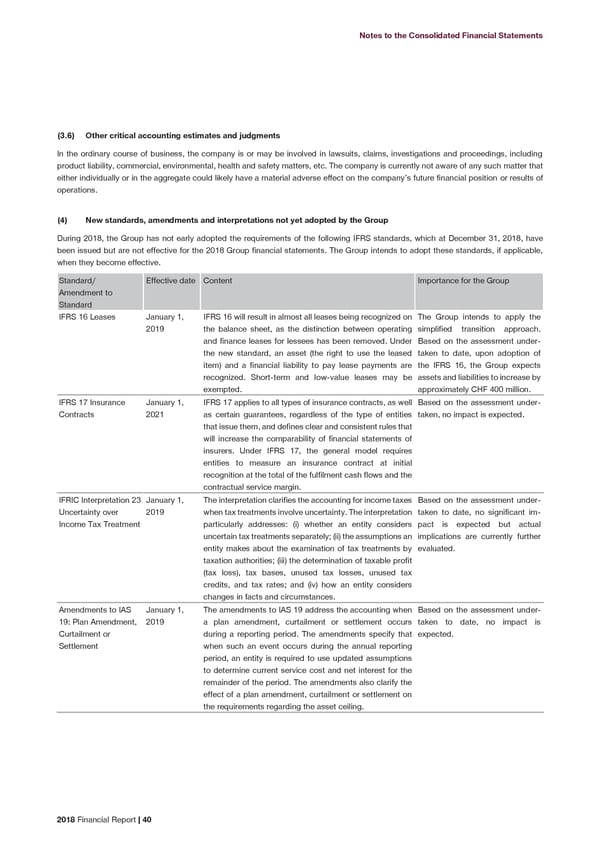

Notes to the Consolidated Financial Statements Other critical accounting estimates and judgments (3.6) In the ordinary course of business, the company is or may be involved in lawsuits, claims, investigations and proceedings, including product liability, commercial, environmental, health and safety matters, etc. The company is currently not aware of any such matter that either individually or in the aggregate could likely have a material adverse effect on the company’s future financial position or results of operations. New standards, amendments and interpretations not yet adopted by the Group (4) During 2018, the Group has not early adopted the requirements of the following IFRS standards, which at December 31, 2018, have been issued but are not effective for the 2018 Group financial statements. The Group intends to adopt these standards, if applicable, when they become effective. Standard/ Effective date Content Importance for the Group Amendment to Standard IFRS 16 Leases January 1, IFRS 16 will result in almost all leases being recognized on The Group intends to apply the 2019 the balance sheet, as the distinction between operating simplified transition approach. and finance leases for lessees has been removed. Under Based on the assessment under- the new standard, an asset (the right to use the leased taken to date, upon adoption of item) and a financial liability to pay lease payments are the IFRS 16, the Group expects recognized. Short-term and low-value leases may be assets and liabilities to increase by exempted. approximately CHF 400 million. IFRS 17 Insurance January 1, IFRS 17 applies to all types of insurance contracts, as well Based on the assessment under- Contracts 2021 as certain guarantees, regardless of the type of entities taken, no impact is expected. that issue them, and defines clear and consistent rules that will increase the comparability of financial statements of insurers. Under IFRS 17, the general model requires entities to measure an insurance contract at initial recognition at the total of the fulfilment cash flows and the contractual service margin. IFRIC Interpretation 23 January 1, The interpretation clarifies the accounting for income taxes Based on the assessment under- Uncertainty over 2019 when tax treatments involve uncertainty. The interpretation taken to date, no significant im- particularly addresses: (i) whether an entity considers pact is expected but actual Income Tax Treatment uncertain tax treatments separately; (ii) the assumptions an implications are currently further entity makes about the examination of tax treatments by evaluated. taxation authorities; (iii) the determination of taxable profit (tax loss), tax bases, unused tax losses, unused tax credits, and tax rates; and (iv) how an entity considers changes in facts and circumstances. Amendments to IAS January 1, The amendments to IAS 19 address the accounting when Based on the assessment under- 19: Plan Amendment, 2019 a plan amendment, curtailment or settlement occurs taken to date, no impact is Curtailment or during a reporting period. The amendments specify that expected. Settlement when such an event occurs during the annual reporting period, an entity is required to use updated assumptions to determine current service cost and net interest for the remainder of the period. The amendments also clarify the effect of a plan amendment, curtailment or settlement on the requirements regarding the asset ceiling. 2018 Financial Report | 40

2018 Financial Report Page 41 Page 43

2018 Financial Report Page 41 Page 43