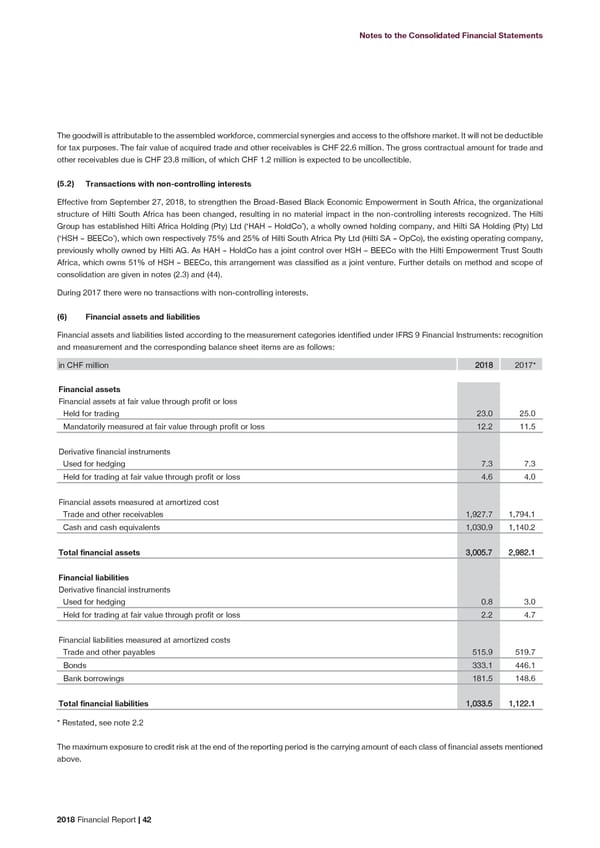

Notes to the Consolidated Financial Statements The goodwill is attributable to the assembled workforce, commercial synergies and access to the offshore market. It will not be deductible for tax purposes. The fair value of acquired trade and other receivables is CHF 22.6 million. The gross contractual amount for trade and other receivables due is CHF 23.8 million, of which CHF 1.2 million is expected to be uncollectible. (5.2) Transactions with non-controlling interests Effective from September 27, 2018, to strengthen the Broad-Based Black Economic Empowerment in South Africa, the organizational structure of Hilti South Africa has been changed, resulting in no material impact in the non-controlling interests recognized. The Hilti Group has established Hilti Africa Holding (Pty) Ltd (‘HAH – HoldCo’), a wholly owned holding company, and Hilti SA Holding (Pty) Ltd (‘HSH – BEECo’), which own respectively 75% and 25% of Hilti South Africa Pty Ltd (Hilti SA – OpCo), the existing operating company, previously wholly owned by Hilti AG. As HAH – HoldCo has a joint control over HSH – BEECo with the Hilti Empowerment Trust South Africa, which owns 51% of HSH – BEECo, this arrangement was classified as a joint venture. Further details on method and scope of consolidation are given in notes (2.3) and (44). During 2017 there were no transactions with non-controlling interests. Financial assets and liabilities (6) Financial assets and liabilities listed according to the measurement categories identified under IFRS 9 Financial Instruments: recognition and measurement and the corresponding balance sheet items are as follows: in CHF million 2018 2017* Financial assets Financial assets at fair value through profit or loss Held for trading 23.0 25.0 Mandatorily measured at fair value through profit or loss 12.2 11.5 Derivative financial instruments Used for hedging 7.3 7.3 Held for trading at fair value through profit or loss 4.6 4.0 Financial assets measured at amortized cost Trade and other receivables 1,927.7 1,794.1 Cash and cash equivalents 1,030.9 1,140.2 Total financial assets 3,005.7 2,982.1 Financial liabilities Derivative financial instruments Used for hedging 0.8 3.0 Held for trading at fair value through profit or loss 2.2 4.7 Financial liabilities measured at amortized costs Trade and other payables 515.9 519.7 Bonds 333.1 446.1 Bank borrowings 181.5 148.6 Total financial liabilities 1,033.5 1,122.1 * Restated, see note 2.2 The maximum exposure to credit risk at the end of the reporting period is the carrying amount of each class of financial assets mentioned above. 2018 Financial Report | 42

2018 Financial Report Page 43 Page 45

2018 Financial Report Page 43 Page 45