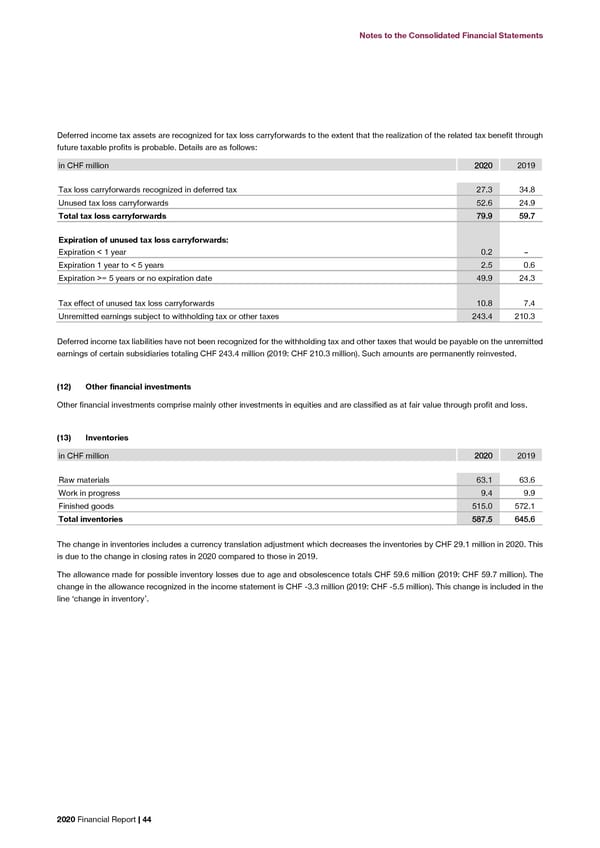

Notes to the Consolidated Financial Statements Notes to the Consolidated Financial Statements Deferred income tax assets are recognized for tax loss carryforwards to the extent that the realization of the related tax benefit through (14) Trade and other receivables future taxable profits is probable. Details are as follows: in CHF million 22002200 2019 in CHF million 22002200 2019 Trade receivables 2,074.8 2,076.6 Tax loss carryforwards recognized in deferred tax 27.3 34.8 Less adjustment for impairment of trade receivables (148.1) (134.7) Unused tax loss carryforwards 52.6 24.9 Trade receivables net 11,,992266..77 11,,994411..99 Total tax loss carryforwards 7799..99 5599..77 Other receivables 108.5 108.6 Expiration of unused tax loss carryforwards: Total trade and other receivables 22,,003355..22 22,,005500..55 Expiration < 1 year 0.2 – Expiration 1 year to < 5 years 2.5 0.6 Current portion 1,245.7 1,249.6 Expiration >= 5 years or no expiration date 49.9 24.3 Non-current portion 789.5 800.9 Total trade and other receivables 22,,003355..22 22,,005500..55 Tax effect of unused tax loss carryforwards 10.8 7.4 Unremitted earnings subject to withholding tax or other taxes 243.4 210.3 Maturity of non-current portion 1 to < 2 years 410.6 400.0 2 to < 3 years 250.0 252.5 Deferred income tax liabilities have not been recognized for the withholding tax and other taxes that would be payable on the unremitted 3 to < 4 years 104.3 113.0 earnings of certain subsidiaries totaling CHF 243.4 million (2019: CHF 210.3 million). Such amounts are permanently reinvested. 4 to < 5 years 17.5 25.4 >= 5 years 7.1 10.0 (12) Other financial investments Total non-current trade and other receivables 778899..55 880000..99 Other financial investments comprise mainly other investments in equities and are classified as at fair value through profit and loss. The closing loss allowances for trade receivables and receivables with significant financing component reconcile to the opening loss allowances as follows: (13) Inventories in CHF million 22002200 2019 in CHF million 22002200 2019 Opening balance of adjustment for the impairment of trade receivables at January 1 113344..77 112277..00 Raw materials 63.1 63.6 Additional impairment adjustment charged to income statement during year 40.1 41.4 Work in progress 9.4 9.9 Write-offs of trade receivables charged to impairment adjustment account during year (26.7) (33.7) Finished goods 515.0 572.1 Closing balance of adjustment for the impairment of trade receivables at December 31 114488..11 113344..77 Total inventories 558877..55 664455..66 in CHF million 22002200 2019 The change in inventories includes a currency translation adjustment which decreases the inventories by CHF 29.1 million in 2020. This is due to the change in closing rates in 2020 compared to those in 2019. Currency denominations of the carrying amounts of trade and other receivables EUR 1,101.4 1,055.4 The allowance made for possible inventory losses due to age and obsolescence totals CHF 59.6 million (2019: CHF 59.7 million). The USD 224.9 247.3 change in the allowance recognized in the income statement is CHF -3.3 million (2019: CHF -5.5 million). This change is included in the Other 708.9 747.8 line ‘change in inventory’. Total trade and other receivables 22,,003355..22 22,,005500..55 The Group provides for credit losses against trade receivables as follows: in CHF million 22002200 2019 Normal Doubtful TToottaall Normal Doubtful TToottaall Gross carrying amount receivables without significant financing component 726.9 71.5 779988..44 803.4 66.9 887700..33 Gross carrying amount receivables with significant financing component 1,359.5 25.4 11,,338844..99 1,292.4 22.5 11,,331144..99 Loss allowance provisions 58.3 89.8 114488..11 53.9 80.8 113344..77 2020 Financial Report | 44 2020 Financial Report | 45

2020 Financial Report Page 45 Page 47

2020 Financial Report Page 45 Page 47