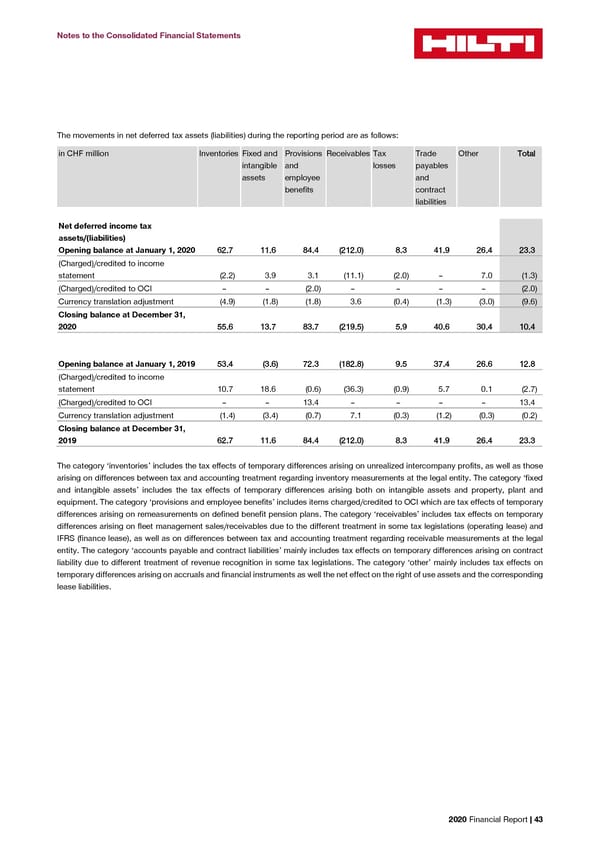

Notes to the Consolidated Financial Statements The movements in net deferred tax assets (liabilities) during the reporting period are as follows: in CHF million Inventories Fixed and Provisions Receivables Tax Trade Other TToottaall intangible and losses payables assets employee and benefits contract liabilities Net deferred income tax assets/(liabilities) Opening balance at January 1, 2020 6622..77 1111..66 8844..44 ((221122..00)) 88..33 4411..99 2266..44 2233..33 (Charged)/credited to income statement (2.2) 3.9 3.1 (11.1) (2.0) – 7.0 (1.3) (Charged)/credited to OCI – – (2.0) – – – – (2.0) Currency translation adjustment (4.9) (1.8) (1.8) 3.6 (0.4) (1.3) (3.0) (9.6) Closing balance at December 31, 2020 5555..66 1133..77 8833..77 ((221199..55)) 55..99 4400..66 3300..44 1100..44 Opening balance at January 1, 2019 5533..44 ((33..66)) 7722..33 ((118822..88)) 99..55 3377..44 2266..66 1122..88 (Charged)/credited to income statement 10.7 18.6 (0.6) (36.3) (0.9) 5.7 0.1 (2.7) (Charged)/credited to OCI – – 13.4 – – – – 13.4 Currency translation adjustment (1.4) (3.4) (0.7) 7.1 (0.3) (1.2) (0.3) (0.2) Closing balance at December 31, 2019 6622..77 1111..66 8844..44 ((221122..00)) 88..33 4411..99 2266..44 2233..33 The category ‘inventories’ includes the tax effects of temporary differences arising on unrealized intercompany profits, as well as those arising on differences between tax and accounting treatment regarding inventory measurements at the legal entity. The category ‘fixed and intangible assets’ includes the tax effects of temporary differences arising both on intangible assets and property, plant and equipment. The category ‘provisions and employee benefits’ includes items charged/credited to OCI which are tax effects of temporary differences arising on remeasurements on defined benefit pension plans. The category ‘receivables’ includes tax effects on temporary differences arising on fleet management sales/receivables due to the different treatment in some tax legislations (operating lease) and IFRS (finance lease), as well as on differences between tax and accounting treatment regarding receivable measurements at the legal entity. The category ‘accounts payable and contract liabilities’ mainly includes tax effects on temporary differences arising on contract liability due to different treatment of revenue recognition in some tax legislations. The category ‘other’ mainly includes tax effects on temporary differences arising on accruals and financial instruments as well the net effect on the right of use assets and the corresponding lease liabilities. 2020 Financial Report | 43

2020 Financial Report Page 44 Page 46

2020 Financial Report Page 44 Page 46