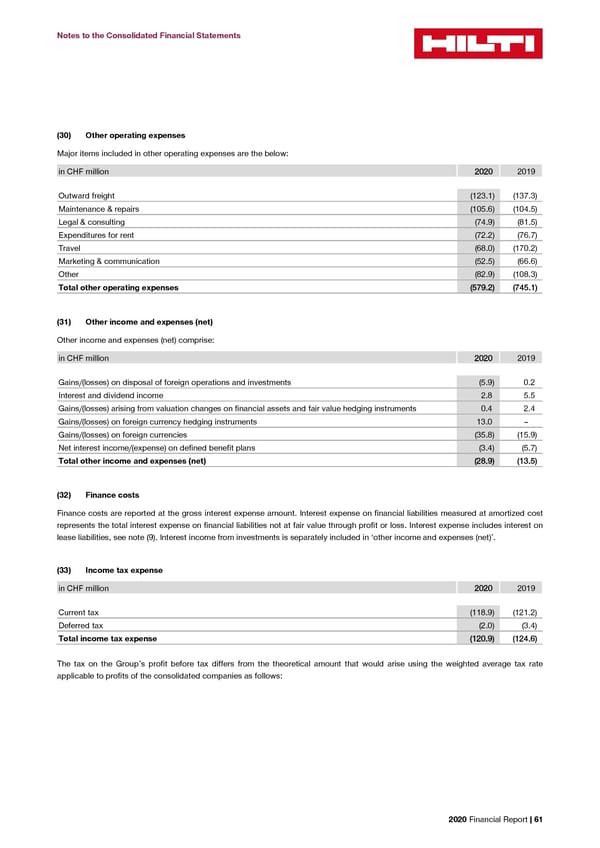

Notes to the Consolidated Financial Statements (30) Other operating expenses Major items included in other operating expenses are the below: in CHF million 22002200 2019 Outward freight (123.1) (137.3) Maintenance & repairs (105.6) (104.5) Legal & consulting (74.9) (81.5) Expenditures for rent (72.2) (76.7) Travel (68.0) (170.2) Marketing & communication (52.5) (66.6) Other (82.9) (108.3) Total other operating expenses ((557799..22)) ((774455..11)) (31) Other income and expenses (net) Other income and expenses (net) comprise: in CHF million 22002200 2019 Gains/(losses) on disposal of foreign operations and investments (5.9) 0.2 Interest and dividend income 2.8 5.5 Gains/(losses) arising from valuation changes on financial assets and fair value hedging instruments 0.4 2.4 Gains/(losses) on foreign currency hedging instruments 13.0 – Gains/(losses) on foreign currencies (35.8) (15.9) Net interest income/(expense) on defined benefit plans (3.4) (5.7) Total other income and expenses (net) ((2288..99)) ((1133..55)) (32) Finance costs Finance costs are reported at the gross interest expense amount. Interest expense on financial liabilities measured at amortized cost represents the total interest expense on financial liabilities not at fair value through profit or loss. Interest expense includes interest on lease liabilities, see note (9). Interest income from investments is separately included in ‘other income and expenses (net)’. (33) Income tax expense in CHF million 22002200 2019 Current tax (118.9) (121.2) Deferred tax (2.0) (3.4) Total income tax expense ((112200..99)) ((112244..66)) The tax on the Group’s profit before tax differs from the theoretical amount that would arise using the weighted average tax rate applicable to profits of the consolidated companies as follows: 2020 Financial Report | 61

2020 Financial Report Page 62 Page 64

2020 Financial Report Page 62 Page 64