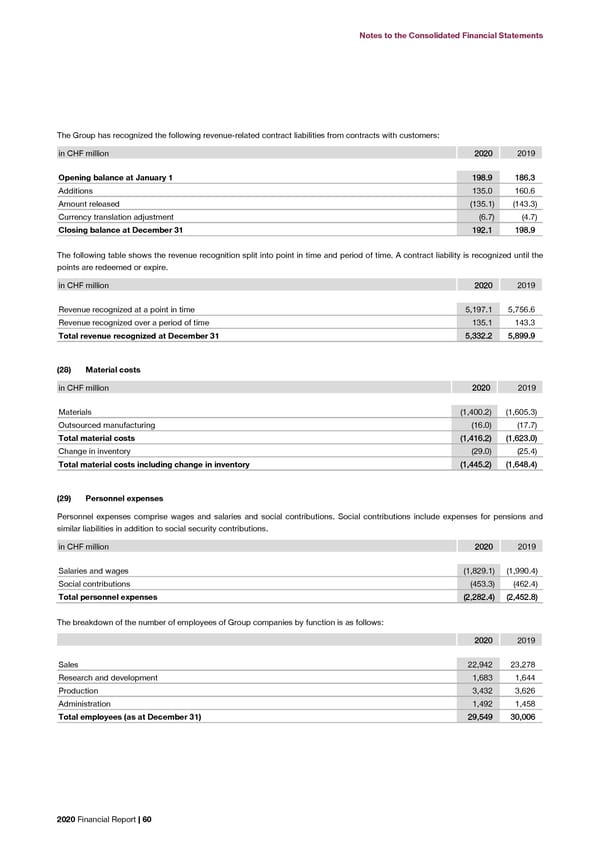

Notes to the Consolidated Financial Statements Notes to the Consolidated Financial Statements The Group has recognized the following revenue-related contract liabilities from contracts with customers: (30) Other operating expenses in CHF million 22002200 2019 Major items included in other operating expenses are the below: Opening balance at January 1 119988..99 118866..33 in CHF million 22002200 2019 Additions 135.0 160.6 Amount released (135.1) (143.3) Outward freight (123.1) (137.3) Currency translation adjustment (6.7) (4.7) Maintenance & repairs (105.6) (104.5) Closing balance at December 31 119922..11 119988..99 Legal & consulting (74.9) (81.5) Expenditures for rent (72.2) (76.7) The following table shows the revenue recognition split into point in time and period of time. A contract liability is recognized until the Travel (68.0) (170.2) points are redeemed or expire. Marketing & communication (52.5) (66.6) Other (82.9) (108.3) in CHF million 22002200 2019 Total other operating expenses ((557799..22)) ((774455..11)) Revenue recognized at a point in time 5,197.1 5,756.6 Revenue recognized over a period of time 135.1 143.3 (31) Other income and expenses (net) Total revenue recognized at December 31 55,,333322..22 55,,889999..99 Other income and expenses (net) comprise: in CHF million 22002200 2019 (28) Material costs Gains/(losses) on disposal of foreign operations and investments (5.9) 0.2 in CHF million 22002200 2019 Interest and dividend income 2.8 5.5 Gains/(losses) arising from valuation changes on financial assets and fair value hedging instruments 0.4 2.4 Materials (1,400.2) (1,605.3) Gains/(losses) on foreign currency hedging instruments 13.0 – Outsourced manufacturing (16.0) (17.7) Gains/(losses) on foreign currencies (35.8) (15.9) Total material costs ((11,,441166..22)) ((11,,662233..00)) Net interest income/(expense) on defined benefit plans (3.4) (5.7) Change in inventory (29.0) (25.4) Total other income and expenses (net) ((2288..99)) ((1133..55)) Total material costs including change in inventory ((11,,444455..22)) ((11,,664488..44)) (29) Personnel expenses (32) Finance costs Personnel expenses comprise wages and salaries and social contributions. Social contributions include expenses for pensions and Finance costs are reported at the gross interest expense amount. Interest expense on financial liabilities measured at amortized cost similar liabilities in addition to social security contributions. represents the total interest expense on financial liabilities not at fair value through profit or loss. Interest expense includes interest on lease liabilities, see note (9). Interest income from investments is separately included in ‘other income and expenses (net)’. in CHF million 22002200 2019 Salaries and wages (1,829.1) (1,990.4) (33) Income tax expense Social contributions (453.3) (462.4) Total personnel expenses ((22,,228822..44)) ((22,,445522..88)) in CHF million 22002200 2019 The breakdown of the number of employees of Group companies by function is as follows: Current tax (118.9) (121.2) Deferred tax (2.0) (3.4) 22002200 2019 Total income tax expense ((112200..99)) ((112244..66)) Sales 22,942 23,278 The tax on the Group’s profit before tax differs from the theoretical amount that would arise using the weighted average tax rate Research and development 1,683 1,644 applicable to profits of the consolidated companies as follows: Production 3,432 3,626 Administration 1,492 1,458 Total employees (as at December 31) 2299,,554499 3300,,000066 2020 Financial Report | 60 2020 Financial Report | 61

2020 Financial Report Page 61 Page 63

2020 Financial Report Page 61 Page 63