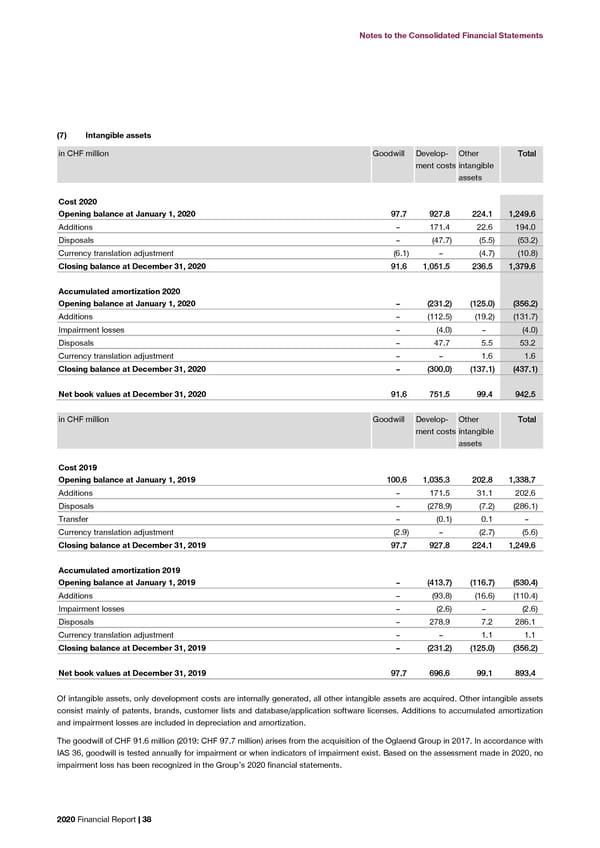

Notes to the Consolidated Financial Statements Notes to the Consolidated Financial Statements (7) Intangible assets For impairment testing purposes, goodwill is solely allocated to the Group’s offshore business as the cash-generating unit (CGU). To test for possible impairment of goodwill, the recoverable amount, calculated as discounted value of the estimated future cash flows of in CHF million Goodwill Develop- Other TToottaall the CGU (its ‘value in use’), is compared with its carrying amount. The future cash flows are estimated on the basis of the business plan ment costs intangible approved by management in general covering a four-year forecast period – 2021 to 2024 – and a constant growth rate assumption of assets 2.0% for the terminal value beyond 2024. The value in use of the CGU is based on a post-tax discount rate of 10.1%. The calculation of value in use is most sensitive to the below assumptions that were tested for sensitivity by applying a reasonably Cost 2020 possible change. Opening balance at January 1, 2020 9977..77 992277..88 222244..11 11,,224499..66 Additions – 171.4 22.6 194.0 • Projected cash flows: These largely depend on management’s expectations concerning the development of the offshore Disposals – (47.7) (5.5) (53.2) market and the planned business focus by the Group on this area of operation. Currency translation adjustment (6.1) – (4.7) (10.8) • Discount rate: The discount rate used reflects specific risks to the CGU offshore and is derived from its weighted cost of Closing balance at December 31, 2020 9911..66 11,,005511..55 223366..55 11,,337799..66 capital (WACC). • Long-term growth rate: The long-term growth rate is based upon management’s expectations corroborated by external Accumulated amortization 2020 information sources and does not exceed the long-term average growth rate customarily used for the relevant countries and Opening balance at January 1, 2020 –– ((223311..22)) ((112255..00)) ((335566..22)) markets. Additions – (112.5) (19.2) (131.7) Under the reasonably possible scenarios, a rise of 2% in the discount rate in the offshore business or a decrease of more than 20% of Impairment losses – (4.0) – (4.0) the terminal value would result in an impairment. Disposals – 47.7 5.5 53.2 Currency translation adjustment – – 1.6 1.6 (8) Property, plant and equipment Closing balance at December 31, 2020 –– ((330000..00)) ((113377..11)) ((443377..11)) in CHF million Land and Plant and Other Assets TToottaall Net book values at December 31, 2020 9911..66 775511..55 9999..44 994422..55 buildings machinery operating under con- assets struction in CHF million Goodwill Develop- Other TToottaall ment costs intangible Cost 2020 assets Opening balance at January 1, 2020 883366..99 776644..55 661100..66 112233..99 22,,333355..99 Additions 16.8 25.1 51.0 57.8 150.7 Cost 2019 Disposals (0.8) (14.8) (24.6) – (40.2) Opening balance at January 1, 2019 110000..66 11,,003355..33 220022..88 11,,333388..77 Other transfers 46.1 20.2 12.0 (78.3) – Additions – 171.5 31.1 202.6 Currency translation adjustment (6.4) (11.7) (24.5) (1.6) (44.2) Disposals – (278.9) (7.2) (286.1) Closing balance at December 31, 2020 889922..66 778833..33 662244..55 110011..88 22,,440022..22 Transfer – (0.1) 0.1 – Currency translation adjustment (2.9) – (2.7) (5.6) Accumulated depreciation 2020 Closing balance at December 31, 2019 9977..77 992277..88 222244..11 11,,224499..66 Opening balance at January 1, 2020 ((336622..99)) ((661111..88)) ((440088..66)) –– ((11,,338833..33)) Additions (23.7) (35.3) (59.8) – (118.8) Accumulated amortization 2019 Disposals 0.8 10.6 22.8 – 34.2 Opening balance at January 1, 2019 –– ((441133..77)) ((111166..77)) ((553300..44)) Other transfers 0.1 0.1 (0.2) – – Additions – (93.8) (16.6) (110.4) Currency translation adjustment 2.6 7.9 14.9 – 25.4 Impairment losses – (2.6) – (2.6) Closing balance at December 31, 2020 ((338833..11)) ((662288..55)) ((443300..99)) –– ((11,,444422..55)) Disposals – 278.9 7.2 286.1 Currency translation adjustment – – 1.1 1.1 Net book values at December 31, 2020 550099..55 115544..88 119933..66 110011..88 995599..77 Closing balance at December 31, 2019 –– ((223311..22)) ((112255..00)) ((335566..22)) Net book values at December 31, 2019 9977..77 669966..66 9999..11 889933..44 Of intangible assets, only development costs are internally generated, all other intangible assets are acquired. Other intangible assets consist mainly of patents, brands, customer lists and database/application software licenses. Additions to accumulated amortization and impairment losses are included in depreciation and amortization. The goodwill of CHF 91.6 million (2019: CHF 97.7 million) arises from the acquisition of the Oglaend Group in 2017. In accordance with IAS 36, goodwill is tested annually for impairment or when indicators of impairment exist. Based on the assessment made in 2020, no impairment loss has been recognized in the Group’s 2020 financial statements. 2020 Financial Report | 38 2020 Financial Report | 39

2020 Financial Report Page 39 Page 41

2020 Financial Report Page 39 Page 41