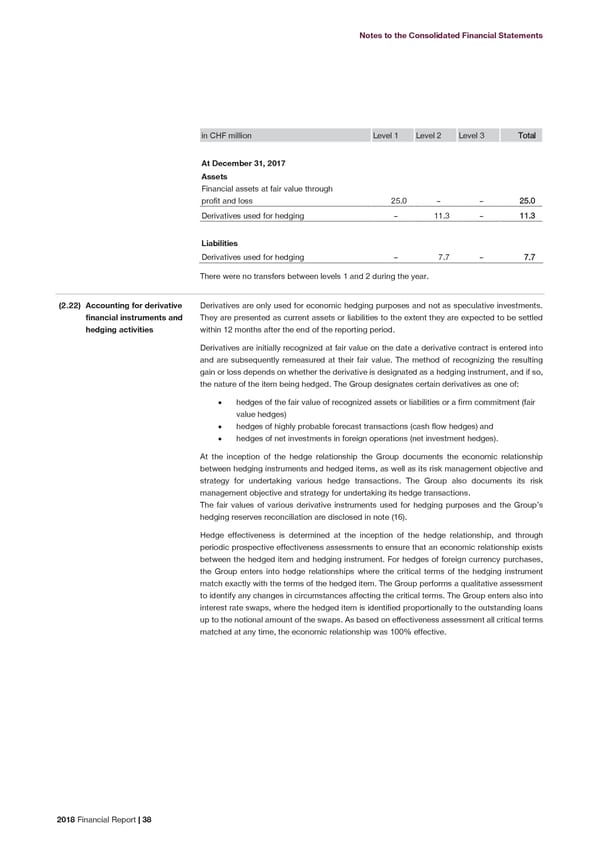

Notes to the Consolidated Financial Statements in CHF million Level 1 Level 2 Level 3 Total At December 31, 2017 Assets Financial assets at fair value through profit and loss 25.0 – – 25.0 Derivatives used for hedging – 11.3 – 11.3 Liabilities Derivatives used for hedging – 7.7 – 7.7 There were no transfers between levels 1 and 2 during the year. (2.22 ) Accounting for derivative Derivatives are only used for economic hedging purposes and not as speculative investments. financial instruments and They are presented as current assets or liabilities to the extent they are expected to be settled hedging activities within 12 months after the end of the reporting period. Derivatives are initially recognized at fair value on the date a derivative contract is entered into and are subsequently remeasured at their fair value. The method of recognizing the resulting gain or loss depends on whether the derivative is designated as a hedging instrument, and if so, the nature of the item being hedged. The Group designates certain derivatives as one of: • hedges of the fair value of recognized assets or liabilities or a firm commitment (fair value hedges) • hedges of highly probable forecast transactions (cash flow hedges) and • hedges of net investments in foreign operations (net investment hedges). At the inception of the hedge relationship the Group documents the economic relationship between hedging instruments and hedged items, as well as its risk management objective and strategy for undertaking various hedge transactions. The Group also documents its risk management objective and strategy for undertaking its hedge transactions. The fair values of various derivative instruments used for hedging purposes and the Group’s hedging reserves reconciliation are disclosed in note (16). Hedge effectiveness is determined at the inception of the hedge relationship, and through periodic prospective effectiveness assessments to ensure that an economic relationship exists between the hedged item and hedging instrument. For hedges of foreign currency purchases, the Group enters into hedge relationships where the critical terms of the hedging instrument match exactly with the terms of the hedged item. The Group performs a qualitative assessment to identify any changes in circumstances affecting the critical terms. The Group enters also into interest rate swaps, where the hedged item is identified proportionally to the outstanding loans up to the notional amount of the swaps. As based on effectiveness assessment all critical terms matched at any time, the economic relationship was 100% effective. 2018 Financial Report | 38

2018 Financial Report Page 39 Page 41

2018 Financial Report Page 39 Page 41