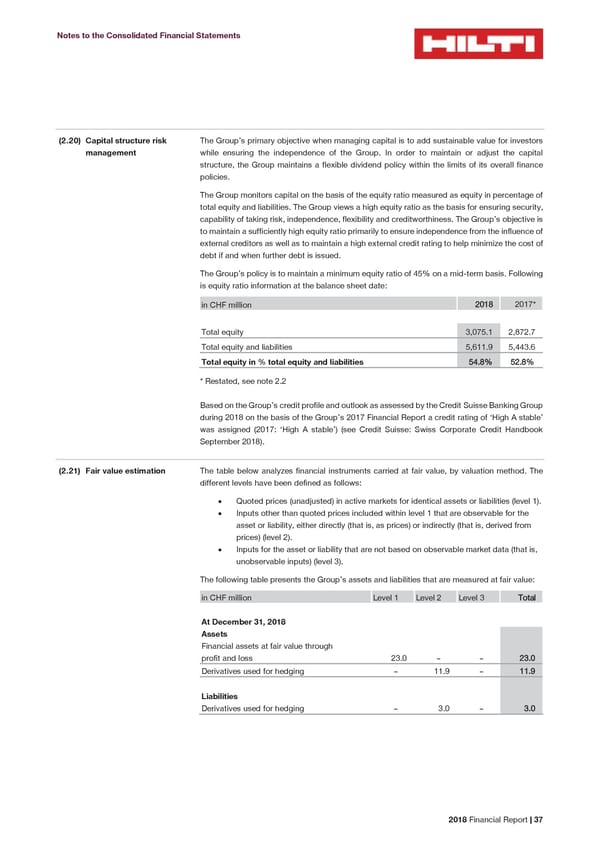

Notes to the Consolidated Financial Statements Capital structure risk The Group’s primary objective when managing capital is to add sustainable value for investors (2.20) management while ensuring the independence of the Group. In order to maintain or adjust the capital structure, the Group maintains a flexible dividend policy within the limits of its overall finance policies. The Group monitors capital on the basis of the equity ratio measured as equity in percentage of total equity and liabilities. The Group views a high equity ratio as the basis for ensuring security, capability of taking risk, independence, flexibility and creditworthiness. The Group’s objective is to maintain a sufficiently high equity ratio primarily to ensure independence from the influence of external creditors as well as to maintain a high external credit rating to help minimize the cost of debt if and when further debt is issued. The Group’s policy is to maintain a minimum equity ratio of 45% on a mid-term basis. Following is equity ratio information at the balance sheet date: in CHF million 2018 2017* Total equity 3,075.1 2,872.7 Total equity and liabilities 5,611.9 5,443.6 Total equity in % total equity and liabilities 54.8% 52.8% * Restated, see note 2.2 Based on the Group’s credit profile and outlook as assessed by the Credit Suisse Banking Group during 2018 on the basis of the Group’s 2017 Financial Report a credit rating of ‘High A stable’ was assigned (2017: ‘High A stable’) (see Credit Suisse: Swiss Corporate Credit Handbook September 2018). (2.21) Fair value estimation The table below analyzes financial instruments carried at fair value, by valuation method. The different levels have been defined as follows: • Quoted prices (unadjusted) in active markets for identical assets or liabilities (level 1). • Inputs other than quoted prices included within level 1 that are observable for the asset or liability, either directly (that is, as prices) or indirectly (that is, derived from prices) (level 2). • Inputs for the asset or liability that are not based on observable market data (that is, unobservable inputs) (level 3). The following table presents the Group’s assets and liabilities that are measured at fair value: in CHF million Level 1 Level 2 Level 3 Total At December 31, 2018 Assets Financial assets at fair value through profit and loss 23.0 – – 23.0 Derivatives used for hedging – 11.9 – 11.9 Liabilities Derivatives used for hedging – 3.0 – 3.0 2018 Financial Report | 37

2018 Financial Report Page 38 Page 40

2018 Financial Report Page 38 Page 40