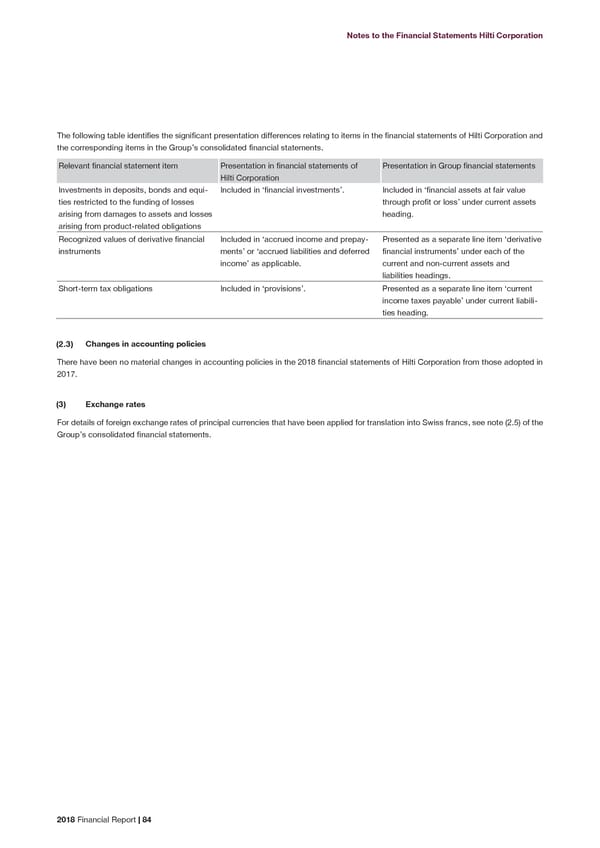

Notes to the Financial Statements Hilti Corporation The following table identifies the significant presentation differences relating to items in the financial statements of Hilti Corporation and the corresponding items in the Group’s consolidated financial statements. Relevant financial statement item Presentation in financial statements of Presentation in Group financial statements Hilti Corporation Investments in deposits, bonds and equi- Included in ‘financial investments’. Included in ‘financial assets at fair value ties restricted to the funding of losses through profit or loss’ under current assets arising from damages to assets and losses heading. arising from product-related obligations Recognized values of derivative financial Included in ‘accrued income and prepay- Presented as a separate line item ‘derivative instruments ments’ or ‘accrued liabilities and deferred financial instruments’ under each of the income’ as applicable. current and non-current assets and liabilities headings. Short-term tax obligations Included in ‘provisions’. Presented as a separate line item ‘current income taxes payable’ under current liabili- ties heading. Changes in accounting policies (2.3) There have been no material changes in accounting policies in the 2018 financial statements of Hilti Corporation from those adopted in 2017. (3) Exchange rates For details of foreign exchange rates of principal currencies that have been applied for translation into Swiss francs, see note (2.5) of the Group’s consolidated financial statements. 2018 Financial Report | 84

2018 Financial Report Page 85 Page 87

2018 Financial Report Page 85 Page 87