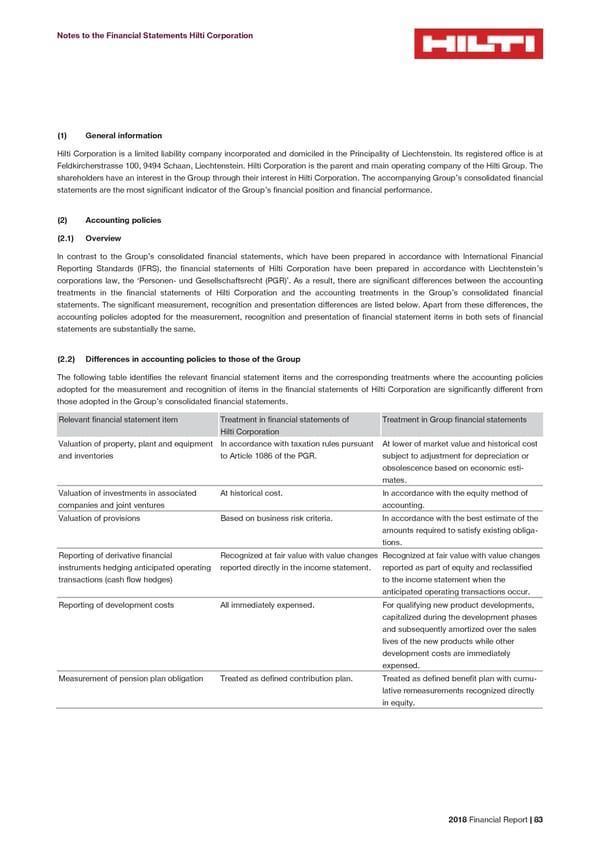

Notes to the Financial Statements Hilti Corporation (1) General information Hilti Corporation is a limited liability company incorporated and domiciled in the Principality of Liechtenstein. Its registered office is at Feldkircherstrasse 100, 9494 Schaan, Liechtenstein. Hilti Corporation is the parent and main operating company of the Hilti Group. The shareholders have an interest in the Group through their interest in Hilti Corporation. The accompanying Group’s consolidated financial statements are the most significant indicator of the Group’s financial position and financial performance. Accounting policies (2) (2.1) Overview In contrast to the Group’s consolidated financial statements, which have been prepared in accordance with International Financial Reporting Standards (IFRS), the financial statements of Hilti Corporation have been prepared in accordance with Liechtenstein’s corporations law, the ‘Personen- und Gesellschaftsrecht (PGR)’. As a result, there are significant differences between the accounting treatments in the financial statements of Hilti Corporation and the accounting treatments in the Group’s consolidated financial statements. The significant measurement, recognition and presentation differences are listed below. Apart from these differences, the accounting policies adopted for the measurement, recognition and presentation of financial statement items in both sets of financial statements are substantially the same. (2.2) Differences in accounting policies to those of the Group The following table identifies the relevant financial statement items and the corresponding treatments where the accounting policies adopted for the measurement and recognition of items in the financial statements of Hilti Corporation are significantly different from those adopted in the Group’s consolidated financial statements. Relevant financial statement item Treatment in financial statements of Treatment in Group financial statements Hilti Corporation Valuation of property, plant and equipment In accordance with taxation rules pursuant At lower of market value and historical cost and inventories to Article 1086 of the PGR. subject to adjustment for depreciation or obsolescence based on economic esti- mates. Valuation of investments in associated At historical cost. In accordance with the equity method of companies and joint ventures accounting. Valuation of provisions Based on business risk criteria. In accordance with the best estimate of the amounts required to satisfy existing obliga- tions. Reporting of derivative financial Recognized at fair value with value changes Recognized at fair value with value changes instruments hedging anticipated operating reported directly in the income statement. reported as part of equity and reclassified transactions (cash flow hedges) to the income statement when the anticipated operating transactions occur. Reporting of development costs All immediately expensed. For qualifying new product developments, capitalized during the development phases and subsequently amortized over the sales lives of the new products while other development costs are immediately expensed. Measurement of pension plan obligation Treated as defined contribution plan. Treated as defined benefit plan with cumu- lative remeasurements recognized directly in equity. 2018 Financial Report | 83

2018 Financial Report Page 84 Page 86

2018 Financial Report Page 84 Page 86