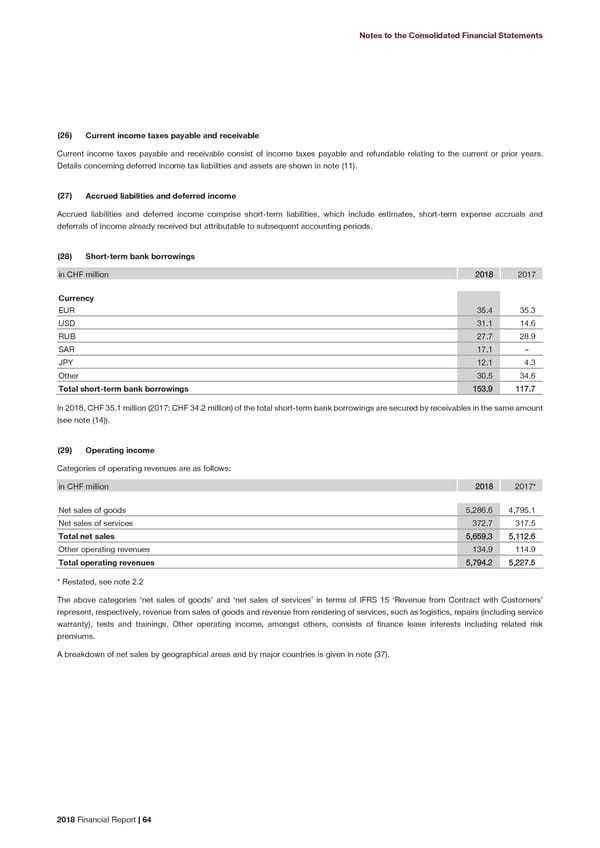

Notes to the Consolidated Financial Statements (26) Current income taxes payable and receivable Current income taxes payable and receivable consist of income taxes payable and refundable relating to the current or prior years. Details concerning deferred income tax liabilities and assets are shown in note (11). (27) Accrued liabilities and deferred income Accrued liabilities and deferred income comprise short-term liabilities, which include estimates, short-term expense accruals and deferrals of income already received but attributable to subsequent accounting periods. Short-term bank borrowings (28) in CHF million 2018 2017 Currency EUR 35.4 35.3 USD 31.1 14.6 RUB 27.7 28.9 SAR 17.1 – JPY 12.1 4.3 Other 30.5 34.6 Total short-term bank borrowings 153.9 117.7 In 2018, CHF 35.1 million (2017: CHF 34.2 million) of the total short-term bank borrowings are secured by receivables in the same amount (see note (14)). Operating income (29) Categories of operating revenues are as follows: in CHF million 2018 2017* Net sales of goods 5,286.6 4,795.1 Net sales of services 372.7 317.5 Total net sales 5,659.3 5,112.6 Other operating revenues 134.9 114.9 Total operating revenues 5,794.2 5,227.5 * Restated, see note 2.2 The above categories ‘net sales of goods’ and ‘net sales of services’ in terms of IFRS 15 ‘Revenue from Contract with Customers’ represent, respectively, revenue from sales of goods and revenue from rendering of services, such as logistics, repairs (including service warranty), tests and trainings. Other operating income, amongst others, consists of finance lease interests including related risk premiums. A breakdown of net sales by geographical areas and by major countries is given in note (37). 2018 Financial Report | 64

2018 Financial Report Page 65 Page 67

2018 Financial Report Page 65 Page 67