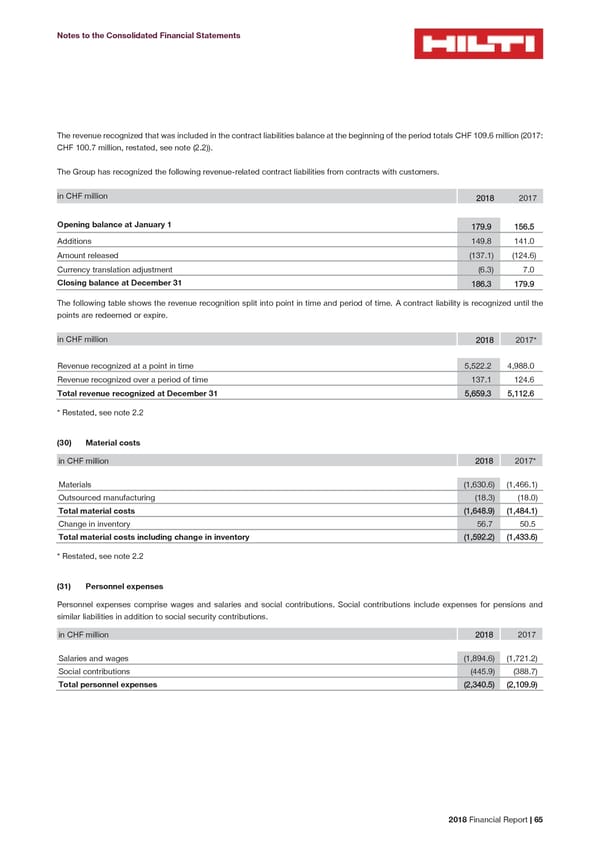

Notes to the Consolidated Financial Statements The revenue recognized that was included in the contract liabilities balance at the beginning of the period totals CHF 109.6 million (2017: CHF 100.7 million, restated, see note (2.2)). The Group has recognized the following revenue-related contract liabilities from contracts with customers. in CHF million 2018 2017 Opening balance at January 1 179.9 156.5 Additions 149.8 141.0 Amount released (137.1) (124.6) Currency translation adjustment (6.3) 7.0 Closing balance at December 31 186.3 179.9 The following table shows the revenue recognition split into point in time and period of time. A contract liability is recognized until the points are redeemed or expire. in CHF million 2018 2017* Revenue recognized at a point in time 5,522.2 4,988.0 Revenue recognized over a period of time 137.1 124.6 Total revenue recognized at December 31 5,659.3 5,112.6 * Restated, see note 2.2 (30) Material costs in CHF million 2018 2017* Materials (1,630.6) (1,466.1) Outsourced manufacturing (18.3) (18.0) Total material costs (1,648.9) (1,484.1) Change in inventory 56.7 50.5 Total material costs including change in inventory (1,592.2) (1,433.6) * Restated, see note 2.2 (31) Personnel expenses Personnel expenses comprise wages and salaries and social contributions. Social contributions include expenses for pensions and similar liabilities in addition to social security contributions. in CHF million 2018 2017 Salaries and wages (1,894.6) (1,721.2) Social contributions (445.9) (388.7) Total personnel expenses (2,340.5) (2,109.9) 2018 Financial Report | 65

2018 Financial Report Page 66 Page 68

2018 Financial Report Page 66 Page 68