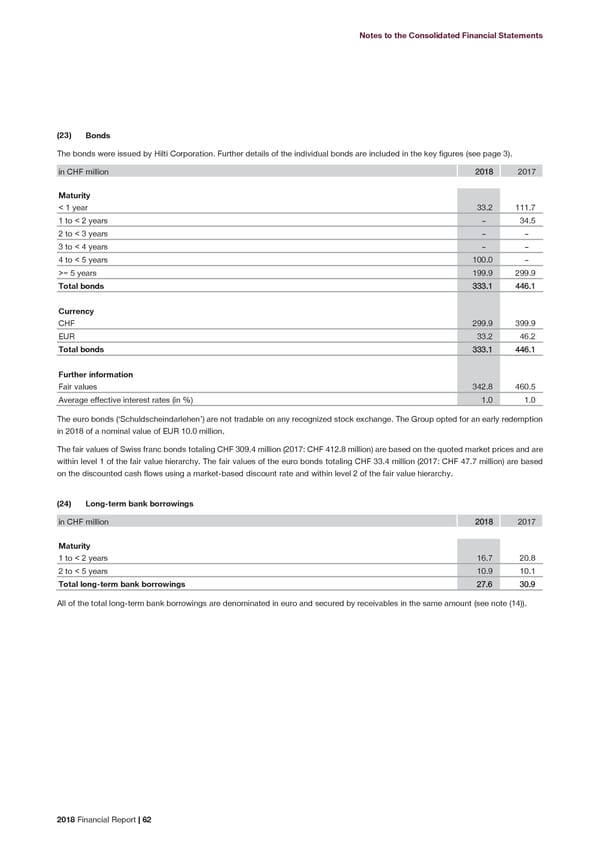

Notes to the Consolidated Financial Statements (23) Bonds The bonds were issued by Hilti Corporation. Further details of the individual bonds are included in the key figures (see page 3). in CHF million 2018 2017 Maturity < 1 year 33.2 111.7 1 to < 2 years – 34.5 2 to < 3 years – – 3 to < 4 years – – 4 to < 5 years 100.0 – >= 5 years 199.9 299.9 Total bonds 333.1 446.1 Currency CHF 299.9 399.9 EUR 33.2 46.2 Total bonds 333.1 446.1 Further information Fair values 342.8 460.5 Average effective interest rates (in %) 1.0 1.0 The euro bonds (‘Schuldscheindarlehen’) are not tradable on any recognized stock exchange. The Group opted for an early redemption in 2018 of a nominal value of EUR 10.0 million. The fair values of Swiss franc bonds totaling CHF 309.4 million (2017: CHF 412.8 million) are based on the quoted market prices and are within level 1 of the fair value hierarchy. The fair values of the euro bonds totaling CHF 33.4 million (2017: CHF 47.7 million) are based on the discounted cash flows using a market-based discount rate and within level 2 of the fair value hierarchy. (24) Long-term bank borrowings in CHF million 2018 2017 Maturity 1 to < 2 years 16.7 20.8 2 to < 5 years 10.9 10.1 Total long-term bank borrowings 27.6 30.9 All of the total long-term bank borrowings are denominated in euro and secured by receivables in the same amount (see note (14)). 2018 Financial Report | 62

2018 Financial Report Page 63 Page 65

2018 Financial Report Page 63 Page 65