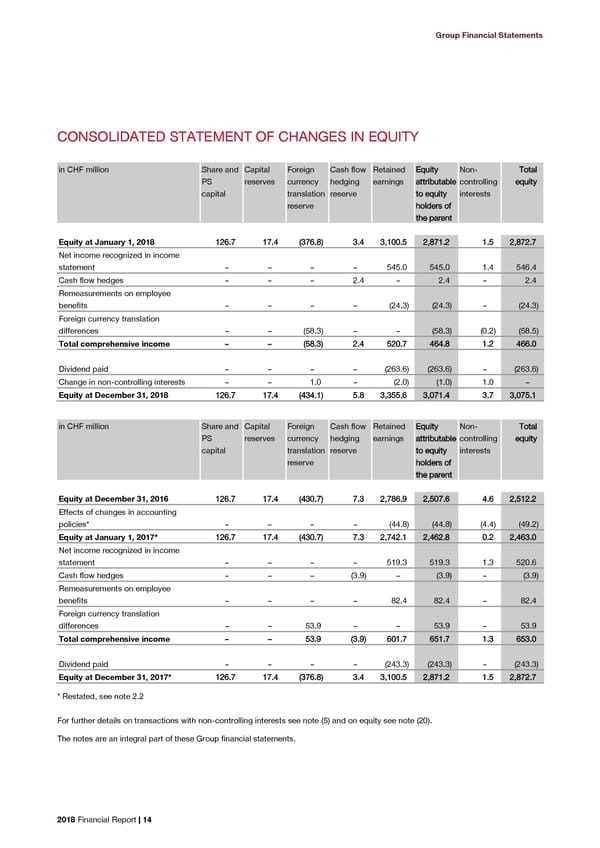

Group Financial Statements CONSOLIDATED STATEMENT OF CHANGES IN EQUITY in CHF million Share and Capital Foreign Cash flow Retained Equity Non- Total PS reserves currency hedging earnings attributable controlling equity capital translation reserve to equity interests reserve holders of the parent Equity at January 1, 2018 126.7 17.4 (376.8) 3.4 3,100.5 2,871.2 1.5 2,872.7 Net income recognized in income statement – – – – 545.0 545.0 1.4 546.4 Cash flow hedges – – – 2.4 – 2.4 – 2.4 Remeasurements on employee benefits – – – – (24.3) (24.3) – (24.3) Foreign currency translation differences – – (58.3) – – (58.3) (0.2) (58.5) Total comprehensive income – – (58.3) 2.4 520.7 464.8 1.2 466.0 Dividend paid – – – – (263.6) (263.6) – (263.6) Change in non-controlling interests – – 1.0 – (2.0) (1.0) 1.0 – Equity at December 31, 2018 126.7 17.4 (434.1) 5.8 3,355.6 3,071.4 3.7 3,075.1 in CHF million Share and Capital Foreign Cash flow Retained Equity Non- Total PS reserves currency hedging earnings attributable controlling equity capital translation reserve to equity interests reserve holders of the parent Equity at December 31, 2016 126.7 17.4 (430.7) 7.3 2,786.9 2,507.6 4.6 2,512.2 Effects of changes in accounting policies* – – – – (44.8) (44.8) (4.4) (49.2) Equity at January 1, 2017* 126.7 17.4 (430.7) 7.3 2,742.1 2,462.8 0.2 2,463.0 Net income recognized in income statement – – – – 519.3 519.3 1.3 520.6 Cash flow hedges – – – (3.9) – (3.9) – (3.9) Remeasurements on employee benefits – – – – 82.4 82.4 – 82.4 Foreign currency translation differences – – 53.9 – – 53.9 – 53.9 Total comprehensive income – – 53.9 (3.9) 601.7 651.7 1.3 653.0 Dividend paid – – – – (243.3) (243.3) – (243.3) Equity at December 31, 2017* 126.7 17.4 (376.8) 3.4 3,100.5 2,871.2 1.5 2,872.7 * Restated, see note 2.2 For further details on transactions with non-controlling interests see note (5) and on equity see note (20). The notes are an integral part of these Group financial statements. 2018 Financial Report | 14

2018 Financial Report Page 15 Page 17

2018 Financial Report Page 15 Page 17