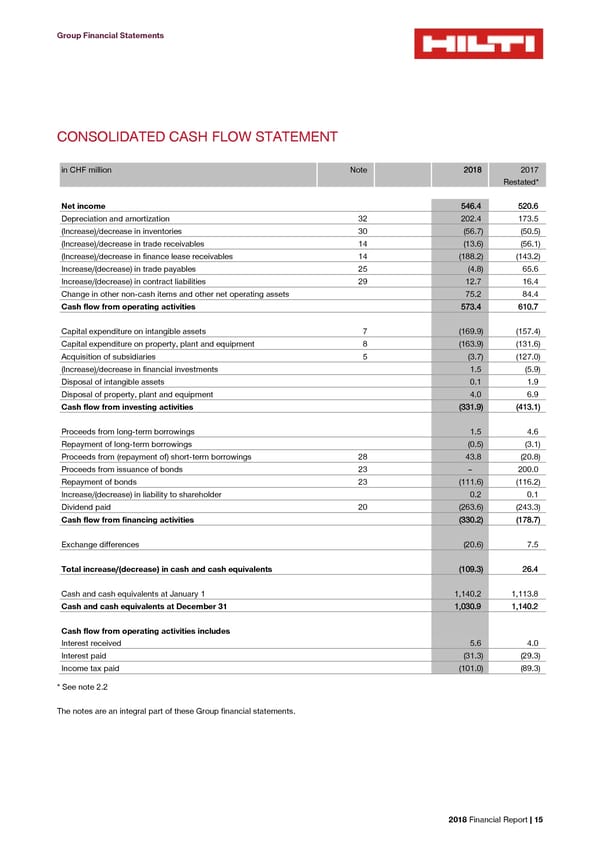

Group Financial Statements CONSOLIDATED CASH FLOW STATEMENT in CHF million Note 2018 2017 Restated* Net income 546.4 520.6 Depreciation and amortization 32 202.4 173.5 (Increase)/decrease in inventories 30 (56.7) (50.5) (Increase)/decrease in trade receivables 14 (13.6) (56.1) (Increase)/decrease in finance lease receivables 14 (188.2) (143.2) Increase/(decrease) in trade payables 25 (4.8) 65.6 Increase/(decrease) in contract liabilities 29 12.7 16.4 Change in other non-cash items and other net operating assets 75.2 84.4 Cash flow from operating activities 573.4 610.7 Capital expenditure on intangible assets 7 (169.9) (157.4) Capital expenditure on property, plant and equipment 8 (163.9) (131.6) Acquisition of subsidiaries 5 (3.7) (127.0) (Increase)/decrease in financial investments 1.5 (5.9) Disposal of intangible assets 0.1 1.9 Disposal of property, plant and equipment 4.0 6.9 Cash flow from investing activities (331.9) (413.1) Proceeds from long-term borrowings 1.5 4.6 Repayment of long-term borrowings (0.5) (3.1) Proceeds from (repayment of) short-term borrowings 28 43.8 (20.8) Proceeds from issuance of bonds 23 – 200.0 Repayment of bonds 23 (111.6) (116.2) Increase/(decrease) in liability to shareholder 0.2 0.1 Dividend paid 20 (263.6) (243.3) Cash flow from financing activities (330.2) (178.7) Exchange differences (20.6) 7.5 Total increase/(decrease) in cash and cash equivalents (109.3) 26.4 Cash and cash equivalents at January 1 1,140.2 1,113.8 Cash and cash equivalents at December 31 1,030.9 1,140.2 Cash flow from operating activities includes Interest received 5.6 4.0 Interest paid (31.3) (29.3) Income tax paid (101.0) (89.3) * See note 2.2 The notes are an integral part of these Group financial statements. 2018 Financial Report | 15

2018 Financial Report Page 16 Page 18

2018 Financial Report Page 16 Page 18