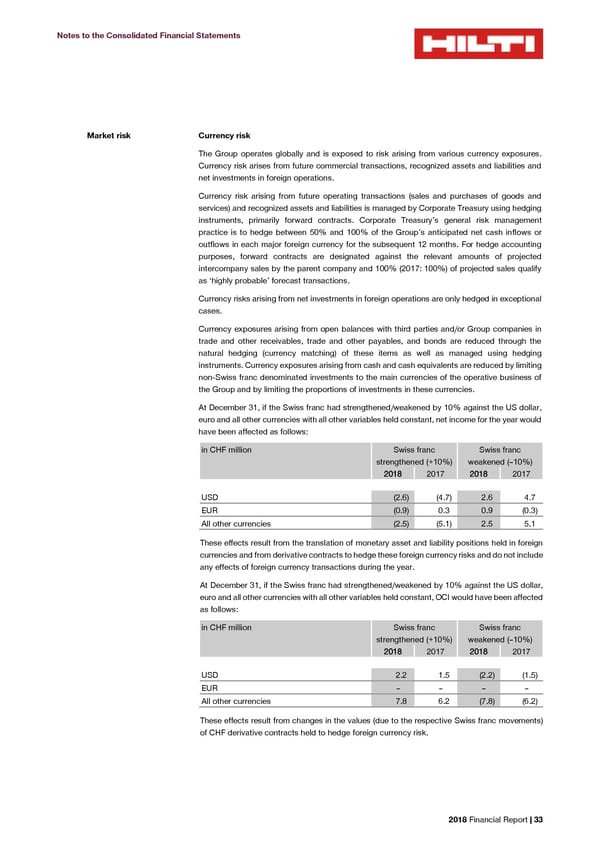

Notes to the Consolidated Financial Statements Market risk Currency risk The Group operates globally and is exposed to risk arising from various currency exposures. Currency risk arises from future commercial transactions, recognized assets and liabilities and net investments in foreign operations. Currency risk arising from future operating transactions (sales and purchases of goods and services) and recognized assets and liabilities is managed by Corporate Treasury using hedging instruments, primarily forward contracts. Corporate Treasury’s general risk management practice is to hedge between 50% and 100% of the Group’s anticipated net cash inflows or outflows in each major foreign currency for the subsequent 12 months. For hedge accounting purposes, forward contracts are designated against the relevant amounts of projected intercompany sales by the parent company and 100% (2017: 100%) of projected sales qualify as ‘highly probable’ forecast transactions. Currency risks arising from net investments in foreign operations are only hedged in exceptional cases. Currency exposures arising from open balances with third parties and/or Group companies in trade and other receivables, trade and other payables, and bonds are reduced through the natural hedging (currency matching) of these items as well as managed using hedging instruments. Currency exposures arising from cash and cash equivalents are reduced by limiting non-Swiss franc denominated investments to the main currencies of the operative business of the Group and by limiting the proportions of investments in these currencies. At December 31, if the Swiss franc had strengthened/weakened by 10% against the US dollar, euro and all other currencies with all other variables held constant, net income for the year would have been affected as follows: in CHF million Swiss franc Swiss franc strengthened (+10%) weakened (–10%) 2018 2017 2018 2017 USD (2.6) (4.7) 2.6 4.7 EUR (0.9) 0.3 0.9 (0.3) All other currencies (2.5) (5.1) 2.5 5.1 These effects result from the translation of monetary asset and liability positions held in foreign currencies and from derivative contracts to hedge these foreign currency risks and do not include any effects of foreign currency transactions during the year. At December 31, if the Swiss franc had strengthened/weakened by 10% against the US dollar, euro and all other currencies with all other variables held constant, OCI would have been affected as follows: in CHF million Swiss franc Swiss franc strengthened (+10%) weakened (–10%) 2018 2017 2018 2017 USD 2.2 1.5 (2.2) (1.5) EUR – – – – All other currencies 7.8 6.2 (7.8) (6.2) These effects result from changes in the values (due to the respective Swiss franc movements) of CHF derivative contracts held to hedge foreign currency risk. 2018 Financial Report | 33

2018 Financial Report Page 34 Page 36

2018 Financial Report Page 34 Page 36