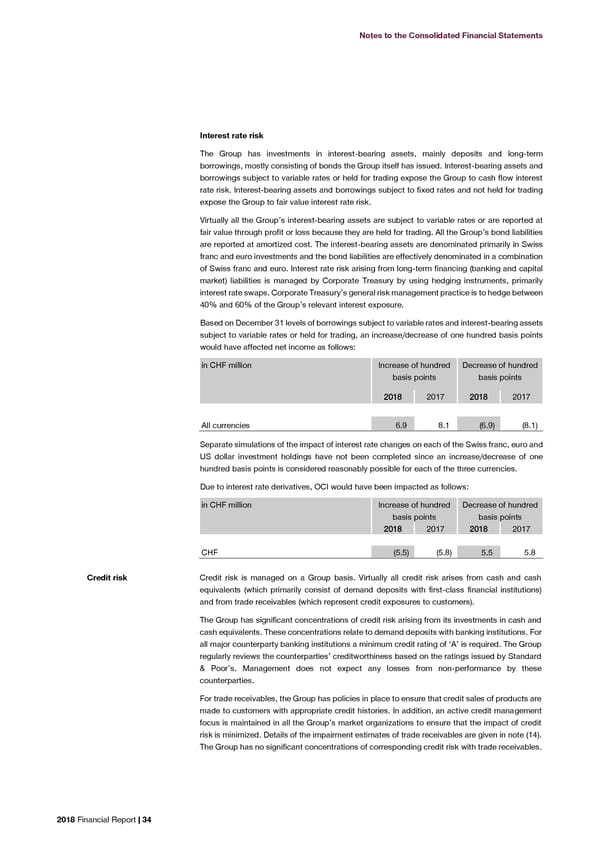

Notes to the Consolidated Financial Statements Interest rate risk The Group has investments in interest-bearing assets, mainly deposits and long-term borrowings, mostly consisting of bonds the Group itself has issued. Interest-bearing assets and borrowings subject to variable rates or held for trading expose the Group to cash flow interest rate risk. Interest-bearing assets and borrowings subject to fixed rates and not held for trading expose the Group to fair value interest rate risk. Virtually all the Group’s interest-bearing assets are subject to variable rates or are reported at fair value through profit or loss because they are held for trading. All the Group’s bond liabilities are reported at amortized cost. The interest-bearing assets are denominated primarily in Swiss franc and euro investments and the bond liabilities are effectively denominated in a combination of Swiss franc and euro. Interest rate risk arising from long-term financing (banking and capital market) liabilities is managed by Corporate Treasury by using hedging instruments, primarily interest rate swaps. Corporate Treasury’s general risk management practice is to hedge between 40% and 60% of the Group’s relevant interest exposure. Based on December 31 levels of borrowings subject to variable rates and interest-bearing assets subject to variable rates or held for trading, an increase/decrease of one hundred basis points would have affected net income as follows: in CHF million Increase of hundred Decrease of hundred basis points basis points 2018 2017 2018 2017 All currencies 6.9 8.1 (6.9) (8.1) Separate simulations of the impact of interest rate changes on each of the Swiss franc, euro and US dollar investment holdings have not been completed since an increase/decrease of one hundred basis points is considered reasonably possible for each of the three currencies. Due to interest rate derivatives, OCI would have been impacted as follows: in CHF million Increase of hundred Decrease of hundred basis points basis points 2018 2017 2018 2017 CHF (5.5) (5.8) 5.5 5.8 Credit risk Credit risk is managed on a Group basis. Virtually all credit risk arises from cash and cash equivalents (which primarily consist of demand deposits with first-class financial institutions) and from trade receivables (which represent credit exposures to customers). The Group has significant concentrations of credit risk arising from its investments in cash and cash equivalents. These concentrations relate to demand deposits with banking institutions. For all major counterparty banking institutions a minimum credit rating of ‘A’ is required. The Group regularly reviews the counterparties’ creditworthiness based on the ratings issued by Standard & Poor’s. Management does not expect any losses from non-performance by these counterparties. For trade receivables, the Group has policies in place to ensure that credit sales of products are made to customers with appropriate credit histories. In addition, an active credit management focus is maintained in all the Group’s market organizations to ensure that the impact of credit risk is minimized. Details of the impairment estimates of trade receivables are given in note (14). The Group has no significant concentrations of corresponding credit risk with trade receivables. 2018 Financial Report | 34

2018 Financial Report Page 35 Page 37

2018 Financial Report Page 35 Page 37