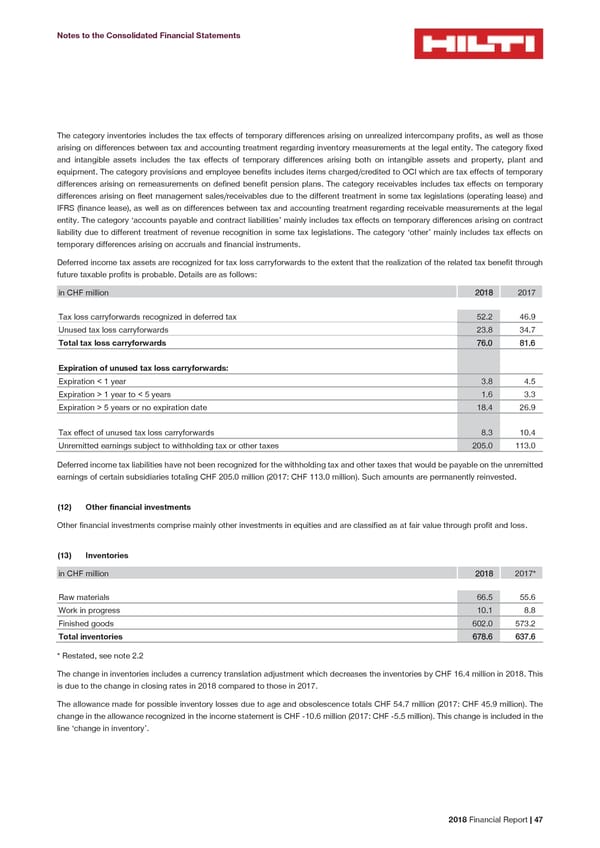

Notes to the Consolidated Financial Statements The category inventories includes the tax effects of temporary differences arising on unrealized intercompany profits, as well as those arising on differences between tax and accounting treatment regarding inventory measurements at the legal entity. The category fixed and intangible assets includes the tax effects of temporary differences arising both on intangible assets and property, plant and equipment. The category provisions and employee benefits includes items charged/credited to OCI which are tax effects of temporary differences arising on remeasurements on defined benefit pension plans. The category receivables includes tax effects on temporary differences arising on fleet management sales/receivables due to the different treatment in some tax legislations (operating lease) and IFRS (finance lease), as well as on differences between tax and accounting treatment regarding receivable measurements at the legal entity. The category ‘accounts payable and contract liabilities’ mainly includes tax effects on temporary differences arising on contract liability due to different treatment of revenue recognition in some tax legislations. The category ‘other’ mainly includes tax effects on temporary differences arising on accruals and financial instruments. Deferred income tax assets are recognized for tax loss carryforwards to the extent that the realization of the related tax benefit through future taxable profits is probable. Details are as follows: in CHF million 2018 2017 Tax loss carryforwards recognized in deferred tax 52.2 46.9 Unused tax loss carryforwards 23.8 34.7 Total tax loss carryforwards 76.0 81.6 Expiration of unused tax loss carryforwards: Expiration < 1 year 3.8 4.5 Expiration > 1 year to < 5 years 1.6 3.3 Expiration > 5 years or no expiration date 18.4 26.9 Tax effect of unused tax loss carryforwards 8.3 10.4 Unremitted earnings subject to withholding tax or other taxes 205.0 113.0 Deferred income tax liabilities have not been recognized for the withholding tax and other taxes that would be payable on the unremitted earnings of certain subsidiaries totaling CHF 205.0 million (2017: CHF 113.0 million). Such amounts are permanently reinvested. (12) Other financial investments Other financial investments comprise mainly other investments in equities and are classified as at fair value through profit and loss. Inventories (13) in CHF million 2018 2017* Raw materials 66.5 55.6 Work in progress 10.1 8.8 Finished goods 602.0 573.2 Total inventories 678.6 637.6 * Restated, see note 2.2 The change in inventories includes a currency translation adjustment which decreases the inventories by CHF 16.4 million in 2018. This is due to the change in closing rates in 2018 compared to those in 2017. The allowance made for possible inventory losses due to age and obsolescence totals CHF 54.7 million (2017: CHF 45.9 million). The change in the allowance recognized in the income statement is CHF -10.6 million (2017: CHF -5.5 million). This change is included in the line ‘change in inventory’. 2018 Financial Report | 47

2018 Financial Report Page 48 Page 50

2018 Financial Report Page 48 Page 50