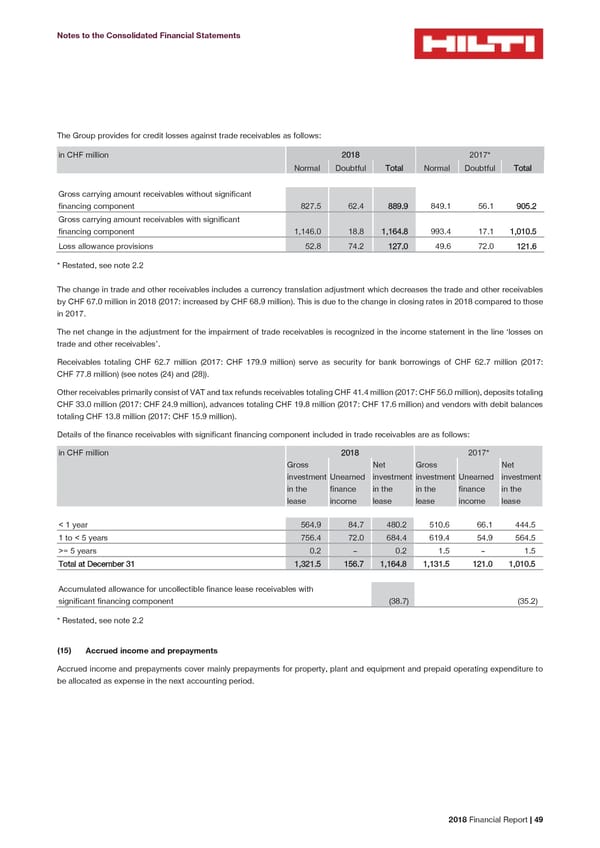

Notes to the Consolidated Financial Statements The Group provides for credit losses against trade receivables as follows: in CHF million 2018 2017* Normal Doubtful Total Normal Doubtful Total Gross carrying amount receivables without significant financing component 827.5 62.4 889.9 849.1 56.1 905.2 Gross carrying amount receivables with significant financing component 1,146.0 18.8 1,164.8 993.4 17.1 1,010.5 Loss allowance provisions 52.8 74.2 127.0 49.6 72.0 121.6 * Restated, see note 2.2 The change in trade and other receivables includes a currency translation adjustment which decreases the trade and other receivables by CHF 67.0 million in 2018 (2017: increased by CHF 68.9 million). This is due to the change in closing rates in 2018 compared to those in 2017. The net change in the adjustment for the impairment of trade receivables is recognized in the income statement in the line ‘losses on trade and other receivables’. Receivables totaling CHF 62.7 million (2017: CHF 179.9 million) serve as security for bank borrowings of CHF 62.7 million (2017: CHF 77.8 million) (see notes (24) and (28)). Other receivables primarily consist of VAT and tax refunds receivables totaling CHF 41.4 million (2017: CHF 56.0 million), deposits totaling CHF 33.0 million (2017: CHF 24.9 million), advances totaling CHF 19.8 million (2017: CHF 17.6 million) and vendors with debit balances totaling CHF 13.8 million (2017: CHF 15.9 million). Details of the finance receivables with significant financing component included in trade receivables are as follows: in CHF million 2018 2017* Gross Net Gross Net investment Unearned investment investment Unearned investment in the finance in the in the finance in the lease income lease lease income lease < 1 year 564.9 84.7 480.2 510.6 66.1 444.5 1 to < 5 years 756.4 72.0 684.4 619.4 54.9 564.5 >= 5 years 0.2 – 0.2 1.5 – 1.5 Total at December 31 1,321.5 156.7 1,164.8 1,131.5 121.0 1,010.5 Accumulated allowance for uncollectible finance lease receivables with significant financing component (38.7) (35.2) * Restated, see note 2.2 (15) Accrued income and prepayments Accrued income and prepayments cover mainly prepayments for property, plant and equipment and prepaid operating expenditure to be allocated as expense in the next accounting period. 2018 Financial Report | 49

2018 Financial Report Page 50 Page 52

2018 Financial Report Page 50 Page 52