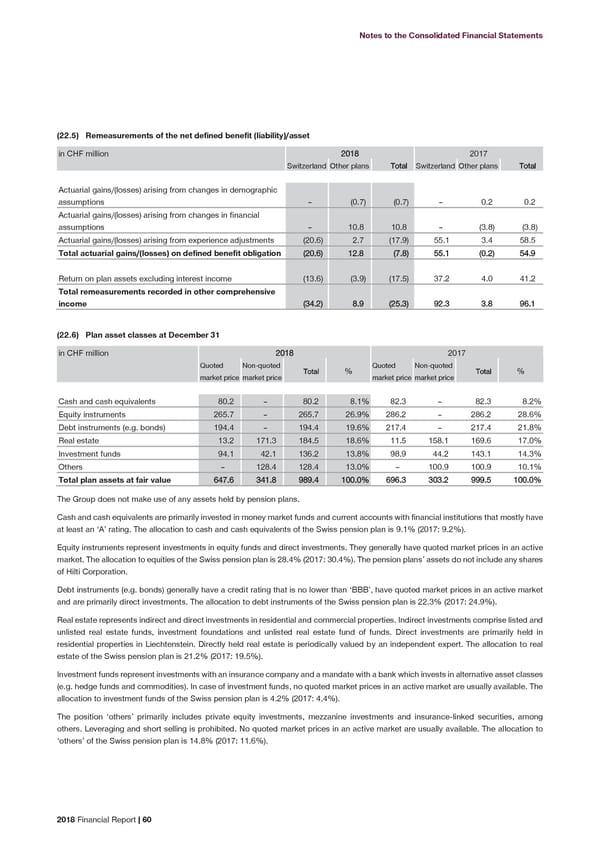

Notes to the Consolidated Financial Statements (22.5) Remeasurements of the net defined benefit (liability)/asset in CHF million 2018 2017 Switzerland Other plans Total Switzerland Other plans Total Actuarial gains/(losses) arising from changes in demographic assumptions – (0.7) (0.7) – 0.2 0.2 Actuarial gains/(losses) arising from changes in financial assumptions – 10.8 10.8 – (3.8) (3.8) Actuarial gains/(losses) arising from experience adjustments (20.6) 2.7 (17.9) 55.1 3.4 58.5 Total actuarial gains/(losses) on defined benefit obligation (20.6) 12.8 (7.8) 55.1 (0.2) 54.9 Return on plan assets excluding interest income (13.6) (3.9) (17.5) 37.2 4.0 41.2 Total remeasurements recorded in other comprehensive income (34.2) 8.9 (25.3) 92.3 3.8 96.1 (22.6) Plan asset classes at December 31 in CHF million 2018 2017 Quoted Non-quoted Total % Quoted Non-quoted Total % market price market price market price market price Cash and cash equivalents 80.2 – 80.2 8.1% 82.3 – 82.3 8.2% Equity instruments 265.7 – 265.7 26.9% 286.2 – 286.2 28.6% Debt instruments (e.g. bonds) 194.4 – 194.4 19.6% 217.4 – 217.4 21.8% Real estate 13.2 171.3 184.5 18.6% 11.5 158.1 169.6 17.0% Investment funds 94.1 42.1 136.2 13.8% 98.9 44.2 143.1 14.3% Others – 128.4 128.4 13.0% – 100.9 100.9 10.1% Total plan assets at fair value 647.6 341.8 989.4 100.0% 696.3 303.2 999.5 100.0% The Group does not make use of any assets held by pension plans. Cash and cash equivalents are primarily invested in money market funds and current accounts with financial institutions that mostly have at least an ‘A’ rating. The allocation to cash and cash equivalents of the Swiss pension plan is 9.1% (2017: 9.2%). Equity instruments represent investments in equity funds and direct investments. They generally have quoted market prices in an active market. The allocation to equities of the Swiss pension plan is 28.4% (2017: 30.4%). The pension plans’ assets do not include any shares of Hilti Corporation. Debt instruments (e.g. bonds) generally have a credit rating that is no lower than ‘BBB’, have quoted market prices in an active market and are primarily direct investments. The allocation to debt instruments of the Swiss pension plan is 22.3% (2017: 24.9%). Real estate represents indirect and direct investments in residential and commercial properties. Indirect investments comprise listed and unlisted real estate funds, investment foundations and unlisted real estate fund of funds. Direct investments are primarily held in residential properties in Liechtenstein. Directly held real estate is periodically valued by an independent expert. The allocation to real estate of the Swiss pension plan is 21.2% (2017: 19.5%). Investment funds represent investments with an insurance company and a mandate with a bank which invests in alternative asset classes (e.g. hedge funds and commodities). In case of investment funds, no quoted market prices in an active market are usually available. The allocation to investment funds of the Swiss pension plan is 4.2% (2017: 4.4%). The position ‘others’ primarily includes private equity investments, mezzanine investments and insurance-linked securities, among others. Leveraging and short selling is prohibited. No quoted market prices in an active market are usually available. The allocation to ‘others’ of the Swiss pension plan is 14.8% (2017: 11.6%). 2018 Financial Report | 60

2018 Financial Report Page 61 Page 63

2018 Financial Report Page 61 Page 63