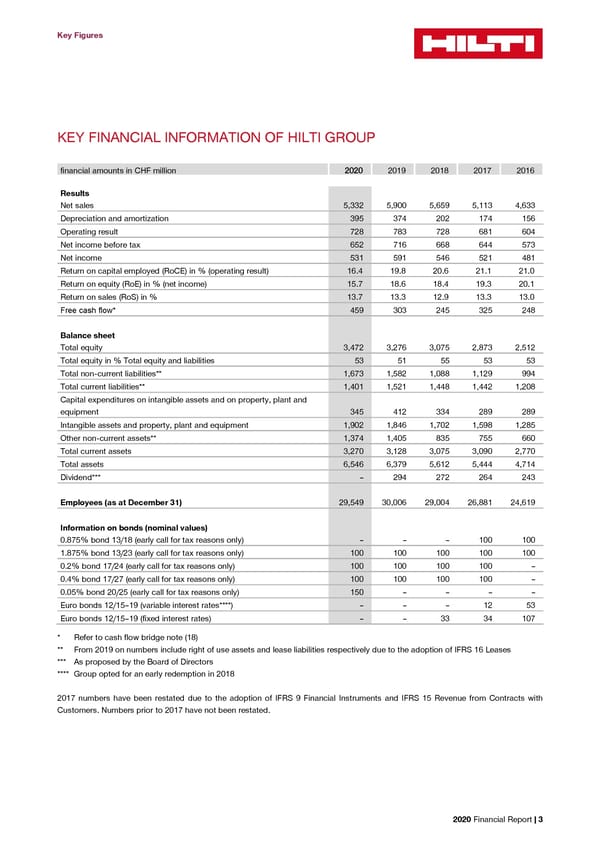

Key Figures Key Figures KEY FINANCIAL INFORMATION OF HILTI GROUP financial amounts in CHF million 22002200 2019 2018 2017 2016 Results Net sales 5,332 5,900 5,659 5,113 4,633 Depreciation and amortization 395 374 202 174 156 Operating result 728 783 728 681 604 Net income before tax 652 716 668 644 573 Net income 531 591 546 521 481 Return on capital employed (RoCE) in % (operating result) 16.4 19.8 20.6 21.1 21.0 Return on equity (RoE) in % (net income) 15.7 18.6 18.4 19.3 20.1 Return on sales (RoS) in % 13.7 13.3 12.9 13.3 13.0 Free cash flow* 459 303 245 325 248 Balance sheet Total equity 3,472 3,276 3,075 2,873 2,512 Total equity in % Total equity and liabilities 53 51 55 53 53 Total non-current liabilities** 1,673 1,582 1,088 1,129 994 Total current liabilities** 1,401 1,521 1,448 1,442 1,208 Capital expenditures on intangible assets and on property, plant and equipment 345 412 334 289 289 Intangible assets and property, plant and equipment 1,902 1,846 1,702 1,598 1,285 Other non-current assets** 1,374 1,405 835 755 660 Total current assets 3,270 3,128 3,075 3,090 2,770 Total assets 6,546 6,379 5,612 5,444 4,714 Dividend*** – 294 272 264 243 Employees (as at December 31) 29,549 30,006 29,004 26,881 24,619 Information on bonds (nominal values) 0.875% bond 13/18 (early call for tax reasons only) – – – 100 100 1.875% bond 13/23 (early call for tax reasons only) 100 100 100 100 100 0.2% bond 17/24 (early call for tax reasons only) 100 100 100 100 – 0.4% bond 17/27 (early call for tax reasons only) 100 100 100 100 – 0.05% bond 20/25 (early call for tax reasons only) 150 – – – – Euro bonds 12/15–19 (variable interest rates****) – – – 12 53 Euro bonds 12/15–19 (fixed interest rates) – – 33 34 107 * Refer to cash flow bridge note (18) ** From 2019 on numbers include right of use assets and lease liabilities respectively due to the adoption of IFRS 16 Leases *** As proposed by the Board of Directors **** Group opted for an early redemption in 2018 2017 numbers have been restated due to the adoption of IFRS 9 Financial Instruments and IFRS 15 Revenue from Contracts with Customers. Numbers prior to 2017 have not been restated. 2020 Financial Report | 3

2020 Financial Report Page 4 Page 6

2020 Financial Report Page 4 Page 6