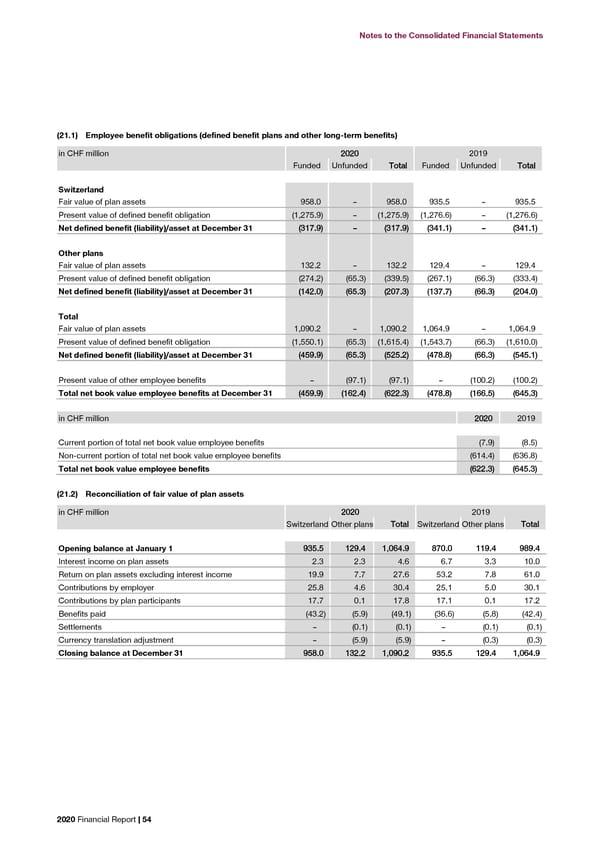

Notes to the Consolidated Financial Statements Notes to the Consolidated Financial Statements (21.1) Employee benefit obligations (defined benefit plans and other long-term benefits) (21.3) Reconciliation of present value of defined benefit obligation in CHF million 22002200 2019 in CHF million 22002200 2019 Funded Unfunded TToottaall Funded Unfunded TToottaall Switzerland Other plans TToottaall Switzerland Other plans TToottaall Switzerland Opening balance at January 1 ((11,,227766..66)) ((333333..44)) ((11,,661100..00)) ((11,,115533..55)) ((330022..44)) ((11,,445555..99)) Fair value of plan assets 958.0 – 958.0 935.5 – 935.5 Current service cost (35.1) (7.6) (42.7) (29.1) (8.4) (37.5) Present value of defined benefit obligation (1,275.9) – (1,275.9) (1,276.6) – (1,276.6) Interest expense on defined benefit obligation (3.2) (4.8) (8.0) (8.7) (7.0) (15.7) Net defined benefit (liability)/asset at December 31 ((331177..99)) –– ((331177..99)) ((334411..11)) –– ((334411..11)) Actuarial gains/(losses) 5.1 (14.1) (9.0) (113.4) (29.3) (142.7) Contributions by plan participants (17.7) – (17.7) (17.1) – (17.1) Other plans Benefits paid 43.2 11.0 54.2 36.6 7.9 44.5 Fair value of plan assets 132.2 – 132.2 129.4 – 129.4 Past service cost 8.4 (0.4) 8.0 8.6 1.7 10.3 Present value of defined benefit obligation (274.2) (65.3) (339.5) (267.1) (66.3) (333.4) Currency translation adjustment – 9.8 9.8 – 4.1 4.1 Net defined benefit (liability)/asset at December 31 ((114422..00)) ((6655..33)) ((220077..33)) ((113377..77)) ((6666..33)) ((220044..00)) Closing balance at December 31 ((11,,227755..99)) ((333399..55)) ((11,,661155..44)) ((11,,227766..66)) ((333333..44)) ((11,,661100..00)) Total (21.4) Components of defined benefit costs recognized in the income statement Fair value of plan assets 1,090.2 – 1,090.2 1,064.9 – 1,064.9 Present value of defined benefit obligation (1,550.1) (65.3) (1,615.4) (1,543.7) (66.3) (1,610.0) in CHF million 22002200 2019 Net defined benefit (liability)/asset at December 31 ((445599..99)) ((6655..33)) ((552255..22)) ((447788..88)) ((6666..33)) ((554455..11)) Switzerland Other plans TToottaall Switzerland Other plans TToottaall Present value of other employee benefits – (97.1) (97.1) – (100.2) (100.2) Current service cost (35.1) (7.6) (42.7) (29.1) (8.4) (37.5) Total net book value employee benefits at December 31 ((445599..99)) ((116622..44)) ((662222..33)) ((447788..88)) ((116666..55)) ((664455..33)) Past service cost 8.4 (0.4) 8.0 8.6 1.7 10.3 Gains/(losses) on settlements – (0.1) (0.1) – (0.1) (0.1) in CHF million 22002200 2019 Total service cost ((2266..77)) ((88..11)) ((3344..88)) ((2200..55)) ((66..88)) ((2277..33)) Interest income on plan assets 2.3 2.3 4.6 6.7 3.3 10.0 Current portion of total net book value employee benefits (7.9) (8.5) Interest expense on defined benefit obligation (3.2) (4.8) (8.0) (8.7) (7.0) (15.7) Non-current portion of total net book value employee benefits (614.4) (636.8) Net interest income/(expense) on defined benefit plans ((00..99)) ((22..55)) ((33..44)) ((22..00)) ((33..77)) ((55..77)) Total net book value employee benefits ((662222..33)) ((664455..33)) Total defined benefit costs recognized in the income statement ((2277..66)) ((1100..66)) ((3388..22)) ((2222..55)) ((1100..55)) ((3333..00)) (21.2) Reconciliation of fair value of plan assets In the income statement, the various components of the defined benefit costs are included as follows: in CHF million 22002200 2019 Switzerland Other plans TToottaall Switzerland Other plans TToottaall • Total service cost – in ‘personnel expenses’ (see note (29)) and • Interest income and expense – in ‘other income and expenses (net)’ (see note (31)). Opening balance at January 1 993355..55 112299..44 11,,006644..99 887700..00 111199..44 998899..44 Interest income on plan assets 2.3 2.3 4.6 6.7 3.3 10.0 (21.5) Remeasurements of the net defined benefit (liability)/asset Return on plan assets excluding interest income 19.9 7.7 27.6 53.2 7.8 61.0 in CHF million 22002200 2019 Contributions by employer 25.8 4.6 30.4 25.1 5.0 30.1 Switzerland Other plans TToottaall Switzerland Other plans TToottaall Contributions by plan participants 17.7 0.1 17.8 17.1 0.1 17.2 Benefits paid (43.2) (5.9) (49.1) (36.6) (5.8) (42.4) Actuarial gains/(losses) arising from changes in demographic Settlements – (0.1) (0.1) – (0.1) (0.1) assumptions – (0.7) (0.7) – 13.5 13.5 Currency translation adjustment – (5.9) (5.9) – (0.3) (0.3) Actuarial gains/(losses) arising from changes in financial Closing balance at December 31 995588..00 113322..22 11,,009900..22 993355..55 112299..44 11,,006644..99 assumptions 12.4 (17.3) (4.9) (105.8) (47.5) (153.3) Actuarial gains/(losses) arising from experience adjustments (7.3) 3.9 (3.4) (7.6) 4.7 (2.9) Total actuarial gains/(losses) on defined benefit obligation 55..11 ((1144..11)) ((99..00)) ((111133..44)) ((2299..33)) ((114422..77)) Return on plan assets excluding interest income 19.9 7.7 27.6 53.2 7.8 61.0 Total remeasurements recorded in other comprehensive income 2255..00 ((66..44)) 1188..66 ((6600..22)) ((2211..55)) ((8811..77)) 2020 Financial Report | 54 2020 Financial Report | 55

2020 Financial Report Page 55 Page 57

2020 Financial Report Page 55 Page 57