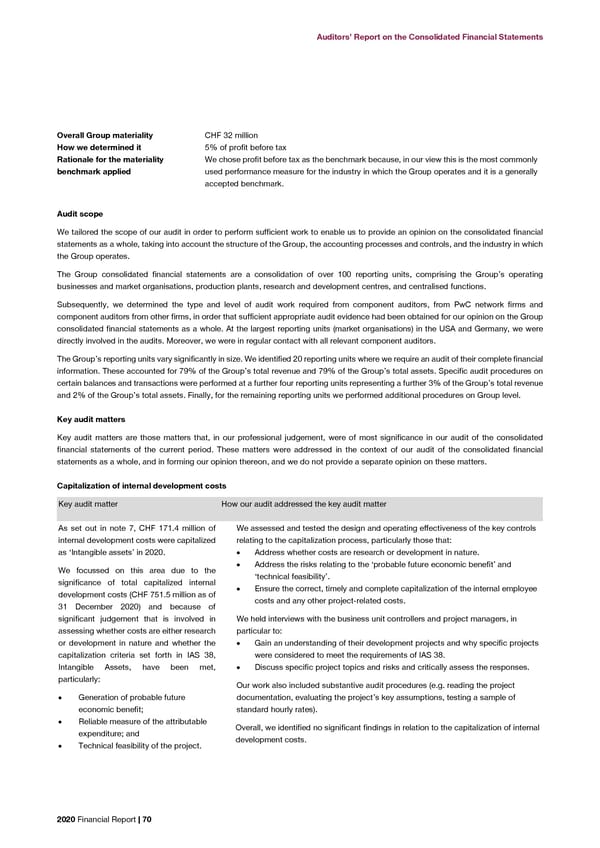

Auditors’ Report on the Consolidated Financial Statements Auditors’ Report on the Consolidated Financial Statements Overall Group materiality CHF 32 million Other information in the annual report How we determined it 5% of profit before tax Rationale for the materiality We chose profit before tax as the benchmark because, in our view this is the most commonly The Board of Directors is responsible for the other information in the annual report. The other information comprises all information benchmark applied used performance measure for the industry in which the Group operates and it is a generally included in the annual report, but does not include the consolidated financial statements, the standalone financial statements of Hilti accepted benchmark. Aktiengesellschaft and our auditor’s reports thereon. Our opinion on the consolidated financial statements does not cover the other information in the annual report and we do not express Audit scope any form of assurance conclusion thereon. We tailored the scope of our audit in order to perform sufficient work to enable us to provide an opinion on the consolidated financial In connection with our audit of the consolidated financial statements, our responsibility is to read the other information in the annual statements as a whole, taking into account the structure of the Group, the accounting processes and controls, and the industry in which report and, in doing so, consider whether the other information is materially inconsistent with the consolidated financial statements or the Group operates. our knowledge obtained in the audit, or otherwise appears to be materially misstated. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in The Group consolidated financial statements are a consolidation of over 100 reporting units, comprising the Group’s operating this regard. businesses and market organisations, production plants, research and development centres, and centralised functions. Responsibilities of the Board of Directors for the consolidated financial statements Subsequently, we determined the type and level of audit work required from component auditors, from PwC network firms and component auditors from other firms, in order that sufficient appropriate audit evidence had been obtained for our opinion on the Group The Board of Directors is responsible for the preparation of the consolidated financial statements that give a true and fair view in consolidated financial statements as a whole. At the largest reporting units (market organisations) in the USA and Germany, we were accordance with IFRS and the provisions of Liechtenstein law, and for such internal control as the Board of Directors determines is directly involved in the audits. Moreover, we were in regular contact with all relevant component auditors. necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. The Group’s reporting units vary significantly in size. We identified 20 reporting units where we require an audit of their complete financial information. These accounted for 79% of the Group’s total revenue and 79% of the Group’s total assets. Specific audit procedures on In preparing the consolidated financial statements, the Board of Directors is responsible for assessing the Group’s ability to continue as certain balances and transactions were performed at a further four reporting units representing a further 3% of the Group’s total revenue a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the and 2% of the Group’s total assets. Finally, for the remaining reporting units we performed additional procedures on Group level. Board of Directors either intends to liquidate the Group or to cease operations, or has no realistic alternative but to do so. Key audit matters Auditor’s responsibilities for the audit of the consolidated financial statements Key audit matters are those matters that, in our professional judgement, were of most significance in our audit of the consolidated Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material financial statements of the current period. These matters were addressed in the context of our audit of the consolidated financial misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters. level of assurance, but is not a guarantee that an audit conducted in accordance with Liechtenstein law and ISAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the Capitalization of internal development costs aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these consolidated financial statements. Key audit matter How our audit addressed the key audit matter As part of an audit in accordance with Liechtenstein law and ISAs, we exercise professional judgment and maintain professional As set out in note 7, CHF 171.4 million of We assessed and tested the design and operating effectiveness of the key controls scepticism throughout the audit. We also: internal development costs were capitalized relating to the capitalization process, particularly those that: as ‘Intangible assets’ in 2020. • Address whether costs are research or development in nature. • Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, • Address the risks relating to the ‘probable future economic benefit’ and design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to We focussed on this area due to the ‘technical feasibility’. provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one significance of total capitalized internal • Ensure the correct, timely and complete capitalization of the internal employee resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal development costs (CHF 751.5 million as of costs and any other project-related costs. control. 31 December 2020) and because of • Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the significant judgement that is involved in We held interviews with the business unit controllers and project managers, in circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Group’s internal control. assessing whether costs are either research particular to: • Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures or development in nature and whether the • Gain an understanding of their development projects and why specific projects made. capitalization criteria set forth in IAS 38, were considered to meet the requirements of IAS 38. • Conclude on the appropriateness of the Board of Directors’ use of the going concern basis of accounting and, based on the audit Intangible Assets, have been met, • Discuss specific project topics and risks and critically assess the responses. evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the particularly: Group’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention Our work also included substantive audit procedures (e.g. reading the project in our auditor’s report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to • Generation of probable future documentation, evaluating the project’s key assumptions, testing a sample of modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, economic benefit; standard hourly rates). future events or conditions may cause the Group to cease to continue as a going concern. • Reliable measure of the attributable Overall, we identified no significant findings in relation to the capitalization of internal • Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and expenditure; and development costs. whether the consolidated financial statements represent the underlying transactions and events in a manner that achieves fair • Technical feasibility of the project. presentation. 2020 Financial Report | 70 2020 Financial Report | 71

2020 Financial Report Page 71 Page 73

2020 Financial Report Page 71 Page 73