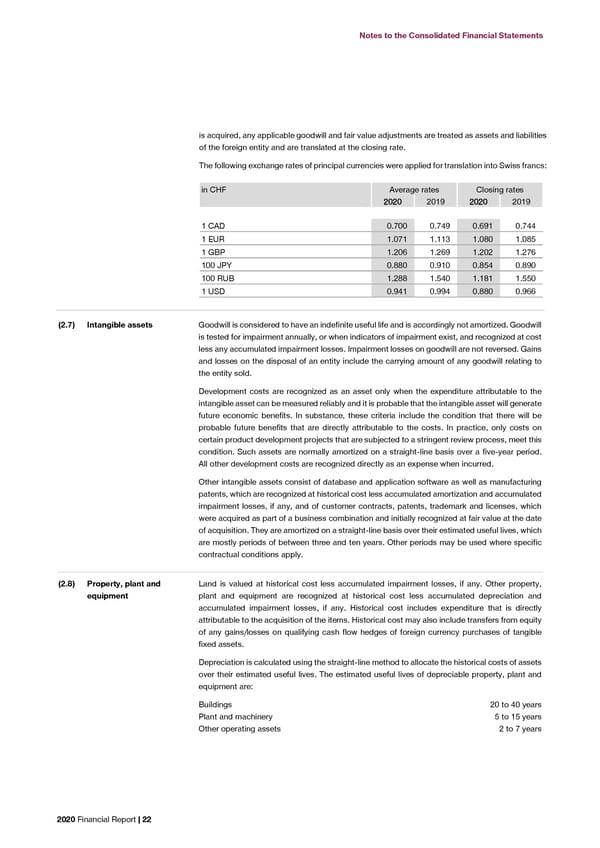

Notes to the Consolidated Financial Statements Notes to the Consolidated Financial Statements is acquired, any applicable goodwill and fair value adjustments are treated as assets and liabilities of the foreign entity and are translated at the closing rate. (2.9) Leases The Group assesses at the contract inception whether a contract is, or contains, a lease. That The following exchange rates of principal currencies were applied for translation into Swiss francs: is, if the contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration. in CHF Average rates Closing rates 22002200 2019 22002200 2019 As lessee 1 CAD 0.700 0.749 0.691 0.744 The Group, as a lessee, identified leases mainly relating to rental contracts for buildings (e.g. 1 EUR 1.071 1.113 1.080 1.085 offices, warehouses, retail stores) and vehicles. Contracts may contain both lease and non-lease 1 GBP 1.206 1.269 1.202 1.276 components, the Group has elected not to separate lease and non-lease components and instead accounts for these as a single lease component. 100 JPY 0.880 0.910 0.854 0.890 100 RUB 1.288 1.540 1.181 1.550 The Group applies a single recognition and measurement approach for all leases, except for 1 USD 0.941 0.994 0.880 0.966 short-term leases and leases of low-value assets, which are recognized as expense on a straight- line basis over the lease terms. At the date at which the leased asset is available for use, the Group recognizes lease liabilities (2.7) Intangible assets Goodwill is considered to have an indefinite useful life and is accordingly not amortized. Goodwill to make lease payments and right of use assets representing the right to use the underlying is tested for impairment annually, or when indicators of impairment exist, and recognized at cost assets. less any accumulated impairment losses. Impairment losses on goodwill are not reversed. Gains and losses on the disposal of an entity include the carrying amount of any goodwill relating to At the commencement date of the lease, the Group recognizes lease liabilities measured at the the entity sold. present value of lease payments to be made over the lease term, which include: Development costs are recognized as an asset only when the expenditure attributable to the • fixed payments, less any lease incentives receivable intangible asset can be measured reliably and it is probable that the intangible asset will generate • variable lease payment that are based on an index or a rate future economic benefits. In substance, these criteria include the condition that there will be • amounts expected to be payable by the Group under residual value guarantees probable future benefits that are directly attributable to the costs. In practice, only costs on • the exercise price of a purchase option if the Group is reasonably certain to exercise certain product development projects that are subjected to a stringent review process, meet this that option, and condition. Such assets are normally amortized on a straight-line basis over a five-year period. • payments of penalties for terminating the lease. All other development costs are recognized directly as an expense when incurred. Lease liabilities are subsequently increased by the interest cost on the lease liability and are decreased by lease payments made. Other intangible assets consist of database and application software as well as manufacturing patents, which are recognized at historical cost less accumulated amortization and accumulated The Group has several lease contracts that include extension and termination options. Lease impairment losses, if any, and of customer contracts, patents, trademark and licenses, which payments to be made under reasonably certain extension options are also included in the were acquired as part of a business combination and initially recognized at fair value at the date measurement of the liability. The Group applies judgement in evaluating whether it is reasonably of acquisition. They are amortized on a straight-line basis over their estimated useful lives, which certain whether or not to exercise the option to renew or terminate the lease, considering relevant are mostly periods of between three and ten years. Other periods may be used where specific facts and circumstances that create an economic incentive. contractual conditions apply. The lease payments are discounted using the interest rate implicit in the lease. If that rate cannot be readily determined, which is generally the case for leases in the Group, the lessee’s (2.8) Property, plant and Land is valued at historical cost less accumulated impairment losses, if any. Other property, incremental borrowing rate is used, being the rate that the individual lessee would have to pay equipment plant and equipment are recognized at historical cost less accumulated depreciation and to borrow the funds necessary to obtain an asset of similar value to the right of use asset in a accumulated impairment losses, if any. Historical cost includes expenditure that is directly similar economic environment with similar terms, security and conditions. attributable to the acquisition of the items. Historical cost may also include transfers from equity of any gains/losses on qualifying cash flow hedges of foreign currency purchases of tangible The right of use assets are initially measured at cost comprising the following: fixed assets. • the amount of the initial measurement of lease liability • any lease payments made at or before the commencement date less any lease Depreciation is calculated using the straight-line method to allocate the historical costs of assets over their estimated useful lives. The estimated useful lives of depreciable property, plant and incentives received equipment are: • any initial direct costs, and • restoration costs. Buildings 20 to 40 years Plant and machinery 5 to 15 years Subsequently, the right of use assets are measured at cost less any accumulated depreciation Other operating assets 2 to 7 years and impairment losses and adjusted for any remeasurement of lease liabilities. Right of use assets are generally depreciated over the shorter of the asset's useful life and the lease term on a straight-line basis. If the Group is reasonably certain to exercise a purchase 2020 Financial Report | 22 2020 Financial Report | 23

2020 Financial Report Page 23 Page 25

2020 Financial Report Page 23 Page 25