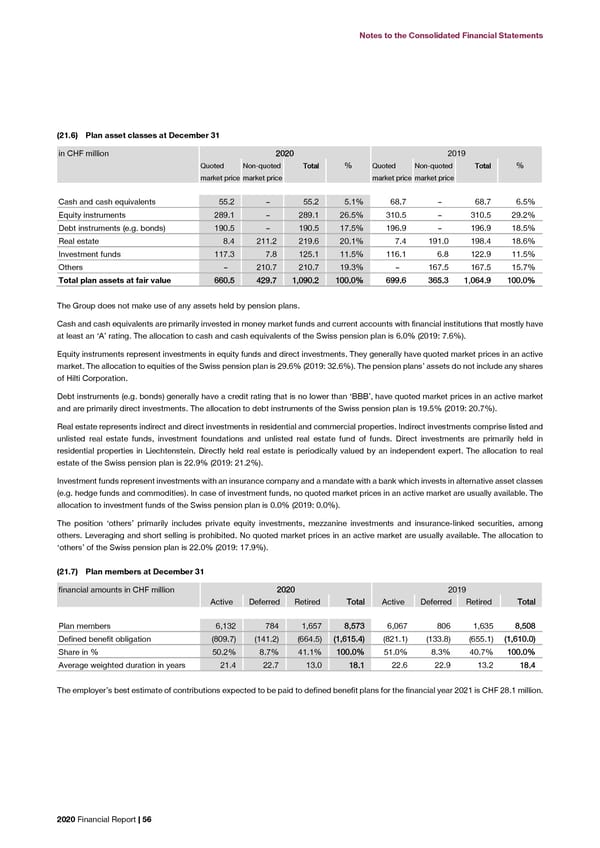

Notes to the Consolidated Financial Statements Notes to the Consolidated Financial Statements (21.6) Plan asset classes at December 31 (21.8) Actuarial assumptions in CHF million 22002200 2019 Actuarial assumptions are based on long-term economic factors in the respective countries. Each item of ‘other plans’ is a weighted Quoted Non-quoted TToottaall % Quoted Non-quoted TToottaall % average in relation to the relevant underlying component. The significant assumptions are as follows: market price market price market price market price in % 22002200 2019 Cash and cash equivalents 55.2 – 55.2 5.1% 68.7 – 68.7 6.5% Switzerland Other plans TToottaall Switzerland Other plans TToottaall Equity instruments 289.1 – 289.1 26.5% 310.5 – 310.5 29.2% Debt instruments (e.g. bonds) 190.5 – 190.5 17.5% 196.9 – 196.9 18.5% Discount rate 0.25% 1.10% 00..4433%% 0.25% 1.49% 00..5511%% Real estate 8.4 211.2 219.6 20.1% 7.4 191.0 198.4 18.6% Future salary increase 1.50% 1.25% 11..4455%% 1.50% 1.30% 11..4466%% Investment funds 117.3 7.8 125.1 11.5% 116.1 6.8 122.9 11.5% Future pension increase 0.00% 2.01% 00..4422%% 0.00% 2.11% 00..4444%% Others – 210.7 210.7 19.3% – 167.5 167.5 15.7% Total plan assets at fair value 666600..55 442299..77 11,,009900..22 110000..00%% 669999..66 336655..33 11,,006644..99 110000..00%% Life expectancy is reflected in the defined benefit obligations by using mortality tables of the country in which the plan is located. The generational tables BVG/LPP 2015 (2019: BVG/LPP 2015) have been used for Switzerland. The Group does not make use of any assets held by pension plans. In general, the present value of the defined benefit obligations is determined annually by independent actuaries using the projected unit credit method. Actuarial assumptions are required for this purpose. Cash and cash equivalents are primarily invested in money market funds and current accounts with financial institutions that mostly have at least an ‘A’ rating. The allocation to cash and cash equivalents of the Swiss pension plan is 6.0% (2019: 7.6%). The discount rate, future salary increase and life expectancy were identified as significant actuarial assumptions. The following impacts on the defined benefit obligation are to be expected: Equity instruments represent investments in equity funds and direct investments. They generally have quoted market prices in an active market. The allocation to equities of the Swiss pension plan is 29.6% (2019: 32.6%). The pension plans’ assets do not include any shares • A 0.25% increase/decrease in the discount rate would lead to a decrease/increase of 4.49% in the defined benefit of Hilti Corporation. obligation. • A 0.25% increase/decrease in expected future salaries would lead to an increase/decrease of 0.56% in the defined benefit Debt instruments (e.g. bonds) generally have a credit rating that is no lower than ‘BBB’, have quoted market prices in an active market obligation. and are primarily direct investments. The allocation to debt instruments of the Swiss pension plan is 19.5% (2019: 20.7%). • A one-year increase/decrease in life expectancy would lead to an increase/decrease of 2.93% in the defined benefit obligation. Real estate represents indirect and direct investments in residential and commercial properties. Indirect investments comprise listed and unlisted real estate funds, investment foundations and unlisted real estate fund of funds. Direct investments are primarily held in The sensitivity analysis is based on realistically possible changes as of the end of the reporting period. Each change in a significant residential properties in Liechtenstein. Directly held real estate is periodically valued by an independent expert. The allocation to real actuarial assumption was analyzed separately as part of the test. Interdependencies were not taken into account. estate of the Swiss pension plan is 22.9% (2019: 21.2%). Investment funds represent investments with an insurance company and a mandate with a bank which invests in alternative asset classes (22) Bonds (e.g. hedge funds and commodities). In case of investment funds, no quoted market prices in an active market are usually available. The allocation to investment funds of the Swiss pension plan is 0.0% (2019: 0.0%). The bonds were issued by Hilti Corporation. Further details of the individual bonds are included in the key figures (see page 3). The position ‘others’ primarily includes private equity investments, mezzanine investments and insurance-linked securities, among in CHF million 22002200 2019 others. Leveraging and short selling is prohibited. No quoted market prices in an active market are usually available. The allocation to ‘others’ of the Swiss pension plan is 22.0% (2019: 17.9%). Maturity < 1 year – – (21.7) Plan members at December 31 1 to < 2 years – – 2 to < 3 years 100.0 – financial amounts in CHF million 22002200 2019 3 to < 4 years 100.0 100.0 Active Deferred Retired TToottaall Active Deferred Retired TToottaall 4 to < 5 years 149.9 100.0 >= 5 years 99.9 99.9 Plan members 6,132 784 1,657 88,,557733 6,067 806 1,635 88,,550088 Defined benefit obligation (809.7) (141.2) (664.5) ((11,,661155..44)) (821.1) (133.8) (655.1) ((11,,661100..00)) Total bonds 444499..88 229999..99 Share in % 50.2% 8.7% 41.1% 110000..00%% 51.0% 8.3% 40.7% 110000..00%% Average weighted duration in years 21.4 22.7 13.0 1188..11 22.6 22.9 13.2 1188..44 Further information Fair values 460.8 312.5 The employer’s best estimate of contributions expected to be paid to defined benefit plans for the financial year 2021 is CHF 28.1 million. Average effective interest rates (in %) 0.6 0.8 The fair values of Swiss franc bonds totaling CHF 460.8 million (2019: CHF 312.5 million) are based on the quoted market prices and are within level 1 of the fair value hierarchy. 2020 Financial Report | 56 2020 Financial Report | 57

2020 Financial Report Page 57 Page 59

2020 Financial Report Page 57 Page 59