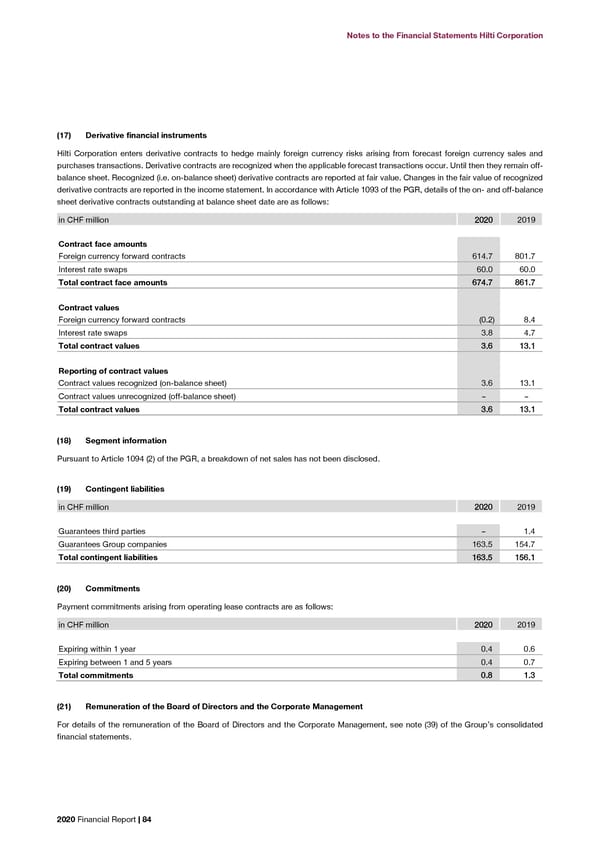

Notes to the Financial Statements Hilti Corporation Notes to the Financial Statements Hilti Corporation (17) Derivative financial instruments (22) Other transactions and balances with the shareholder Hilti Corporation enters derivative contracts to hedge mainly foreign currency risks arising from forecast foreign currency sales and For details about other transactions and balances with the shareholder see note (39.3) within the notes to the consolidated financial purchases transactions. Derivative contracts are recognized when the applicable forecast transactions occur. Until then they remain off- statements. balance sheet. Recognized (i.e. on-balance sheet) derivative contracts are reported at fair value. Changes in the fair value of recognized derivative contracts are reported in the income statement. In accordance with Article 1093 of the PGR, details of the on- and off-balance (23) Number of employees sheet derivative contracts outstanding at balance sheet date are as follows: The breakdown of employees by nationality is as follows: in CHF million 22002200 2019 Country 22002200 %% 2019 % Contract face amounts Foreign currency forward contracts 614.7 801.7 Austria 839 40% 868 40% Interest rate swaps 60.0 60.0 Germany 436 21% 431 20% Total contract face amounts 667744..77 886611..77 Liechtenstein 136 6% 143 7% Switzerland 226 11% 232 11% Contract values Other countries 478 22% 471 22% Foreign currency forward contracts (0.2) 8.4 Total employees 22,,111155 110000%% 22,,114455 110000%% Interest rate swaps 3.8 4.7 Total contract values 33..66 1133..11 (24) Management report Reporting of contract values Pursuant to Article 1121 (3) of the PGR, the management report of Hilti Corporation has been combined with the consolidated Contract values recognized (on-balance sheet) 3.6 13.1 management report. The consolidated management report is on pages 6 to 8 of this Financial Report. Contract values unrecognized (off-balance sheet) – – Total contract values 33..66 1133..11 (25) Appropriation of retained earnings (18) Segment information in CHF million 22002200 2019 Pursuant to Article 1094 (2) of the PGR, a breakdown of net sales has not been disclosed. Profit brought forward 2,317.8 2,185.0 Net income 343.4 426.8 (19) Contingent liabilities At the disposal of the General Meeting 22,,666611..22 22,,661111..88 in CHF million 22002200 2019 Proposal by the Board of Directors Dividend of CHF nil (2019: CHF 1160) per share – 294.0 Guarantees third parties – 1.4 Appropriation to other reserves – – Guarantees Group companies 163.5 154.7 Balance carried forward 2,661.2 2,317.8 Total contingent liabilities 116633..55 115566..11 Total 22,,666611..22 22,,661111..88 (20) Commitments Payment commitments arising from operating lease contracts are as follows: in CHF million 22002200 2019 Expiring within 1 year 0.4 0.6 Expiring between 1 and 5 years 0.4 0.7 Total commitments 00..88 11..33 (21) Remuneration of the Board of Directors and the Corporate Management For details of the remuneration of the Board of Directors and the Corporate Management, see note (39) of the Group’s consolidated financial statements. 2020 Financial Report | 84 2020 Financial Report | 85

2020 Financial Report Page 85 Page 87

2020 Financial Report Page 85 Page 87