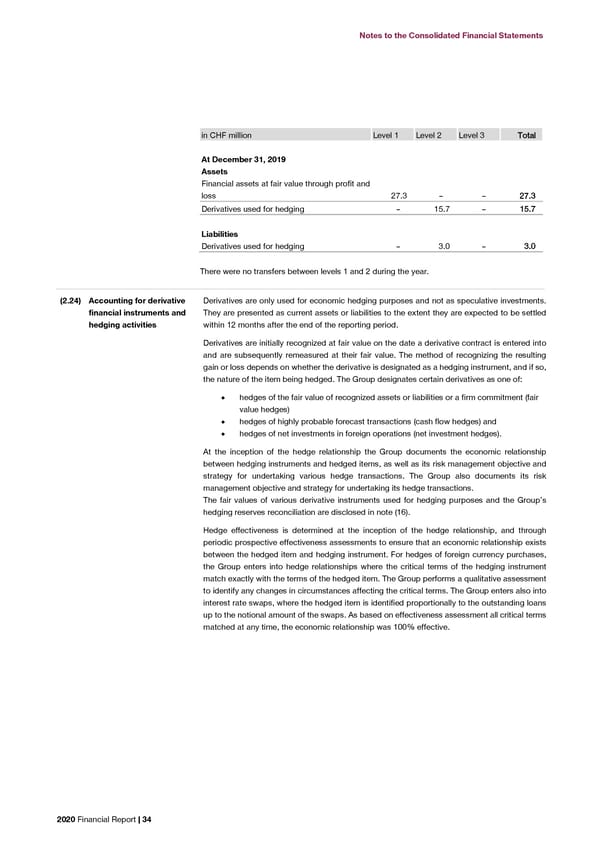

Notes to the Consolidated Financial Statements Notes to the Consolidated Financial Statements in CHF million Level 1 Level 2 Level 3 TToottaall (3) Critical accounting estimates and judgments At December 31, 2019 Estimates and judgments are continually evaluated and are based on historical experience and other factors, including expectations of Assets future events that are believed to be reasonable under the circumstances. The Group makes estimates and assumptions concerning the Financial assets at fair value through profit and future. The resulting accounting estimates will, by definition, seldom equal the related actual results. The estimates and assumptions loss 27.3 – – 2277..33 that have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within the next financial year Derivatives used for hedging – 15.7 – 1155..77 are discussed below. (3.1) Trade receivables Liabilities Derivatives used for hedging – 3.0 – 33..00 Losses on trade receivables are recognized when they are expected, which requires management’s best estimate of probable losses. Such estimates require consideration of historical loss experience, adjusted for current conditions, and judgments about the probable There were no transfers between levels 1 and 2 during the year. effects of relevant observable data, including financial health of specific customers and market sectors or collateral values. Detailed information concerning trade receivables is given in notes (2.12), (2.10) and (14). (2.24) Accounting for derivative Derivatives are only used for economic hedging purposes and not as speculative investments. (3.2) Inventories financial instruments and They are presented as current assets or liabilities to the extent they are expected to be settled hedging activities within 12 months after the end of the reporting period. Write-downs of inventories are recognized for particular items when net realizable value falls below cost. The determination of net realizable value is made using a valuation process based on the aging of items with aging parameters set based on estimates of historical Derivatives are initially recognized at fair value on the date a derivative contract is entered into loss experience. This process assumes a linear realizable value reduction based on age. Detailed information concerning inventories is and are subsequently remeasured at their fair value. The method of recognizing the resulting given in note (13). gain or loss depends on whether the derivative is designated as a hedging instrument, and if so, the nature of the item being hedged. The Group designates certain derivatives as one of: (3.3) Impairment of goodwill; development costs capitalized under intangible assets; property, plant and equipment • hedges of the fair value of recognized assets or liabilities or a firm commitment (fair value hedges) Intangible assets that have an indefinite useful life or intangible assets not ready to use are not subject to amortization and are tested • hedges of highly probable forecast transactions (cash flow hedges) and annually for impairment. Other intangible assets and property, plant and equipment are reviewed for impairment annually or whenever • hedges of net investments in foreign operations (net investment hedges). events or changes in circumstances indicate that the carrying amount may not be recoverable. An impairment loss is recognized for the amount by which an asset’s carrying amount exceeds its recoverable amount. The recoverable amount is the higher of an asset’s fair At the inception of the hedge relationship the Group documents the economic relationship value less costs of disposal and its value in use. For the purposes of assessing impairment, assets are grouped at the lowest levels for between hedging instruments and hedged items, as well as its risk management objective and which there are largely independent cash flows (cash-generating units). For impairment of goodwill the recoverable amounts of cash- strategy for undertaking various hedge transactions. The Group also documents its risk generating units (CGUs) are determined based on value-in-use calculations which require medium- and long-term estimates. The management objective and strategy for undertaking its hedge transactions. methodology for goodwill impairment testing is based on a discounted cash flow model that is most sensitive to the following key The fair values of various derivative instruments used for hedging purposes and the Group’s assumptions: i) forecasts of free cash flows in years one to four and ii) changes in the long-term growth rate, which are based on internal hedging reserves reconciliation are disclosed in note (16). planning data, as well as iii) changes in the discount rates, which are based on external data. Detailed information concerning the annual goodwill impairment test is given in note (7). Hedge effectiveness is determined at the inception of the hedge relationship, and through periodic prospective effectiveness assessments to ensure that an economic relationship exists (3.4) Employee benefits between the hedged item and hedging instrument. For hedges of foreign currency purchases, the Group enters into hedge relationships where the critical terms of the hedging instrument The status of various defined benefit plans depends on long-term actuarial assumptions that may differ from actual future developments. match exactly with the terms of the hedged item. The Group performs a qualitative assessment The calculation of the discount rate, future increases in salaries/wages and pensions, and mortality are important assumptions in actuarial to identify any changes in circumstances affecting the critical terms. The Group enters also into valuations. Detailed information concerning the defined benefit plans is given in note (21). interest rate swaps, where the hedged item is identified proportionally to the outstanding loans up to the notional amount of the swaps. As based on effectiveness assessment all critical terms (3.5) Income taxes matched at any time, the economic relationship was 100% effective. The measurement of current and deferred income tax liabilities or assets is dependent on the judgment and interpretation of existing tax laws and regulations in the respective countries and, therefore, requires certain estimates. Generally, deferred tax assets and liabilities are determined based on temporary differences between the financial accounts and the tax balance and are measured relying on enacted tax rates and, if applicable, on tax rates that are anticipated to be in effect when differences are estimated to reverse, if substantively enacted. Unforeseen changes in these areas may affect these estimates. Additionally, in tax disputes, the judgments taken by management could be challenged by tax authorities, potentially resulting in the payment of additional taxes, interest and/or penalties. Consequently, deviations between the initial assumptions and the final determination of income taxes may lead to material changes to current or deferred income tax expenses of the period in which such income tax becomes definite. Furthermore, the recognition of deferred tax assets on tax loss carryforwards depends on the probability of future taxable profits of Group companies. Several internal and external factors, such as forecasts, interpretations of existing tax laws and regulations are used in the estimation of such future profits. Tax positions are regularly and proactively clarified with external tax experts to reduce tax contingencies. If such tax positions 2020 Financial Report | 34 2020 Financial Report | 35

2020 Financial Report Page 35 Page 37

2020 Financial Report Page 35 Page 37