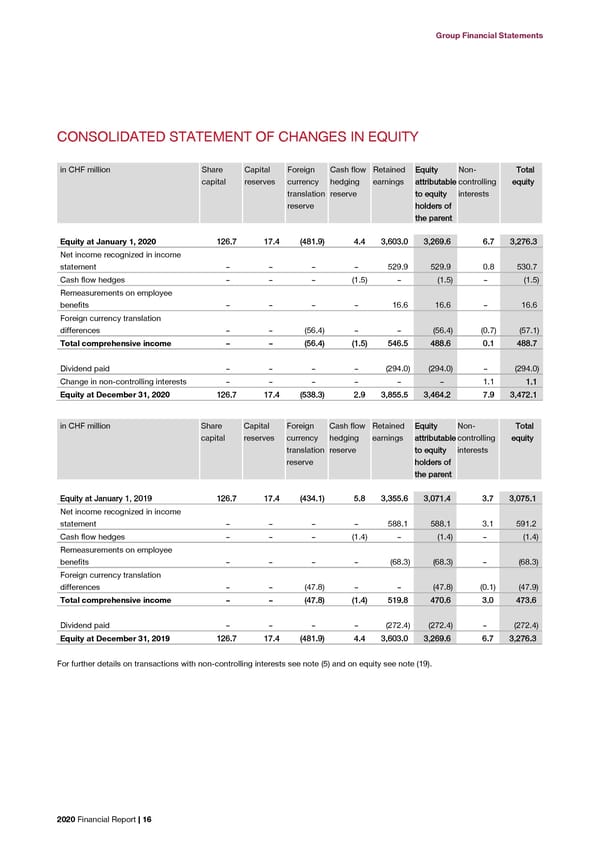

Group Financial Statements Group Financial Statements CONSOLIDATED STATEMENT OF CHANGES IN EQUITY CONSOLIDATED CASH FLOW STATEMENT in CHF million Share Capital Foreign Cash flow Retained EEqquuiittyy Non- TToottaall in CHF million Note 22002200 2019 capital reserves currency hedging earnings aattttrriibbuuttaabbllee controlling eeqquuiittyy translation reserve ttoo eeqquuiittyy interests Operating result 772288..22 778822..66 reserve hhoollddeerrss ooff Depreciation and amortization 7/8/9 394.9 374.0 tthhee ppaarreenntt Interest received 2.7 5.2 Interest paid (47.8) (52.4) Equity at January 1, 2020 112266..77 1177..44 ((448811..99)) 44..44 33,,660033..00 33,,226699..66 66..77 33,,227766..33 Income tax paid (121.6) (97.6) Net income recognized in income (Increase)/decrease in inventories 28 29.0 25.4 statement – – – – 529.9 529.9 0.8 530.7 (Increase)/decrease in trade receivables 14 32.3 (9.4) Cash flow hedges – – – (1.5) – (1.5) – (1.5) (Increase)/decrease in finance lease receivables 14 (80.5) (180.9) Remeasurements on employee Increase/(decrease) in trade payables 24 (6.5) (10.3) benefits – – – – 16.6 16.6 – 16.6 Increase/(decrease) in contract liabilities 27 (0.1) 17.2 Foreign currency translation Change in non-cash items (28.3) 14.6 differences – – (56.4) – – (56.4) (0.7) (57.1) Change in other net operating assets 31.6 (36.2) Total comprehensive income –– –– ((5566..44)) ((11..55)) 554466..55 448888..66 00..11 448888..77 Cash flow from operating activities 993333..99 883322..22 Dividend paid – – – – (294.0) (294.0) – (294.0) Capital expenditure on intangible assets 7 (194.0) (202.6) Change in non-controlling interests – – – – – – 1.1 11..11 Capital expenditure on property, plant and equipment 8 (150.7) (209.3) Equity at December 31, 2020 112266..77 1177..44 ((553388..33)) 22..99 33,,885555..55 33,,446644..22 77..99 33,,447722..11 (Increase)/decrease in financial investments (4.5) (11.4) Disposal of property, plant and equipment 6.4 29.8 in CHF million Share Capital Foreign Cash flow Retained EEqquuiittyy Non- TToottaall CCaasshh ffllooww ffrroomm iinnvveessttiinngg aaccttiivviittiieess ((334422..88)) ((339933..55)) capital reserves currency hedging earnings aattttrriibbuuttaabbllee controlling eeqquuiittyy translation reserve ttoo eeqquuiittyy interests Proceeds from long-term borrowings 34.3 26.5 reserve hhoollddeerrss ooff Repayment of long-term borrowings (46.2) (4.5) tthhee ppaarreenntt Payment of lease liabilities 9 (131.8) (136.2) Proceeds from (repayment of) short-term borrowings 26 (75.9) 78.2 EEqquuiittyy aatt JJaannuuaarryy 11,, 22001199 112266..77 1177..44 ((443344..11)) 55..88 33,,335555..66 33,,007711..44 33..77 33,,007755..11 Proceeds from issuance of bonds 22 149.9 – Net income recognized in income Repayment of bonds 22 – (33.5) statement – – – – 588.1 588.1 3.1 591.2 Increase/(decrease) in liability to shareholder – 0.1 Cash flow hedges – – – (1.4) – (1.4) – (1.4) Dividend paid 19 (294.0) (272.4) Remeasurements on employee Cash flow from financing activities ((336633..77)) ((334411..88)) benefits – – – – (68.3) (68.3) – (68.3) Foreign currency translation Exchange differences (8.3) (14.0) differences – – (47.8) – – (47.8) (0.1) (47.9) Total comprehensive income –– –– ((4477..88)) ((11..44)) 551199..88 447700..66 33..00 447733..66 Total increase/(decrease) in cash and cash equivalents 221199..11 8822..99 Dividend paid – – – – (272.4) (272.4) – (272.4) Cash and cash equivalents at January 1 1,113.8 1,030.9 Equity at December 31, 2019 112266..77 1177..44 ((448811..99)) 44..44 33,,660033..00 33,,226699..66 66..77 33,,227766..33 Cash and cash equivalents at December 31 11,,333322..99 11,,111133..88 Cash and cash equivalents at December 31 For further details on transactions with non-controlling interests see note (5) and on equity see note (19). 2020 Financial Report | 16 2020 Financial Report | 17

2020 Financial Report Page 17 Page 19

2020 Financial Report Page 17 Page 19