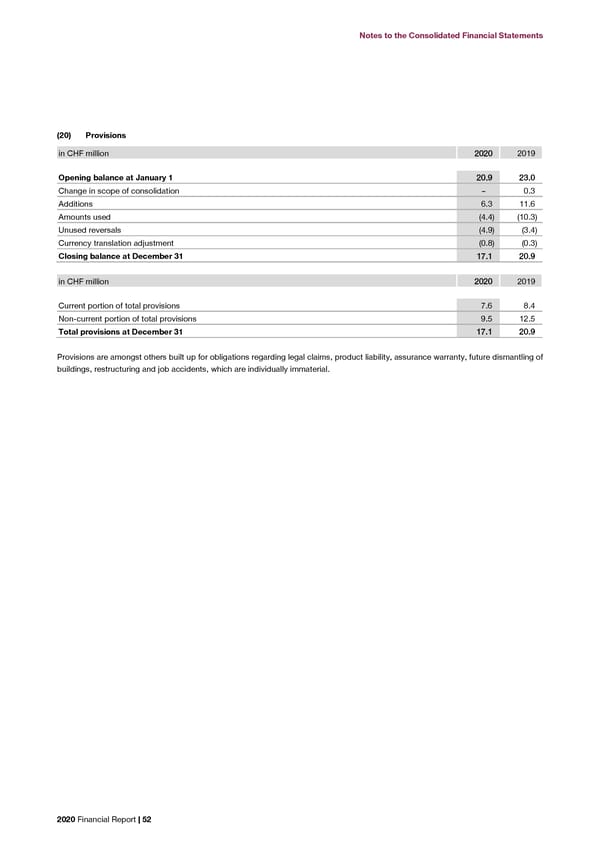

Notes to the Consolidated Financial Statements Notes to the Consolidated Financial Statements (20) Provisions (21) Employee benefits in CHF million 22002200 2019 Employee benefits creating obligations of the Group to its employees comprise defined benefit plans, other long-term employee benefits and short-term employee benefits. The Group also provides employee benefits through defined contribution plans. Opening balance at January 1 2200..99 2233..00 Change in scope of consolidation – 0.3 Defined benefit plans Additions 6.3 11.6 Amounts used (4.4) (10.3) Swiss pension plan Unused reversals (4.9) (3.4) The Group’s largest defined benefit pension plan is located in Switzerland: It covers employees of the parent company as well as of the Currency translation adjustment (0.8) (0.3) Swiss and other Liechtenstein-based Group companies (the ‘Swiss pension plan’). The Swiss pension plan accounts for 79.0% (2019: Closing balance at December 31 1177..11 2200..99 79.3%) of the Group’s total defined benefit obligation and 87.9% (2019: 87.8%) of the Group’s plan assets. in CHF million 22002200 2019 The Swiss pension plan is funded through a legally separate trustee-administered pension fund. The pension plan is overseen by a regulator as well as by a state supervisory body. The pension plan’s most senior governing body (Board of Trustees) must be composed Current portion of total provisions 7.6 8.4 of equal numbers of employee and employer representatives. The Board of Trustees is responsible for the investment of the assets. Non-current portion of total provisions 9.5 12.5 When defining the investment strategy, it takes into account the pension fund’s objectives, benefit obligations and risk capacity. The Total provisions at December 31 1177..11 2200..99 investment strategy is defined in the form of a long-term target asset structure (investment policy). The Board of Trustees delegates the implementation of the investment policy – in accordance with the investment strategy – to an Investment Committee. The cash funding of the plan is designed to ensure that present and future contributions should be sufficient to meet future liabilities. Further on, the Board Provisions are amongst others built up for obligations regarding legal claims, product liability, assurance warranty, future dismantling of of Trustees is able to adapt the contributions and benefits. There is a stop-loss insurance which covers the risk from a certain excess buildings, restructuring and job accidents, which are individually immaterial. amount (e.g. for disability or death). The Swiss pension plan contains a cash balance benefit formula and is therefore accounted for as a defined benefit plan. Employer and employee contributions are defined in the pension fund rules in terms of an age-related sliding scale of percentages of remuneration. Under Swiss law, the pension fund guarantees the vested benefit amount as confirmed annually to members. Interest may be added to member balances at the discretion of the Board of Trustees (i.e. 1.0% in 2020 and 1.0% in 2019). At retirement date, members have the right to take their retirement benefit as a lump sum, an annuity or part as a lump sum with the remaining balance converted to a fixed annuity at the rates defined in the fund rules. The Board of Trustees may change the conversion rate at their discretion subject to the plan’s funded status and the requirements of the Swiss Federal Law on Occupational Retirement, Survivors’ and Disability Pension Plan (BVG). Other defined benefit plans The remaining defined benefit plans are located in Austria, Germany, Great Britain, Italy, Taiwan, Korea, the Philippines, France and Japan. Only the last two plans listed are still open for new plan participants. Other long-term employee benefits Other long-term employee benefits comprise jubilee and other long-service benefits, a long-term incentive and other long-term employee benefits. The relevant period for the long-term incentive is 2019-2021 with payment to be made in 2022. Historically, the level of outflows concerning other long-term employee benefits (excluding the long-term incentive) has been constant each year. Short-term employee benefits Short-term employee benefits such as short-term variable compensation are included in ‘accrued liabilities and deferred income’ (see note (25)). Defined contribution plans The employer’s contribution totals CHF 39.9 million (2019: CHF 43.2 million). 2020 Financial Report | 52 2020 Financial Report | 53

2020 Financial Report Page 53 Page 55

2020 Financial Report Page 53 Page 55