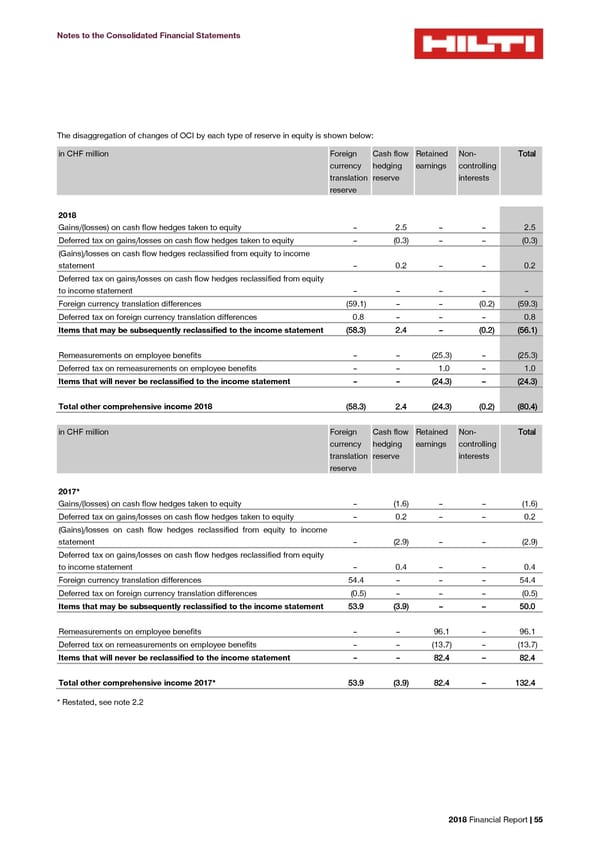

Notes to the Consolidated Financial Statements The disaggregation of changes of OCI by each type of reserve in equity is shown below: in CHF million Foreign Cash flow Retained Non- Total currency hedging earnings controlling translation reserve interests reserve 2018 Gains/(losses) on cash flow hedges taken to equity – 2.5 – – 2.5 Deferred tax on gains/losses on cash flow hedges taken to equity – (0.3) – – (0.3) (Gains)/losses on cash flow hedges reclassified from equity to income statement – 0.2 – – 0.2 Deferred tax on gains/losses on cash flow hedges reclassified from equity to income statement – – – – – Foreign currency translation differences (59.1) – – (0.2) (59.3) Deferred tax on foreign currency translation differences 0.8 – – – 0.8 Items that may be subsequently reclassified to the income statement (58.3) 2.4 – (0.2) (56.1) Remeasurements on employee benefits – – (25.3) – (25.3) Deferred tax on remeasurements on employee benefits – – 1.0 – 1.0 Items that will never be reclassified to the income statement – – (24.3) – (24.3) Total other comprehensive income 2018 (58.3) 2.4 (24.3) (0.2) (80.4) in CHF million Foreign Cash flow Retained Non- Total currency hedging earnings controlling translation reserve interests reserve 2017* Gains/(losses) on cash flow hedges taken to equity – (1.6) – – (1.6) Deferred tax on gains/losses on cash flow hedges taken to equity – 0.2 – – 0.2 (Gains)/losses on cash flow hedges reclassified from equity to income statement – (2.9) – – (2.9) Deferred tax on gains/losses on cash flow hedges reclassified from equity to income statement – 0.4 – – 0.4 Foreign currency translation differences 54.4 – – – 54.4 Deferred tax on foreign currency translation differences (0.5) – – – (0.5) Items that may be subsequently reclassified to the income statement 53.9 (3.9) – – 50.0 Remeasurements on employee benefits – – 96.1 – 96.1 Deferred tax on remeasurements on employee benefits – – (13.7) – (13.7) Items that will never be reclassified to the income statement – – 82.4 – 82.4 Total other comprehensive income 2017* 53.9 (3.9) 82.4 – 132.4 * Restated, see note 2.2 2018 Financial Report | 55

2018 Financial Report Page 56 Page 58

2018 Financial Report Page 56 Page 58