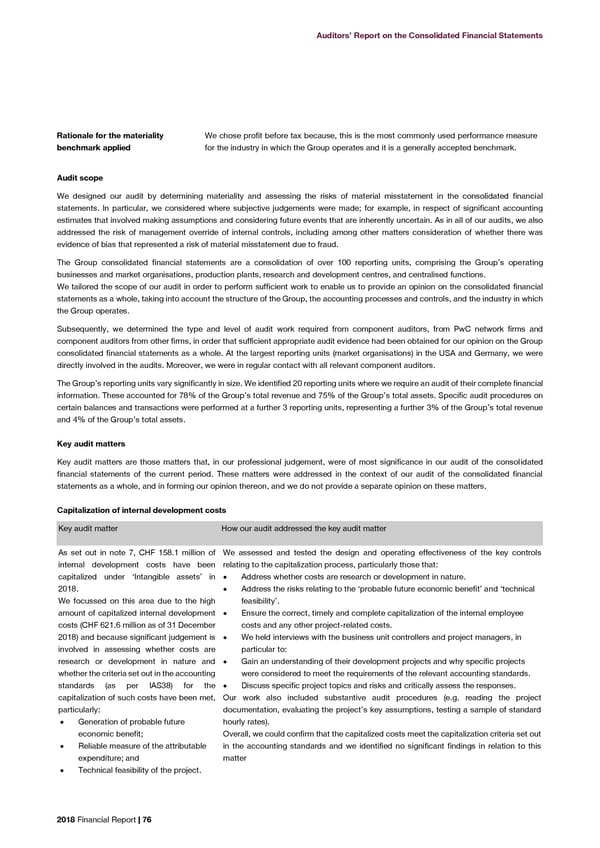

Auditors’ Report on the Consolidated Financial Statements Rationale for the materiality We chose profit before tax because, this is the most commonly used performance measure benchmark applied for the industry in which the Group operates and it is a generally accepted benchmark. Audit scope We designed our audit by determining materiality and assessing the risks of material misstatement in the consolidated financial statements. In particular, we considered where subjective judgements were made; for example, in respect of significant accounting estimates that involved making assumptions and considering future events that are inherently uncertain. As in all of our audits, we also addressed the risk of management override of internal controls, including among other matters consideration of whether there was evidence of bias that represented a risk of material misstatement due to fraud. The Group consolidated financial statements are a consolidation of over 100 reporting units, comprising the Group’s operating businesses and market organisations, production plants, research and development centres, and centralised functions. We tailored the scope of our audit in order to perform sufficient work to enable us to provide an opinion on the consolidated financial statements as a whole, taking into account the structure of the Group, the accounting processes and controls, and the industry in which the Group operates. Subsequently, we determined the type and level of audit work required from component auditors, from PwC network firms and component auditors from other firms, in order that sufficient appropriate audit evidence had been obtained for our opinion on the Group consolidated financial statements as a whole. At the largest reporting units (market organisations) in the USA and Germany, we were directly involved in the audits. Moreover, we were in regular contact with all relevant component auditors. The Group’s reporting units vary significantly in size. We identified 20 reporting units where we require an audit of their complete financial information. These accounted for 78% of the Group’s total revenue and 75% of the Group’s total assets. Specific audit procedures on certain balances and transactions were performed at a further 3 reporting units, representing a further 3% of the Group’s total revenue and 4% of the Group’s total assets. Key audit matters Key audit matters are those matters that, in our professional judgement, were of most significance in our audit of the consolidated financial statements of the current period. These matters were addressed in the context of our audit of the consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters. Capitalization of internal development costs Key audit matter How our audit addressed the key audit matter As set out in note 7, CHF 158.1 million of We assessed and tested the design and operating effectiveness of the key controls internal development costs have been relating to the capitalization process, particularly those that: capitalized under ‘Intangible assets’ in • Address whether costs are research or development in nature. 2018. • Address the risks relating to the ‘probable future economic benefit’ and ‘technical We focussed on this area due to the high feasibility’. amount of capitalized internal development • Ensure the correct, timely and complete capitalization of the internal employee costs (CHF 621.6 million as of 31 December costs and any other project-related costs. 2018) and because significant judgement is • We held interviews with the business unit controllers and project managers, in involved in assessing whether costs are particular to: research or development in nature and • Gain an understanding of their development projects and why specific projects whether the criteria set out in the accounting were considered to meet the requirements of the relevant accounting standards. standards (as per IAS38) for the • Discuss specific project topics and risks and critically assess the responses. capitalization of such costs have been met, Our work also included substantive audit procedures (e.g. reading the project particularly: documentation, evaluating the project’s key assumptions, testing a sample of standard • Generation of probable future hourly rates). economic benefit; Overall, we could confirm that the capitalized costs meet the capitalization criteria set out • Reliable measure of the attributable in the accounting standards and we identified no significant findings in relation to this expenditure; and matter • Technical feasibility of the project. 2018 Financial Report | 76

2018 Financial Report Page 77 Page 79

2018 Financial Report Page 77 Page 79