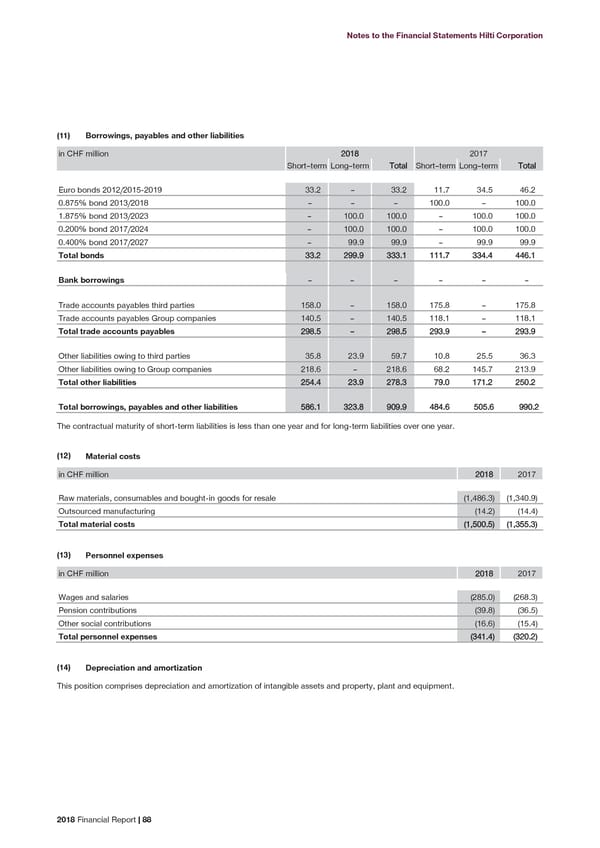

Notes to the Financial Statements Hilti Corporation (11) Borrowings, payables and other liabilities in CHF million 2018 2017 Short–term Long–term Total Short–term Long–term Total Euro bonds 2012/2015-2019 33.2 – 33.2 11.7 34.5 46.2 0.875% bond 2013/2018 – – – 100.0 – 100.0 1.875% bond 2013/2023 – 100.0 100.0 – 100.0 100.0 0.200% bond 2017/2024 – 100.0 100.0 – 100.0 100.0 0.400% bond 2017/2027 – 99.9 99.9 – 99.9 99.9 Total bonds 33.2 299.9 333.1 111.7 334.4 446.1 Bank borrowings – – – – – – Trade accounts payables third parties 158.0 – 158.0 175.8 – 175.8 Trade accounts payables Group companies 140.5 – 140.5 118.1 – 118.1 Total trade accounts payables 298.5 – 298.5 293.9 – 293.9 Other liabilities owing to third parties 35.8 23.9 59.7 10.8 25.5 36.3 Other liabilities owing to Group companies 218.6 – 218.6 68.2 145.7 213.9 Total other liabilities 254.4 23.9 278.3 79.0 171.2 250.2 Total borrowings, payables and other liabilities 586.1 323.8 909.9 484.6 505.6 990.2 The contractual maturity of short-term liabilities is less than one year and for long-term liabilities over one year. (12) Material costs in CHF million 2018 2017 Raw materials, consumables and bought-in goods for resale (1,486.3) (1,340.9) Outsourced manufacturing (14.2) (14.4) Total material costs (1,500.5) (1,355.3) (13) Personnel expenses in CHF million 2018 2017 Wages and salaries (285.0) (268.3) Pension contributions (39.8) (36.5) Other social contributions (16.6) (15.4) Total personnel expenses (341.4) (320.2) (14) Depreciation and amortization This position comprises depreciation and amortization of intangible assets and property, plant and equipment. 2018 Financial Report | 88

2018 Financial Report Page 89 Page 91

2018 Financial Report Page 89 Page 91