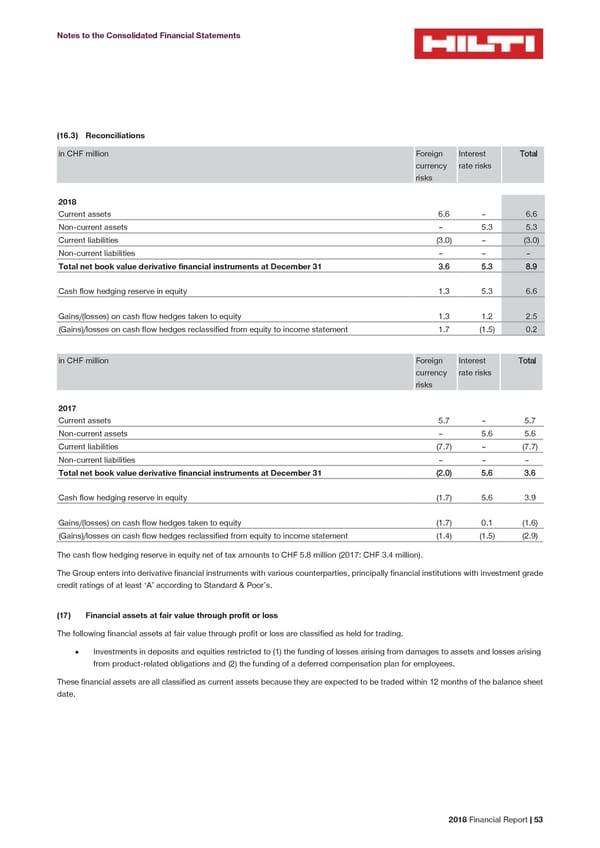

Notes to the Consolidated Financial Statements (16.3) Reconciliations in CHF million Foreign Interest Total currency rate risks risks 2018 Current assets 6.6 – 6.6 Non-current assets – 5.3 5.3 Current liabilities (3.0) – (3.0) Non-current liabilities – – – Total net book value derivative financial instruments at December 31 3.6 5.3 8.9 Cash flow hedging reserve in equity 1.3 5.3 6.6 Gains/(losses) on cash flow hedges taken to equity 1.3 1.2 2.5 (Gains)/losses on cash flow hedges reclassified from equity to income statement 1.7 (1.5) 0.2 in CHF million Foreign Interest Total currency rate risks risks 2017 Current assets 5.7 – 5.7 Non-current assets – 5.6 5.6 Current liabilities (7.7) – (7.7) Non-current liabilities – – – Total net book value derivative financial instruments at December 31 (2.0) 5.6 3.6 Cash flow hedging reserve in equity (1.7) 5.6 3.9 Gains/(losses) on cash flow hedges taken to equity (1.7) 0.1 (1.6) (Gains)/losses on cash flow hedges reclassified from equity to income statement (1.4) (1.5) (2.9) The cash flow hedging reserve in equity net of tax amounts to CHF 5.8 million (2017: CHF 3.4 million). The Group enters into derivative financial instruments with various counterparties, principally financial institutions with investment grade credit ratings of at least ‘A’ according to Standard & Poor’s. (17) Financial assets at fair value through profit or loss The following financial assets at fair value through profit or loss are classified as held for trading. • Investments in deposits and equities restricted to (1) the funding of losses arising from damages to assets and losses arising from product-related obligations and (2) the funding of a deferred compensation plan for employees. These financial assets are all classified as current assets because they are expected to be traded within 12 months of the balance sheet date. 2018 Financial Report | 53

2018 Financial Report Page 54 Page 56

2018 Financial Report Page 54 Page 56