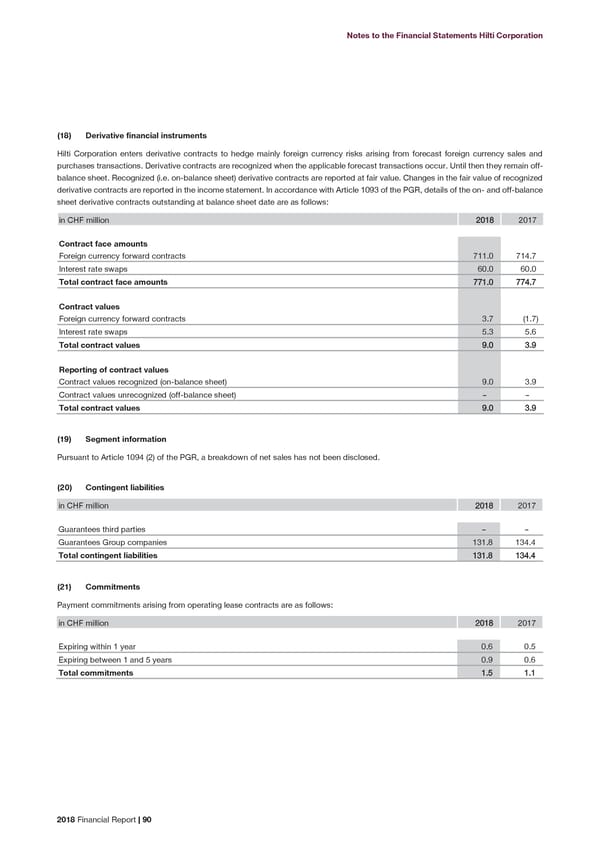

Notes to the Financial Statements Hilti Corporation Derivative financial instruments (18) Hilti Corporation enters derivative contracts to hedge mainly foreign currency risks arising from forecast foreign currency sales and purchases transactions. Derivative contracts are recognized when the applicable forecast transactions occur. Until then they remain off- balance sheet. Recognized (i.e. on-balance sheet) derivative contracts are reported at fair value. Changes in the fair value of recognized derivative contracts are reported in the income statement. In accordance with Article 1093 of the PGR, details of the on- and off-balance sheet derivative contracts outstanding at balance sheet date are as follows: in CHF million 2018 2017 Contract face amounts Foreign currency forward contracts 711.0 714.7 Interest rate swaps 60.0 60.0 Total contract face amounts 771.0 774.7 Contract values Foreign currency forward contracts 3.7 (1.7) Interest rate swaps 5.3 5.6 Total contract values 9.0 3.9 Reporting of contract values Contract values recognized (on-balance sheet) 9.0 3.9 Contract values unrecognized (off-balance sheet) – – Total contract values 9.0 3.9 (19) Segment information Pursuant to Article 1094 (2) of the PGR, a breakdown of net sales has not been disclosed. (20) Contingent liabilities in CHF million 2018 2017 Guarantees third parties – – Guarantees Group companies 131.8 134.4 Total contingent liabilities 131.8 134.4 (21) Commitments Payment commitments arising from operating lease contracts are as follows: in CHF million 2018 2017 Expiring within 1 year 0.6 0.5 Expiring between 1 and 5 years 0.9 0.6 Total commitments 1.5 1.1 2018 Financial Report | 90

2018 Financial Report Page 91 Page 93

2018 Financial Report Page 91 Page 93