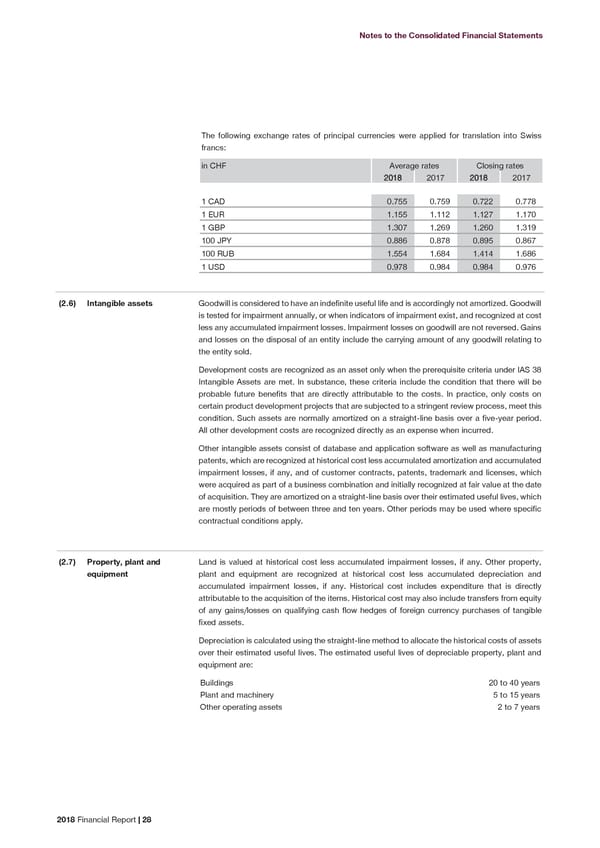

Notes to the Consolidated Financial Statements The following exchange rates of principal currencies were applied for translation into Swiss francs: in CHF Average rates Closing rates 2018 2017 2018 2017 1 CAD 0.755 0.759 0.722 0.778 1 EUR 1.155 1.112 1.127 1.170 1 GBP 1.307 1.269 1.260 1.319 100 JPY 0.886 0.878 0.895 0.867 100 RUB 1.554 1.684 1.414 1.686 1 USD 0.978 0.984 0.984 0.976 (2.6) Intangible assets Goodwill is considered to have an indefinite useful life and is accordingly not amortized. Goodwill is tested for impairment annually, or when indicators of impairment exist, and recognized at cost less any accumulated impairment losses. Impairment losses on goodwill are not reversed. Gains and losses on the disposal of an entity include the carrying amount of any goodwill relating to the entity sold. Development costs are recognized as an asset only when the prerequisite criteria under IAS 38 Intangible Assets are met. In substance, these criteria include the condition that there will be probable future benefits that are directly attributable to the costs. In practice, only costs on certain product development projects that are subjected to a stringent review process, meet this condition. Such assets are normally amortized on a straight-line basis over a five-year period. All other development costs are recognized directly as an expense when incurred. Other intangible assets consist of database and application software as well as manufacturing patents, which are recognized at historical cost less accumulated amortization and accumulated impairment losses, if any, and of customer contracts, patents, trademark and licenses, which were acquired as part of a business combination and initially recognized at fair value at the date of acquisition. They are amortized on a straight-line basis over their estimated useful lives, which are mostly periods of between three and ten years. Other periods may be used where specific contractual conditions apply. Property, plant and Land is valued at historical cost less accumulated impairment losses, if any. Other property, (2.7) equipment plant and equipment are recognized at historical cost less accumulated depreciation and accumulated impairment losses, if any. Historical cost includes expenditure that is directly attributable to the acquisition of the items. Historical cost may also include transfers from equity of any gains/losses on qualifying cash flow hedges of foreign currency purchases of tangible fixed assets. Depreciation is calculated using the straight-line method to allocate the historical costs of assets over their estimated useful lives. The estimated useful lives of depreciable property, plant and equipment are: Buildings 20 to 40 years Plant and machinery 5 to 15 years Other operating assets 2 to 7 years 2018 Financial Report | 28

2018 Financial Report Page 29 Page 31

2018 Financial Report Page 29 Page 31